What is eInvoicing?

eInvoicing is a structured electronic method for issuing, transmitting and receiving invoices between suppliers and buyers. eInvoicing refers to the issuance, transmission and receipt of invoices in a structured, machine-readable format (such as XML/UBL), enabling automated processing and real-time verification.

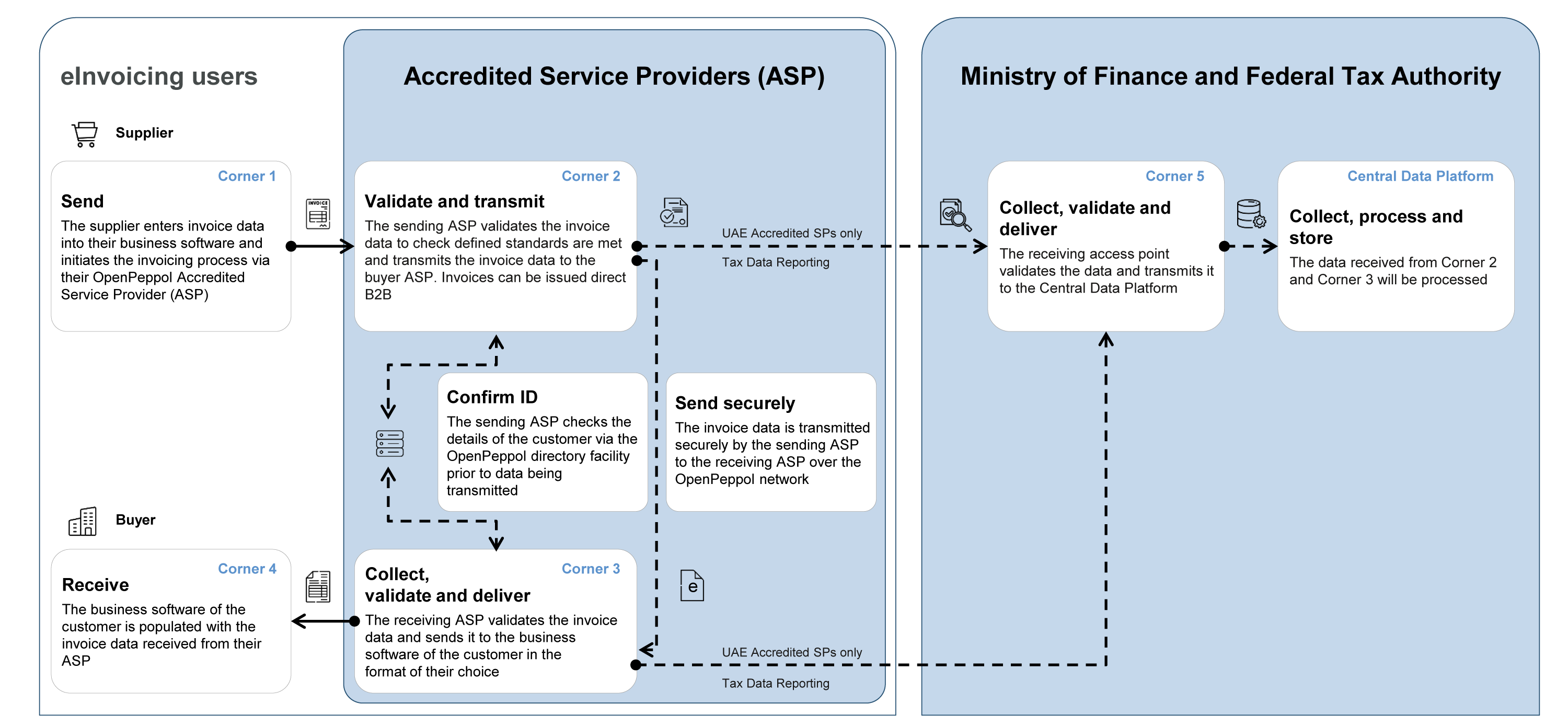

The UAE’s eInvoicing framework uses a decentralised multi-corner model supported by accredited service providers (ASP) and a central platform overseen by the relevant authority. Accredited providers facilitate secure transmission while ensuring technical and regulatory compliance.

Why eInvoicing?

eInvoicing supports a more efficient and transparent fiscal environment. By reducing manual processes, it improves accuracy, strengthens fraud prevention and enhances operational efficiency.

Key benefits include:

- Minimising VAT leakage

- Enhancing security through encrypted validated exchanges

- Improving workflow efficiency and cashflow visibility

- Supporting government policy and sustainability objectives

eInvoicing framework in the UAE

The UAE eInvoicing Model: Decentralized Continuous Transaction Control and Exchange (DCTCE) / 5 Corner

eInvoicing implementation timeline

The UAE government has released updated regulations through Ministerial Decision No. 243 of 2025 and Ministerial Decision No. 244 of 2025 on 28 September 2025. These decisions set out the phased rollout of the eInvoicing system. The implementation roadmap is as follows:

| Phase | Category | Deadline to appoint ASP | Mandatory implementation date |

|---|---|---|---|

| Pilot programme | Selected businesses (Taxpayer Working Group) | Not Applicable | 1 July 2026 |

| Voluntary adoption | Any business (optional) | Flexible | From 1 July 2026 |

| Phase 1 | Large businesses with revenue ≥ AED 50 million | 31 July 2026 | 1 January 2027 |

| Phase 2 | Businesses with revenue < AED 50 million | 31 March 2027 | 1 July 2027 |

| Phase 3 | All UAE Government Entities | 31 March 2027 | 1 October 2027 |

Exceptions

eInvoicing requirements do not apply to:

- Sovereign government entities acting in a sovereign capacity

- International passenger transport services supported by an electronic ticket, including related ancillary services

- International air freight transport documented by an airway bill during an initial exemption period

- Financial services that are VAT exempt or zero rated

- Business-to-consumer transactions

How eInvoicing works

In a multi-corner exchange model, the main steps are:

- The supplier sends invoice data to an accredited service provider

- The provider validates, converts to XML, and transmits it to the buyer’s provider

- Tax data is reported to the central data platform

- Message level statuses confirm successful reporting and delivery

How Forvis Mazars can help

Forvis Mazars supports organisations at every stage of their eInvoicing journey. Our services include:

- Readiness assessments and gap analysis of current invoicing processes versus FTA requirements (mapping, identifying missing data, assessing system readiness, ensuring correct VAT treatment)

- Advising on technical and procedural changes mandated by the FTA

- Providing guidance on compliance documentation and internal controls

While Forvis Mazars is not an ASP, we can recommend preferred ASP partners for integration with your invoicing system, ensuring full alignment with the FTA platform and standards. We focus on practical implementation that balances compliance with operational efficiency to reduce risk and disruption.

The Ministry of Finance |