Closing the Jibar chapter: Progress toward ZARONIA

Why IBOR reform matters

Benchmark reference rates like the Interbank Offered Rates (IBORs) are central to global financial markets. They influence the pricing of loans, bonds, and derivatives.

However, IBORs have come under scrutiny due to limited market activity and low transaction volumes. These weaknesses have made them vulnerable to manipulation and reduced their credibility.

The IBOR reform involves the transition away from IBORs to more robust alternatives known as Risk-free rates (RFRs). These rates are based on actual transactions in highly liquid overnight markets, making them more transparent and reliable.

Many countries around the world have already transitioned; The UK has replaced LIBOR with SONIA (Sterling Overnight Index Average), while the US has adopted SOFR (Secured Overnight Financing Rate). South Africa is following suit, with the Johannesburg Interbank Average Rate (Jibar) being phased out in favour of the ZARONIA (South African Rand Overnight Index Average), which has been formally endorsed by the South African Reserve Bank (SARB) as the preferred alternative.

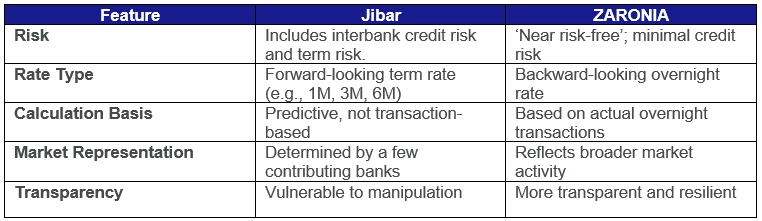

Jibar vs ZARONIA: Key Differences

South Africa’s Transition Progress

The South African Reserve Bank (SARB) established the Market Practitioners Group (MPG) as a collaborative initiative between the public and private sectors, tasked with leading South Africa’s reference rate reform programme.

The transition has progressed significantly since 2024, gaining momentum during 2025; notably the transition plan issued by the MPG in May 2024, proposed fallback methodology1 for the transition to ZARONIA issued by the MPG in November 2024, and market conventions for ZARONIA-linked loans issued by the SARB in January 2025.

May 2025 saw the launch of the ‘ZARONIA First’ initiative by the MPG through a public media release, signalling a shift toward prioritizing ZARONIA-referenced derivative contracts over those linked to Jibar, and confirmation by the Johannesburg Stock Exchange (JSE) and South Africa’s central securities depository of their operational readiness to process and list ZARONIA-linked bonds.

Standard Bank announced the issuance of the first listed bond referencing ZARONIA, marking a significant milestone in the country’s benchmark rate reform and the broader transition away from Jibar.

Finally, the SARB issued a media release on 3 December 2025 announcing the permanent discontinuation of the Jibar after its final publication on 31 December 2026. From that date, all Jibar tenors will cease and will no longer be considered as representative.

Going into 2026, the SARB and the MPG encourage accelerated transition efforts for all financial contracts in anticipation of the final Jibar cession.

Impact on Financial Statements

In response to the IBOR reform, the IASB amended IFRS 9 Financial Instruments to provide certain accounting reliefs. The Phase 1 amendment only addresses hedge accounting, whereas the Phase 2 amendment applies to all financial instruments as well as leases that are impacted by the IBOR reform. For a quick recap on these amendments refer to our previous articles, The joys of JIBAR and IBOR reform still reforming.

To support the amendments made to IFRS 9 Financial Instruments, the IASB introduced changes to IFRS 7 Financial Instruments: Disclosures.

The objective of the required disclosure is to allow users of financial statements to understand how the IBOR reform affects the entity’s financial instruments, risk management strategy, and progress in transitioning to alternative benchmark rates.2

Qualitative Disclosures

Entities should explain:

- Risk Exposure: The types and extent of risks arising from benchmark reform.

- Transition Strategy: How the entity is managing the move to new rates.

- Progress Update: Current status of the IBOR transition and steps taken to date.

Examples include:

1. Engagement with counterparties, for example:

- what is the plan to transition existing contracts from Jibar to an alternative interest rate;

- have Jibar-linked contracts been updated to include fallback language3;

- are Jibar-linked contracts already in the process of being renegotiated or restructured to reference a different interest rate such as Prime or ZARONIA.

2. Has the entity successfully transitioned certain financial instruments to an alternative interest rate.

3. Does the entity have internal governance structures (e.g., committees or task forces) overseeing the transition.

Quantitative Disclosures

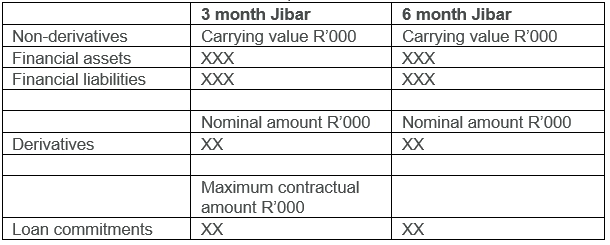

Entities must disclose quantitative information about financial instruments that are still linked to Jibar, broken down by:

- Non-derivative financial assets

- Non-derivative financial liabilities

- Derivatives

IFRS 7 is not prescriptive on how to disclose quantitative information, as long as the disclosure meets the objective, provides useful information and is clearly explained in the financial statements.

Depending on the nature of the instrument and what provides the most useful information to users, entities may discloss4:

- carrying values or contractual par amount of non-derivative financial instruments;

- nominal amounts of derivative contracts; or

- information based on amounts reported internally to key management such as the board of directors, the executive committee etc.

Illustrative example:

The group holds Jibar-linked financial instruments at reporting date with contractual maturities extending beyond the expected cession in 2026. These financial instruments are expected to be impacted by the Jibar transition and are presented in the table below:

Alternatively, the quantitative information can be provided using percentages with additional qualitative disclosure to explain the basis to users.

In addition to the above the following specific disclosures are required for hedging relationships5:

- Benchmarks Used: Identify major interest rate benchmarks (e.g., Jibar).

- Risk Exposure: Explain how benchmark reform affects risk management.

- Transition Strategy: Outline steps taken to adopt new rates (e.g., ZARONIA).

- Judgements Made: Disclose key assumptions and uncertainties.

- Hedging Amounts: Report nominal values of hedging instruments.

- Transition Management: Describe how the entity is managing the change.

To meet IFRS 7 requirements, entities must provide clear, entity-specific qualitative disclosures and relevant quantitative information. While IFRS 7 is principles-based, disclosures should be meaningful, tailored to the nature and volume of JIBAR-linked instruments, and proportionate to the entity’s exposure.

In conclusion…

The shift to ZARONIA is more than a technical adjustment—it is a regulatory imperative that demands proactive engagement from all market participants. With IFRS 7 placing emphasis on meaningful, entity-specific disclosures, organisations must ensure their financial reporting reflects both the risks and progress of the transition in 2026 as South Africa closes the final chapter on the Jibar. Timely preparation will be key to avoiding disruption and maintaining compliance.

1Fallback methodology is a predefined plan, process or contractual provision for determining and transitioning to an alternative interest rate when a benchmark rate (example Jibar) is no longer available.

2Refer to IFRS 7.24I and IFRS 7.24J.

3Pre-agreed contractual terms that specify what interest rate will apply if the original benchmark rate (example Jibar) becomes unavailable or is discontinued.

4Refer to IFRS 7. BC35KKK

5Refer to IFRS 7.24H.

Author:

Justine Lewis, Senior IFRS Manager

Want to know more?