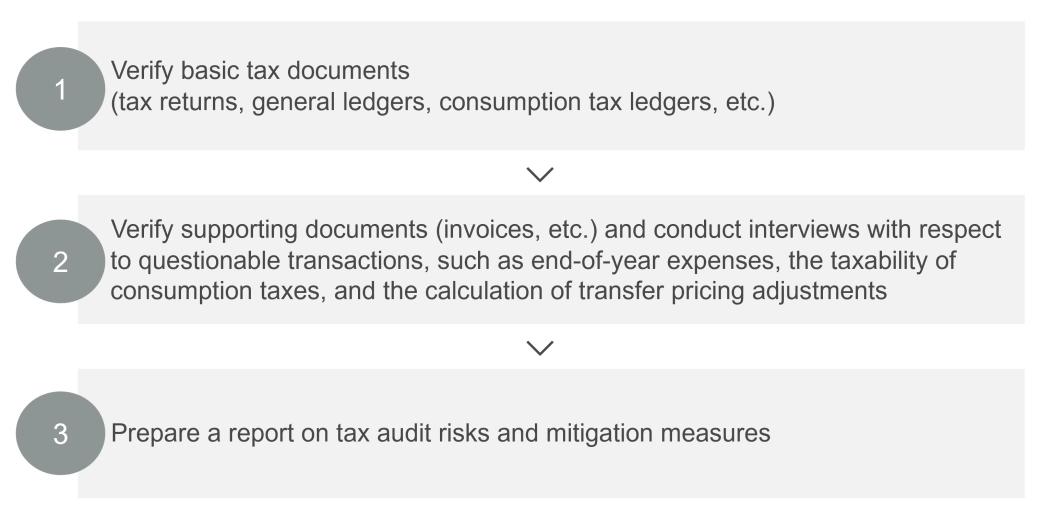

Prior to a tax audit, we review and analyse key tax compliance documents such as tax returns and relevant accounting documents. This enables taxpayers to identify tax audit risks. If they undertake measures to mitigate these risks in advance, they could reduce additional tax payments caused by the tax audit as well as the resources required for the tax audit, such as extensive discussions with tax auditors.

In addition, in recent years the National Tax Agency (NTA)’s focus is not only on additional tax amounts, but also on taking a risk-based approach that assesses the governance standards of each taxpayer. The risk-based approach differentiates the frequency of tax audits. If a taxpayer enhances tax governance prior to a tax audit, good tax governance will help reduce the frequency of future tax audits.

Why Forvis Mazars

Our professionals have rich experience in handling tax audits, particularly for the Japanese subsidiaries of multinational enterprise groups across a variety of industries. Former NTA officials, familiar with tax audits from the NTA’s perspective, will be in charge of tax audit risk analysis.

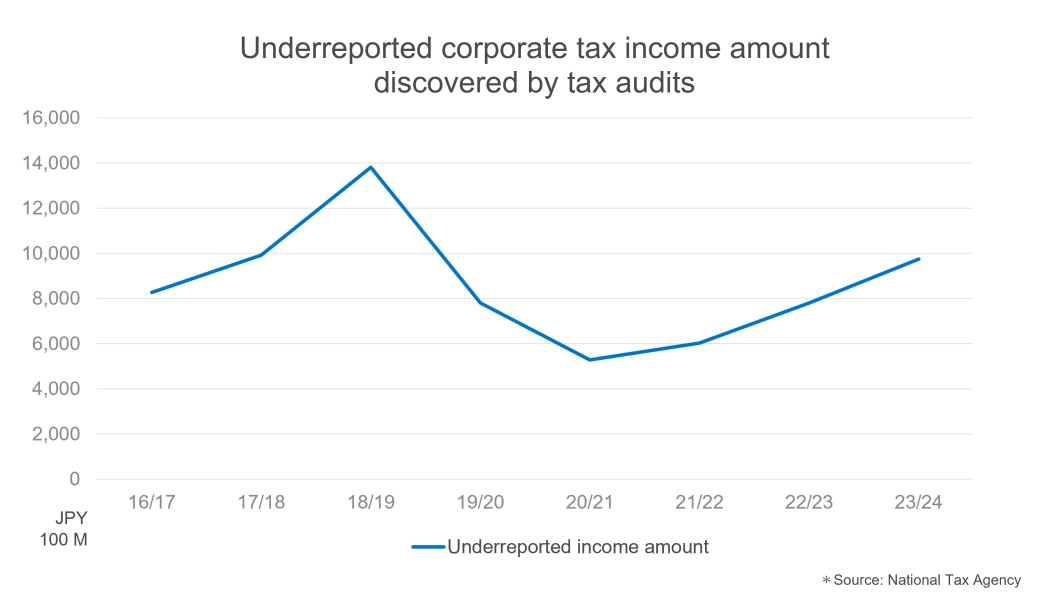

Tax audits are becoming increasingly active

As the following chart indicates, the annual amount of underreported income identified by tax audits has tended to increase over the last couple of years.

Examples of issues targeted by the National Tax Agency

- Consumption taxes (e.g. errors in tax-exempt sales and input tax credits)

- Cross-border transactions in general (e.g. errors in import purchase pricing)

- Misapplication of controlled foreign company rules

- Transfer pricing for transactions with overseas associated enterprises

- Misapplication of withholding income tax on transactions with overseas entities

- Non-filing of tax returns

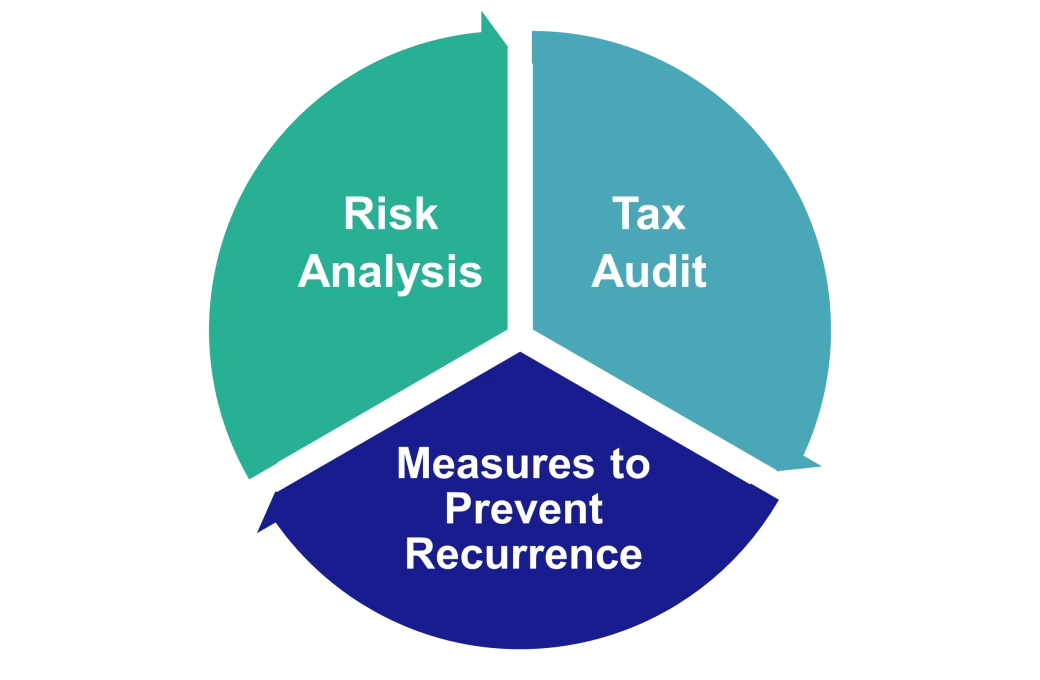

Tax audit risk management cycle

Our professionals can support clients at each of the following stages:

- Tax audit: Represent clients and discuss matters with tax auditors.

- Tax audit outcome analysis: Analyse the outcome of the tax audit and propose appropriate measures to prevent recurrence.

- Check tax risks prior to tax audit: As part of our tax audit risk analysis service, we help mitigate tax audit risks for business years open to tax audits.