MPMs – what are they and how will they affect reporting

In April 2024, the International Accounting Standards Board (‘IASB’) released IFRS 18 Presentation and Disclosure in Financial Statements (‘IFRS 18’), which supersedes IAS 1 Presentation of Financial Statements together with a number of consequential amendments (other Standards that changed due to the new Standard).

One of the key changes introduced by IFRS 18 is the identification and disclosure of management-defined performance measures. The new disclosure requirements aim to improve transparency and promote understanding of the use of such measures within the financial statements.

Stakeholders have found certain subtotals of income and expenses useful in analysing performance to assist in their decision-making. The inclusion of MPMs is intended to offer insights into management's perspective on the entity's financial performance, how the business is managed, as well as how an entity’s performance is communicated to stakeholders.

The IASB has provided new requirements to disclose MPMs to ensure preparers provide the appropriate level of disclosures regarding these entity-specific MPMs. MPMs will now be included within the scope of an audit as a required financial statement disclosure per IFRS 18.

What are MPMs?

An entity might have no MPMs, it might only use IFRS® Accounting Standard measures when communicating their performance; it might have only one, or there could be more. It is important to understand what an MPM is, and what it’s not, and to know whether these new disclosure requirements apply.

MPMs are defined as subtotals of income and expenses that an entity uses:

- in public communications outside the financial statements;

- to communicate management's view of an aspect of the entity's overall financial performance for that period; and

- that are not already listed in IFRS 18 or required by any other IFRS Accounting Standard.

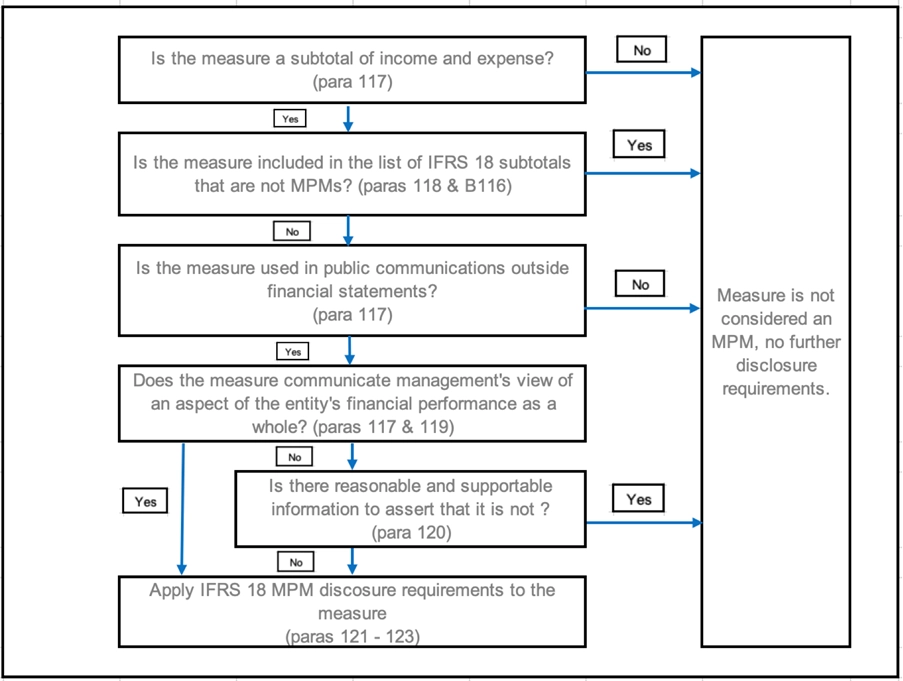

Each of the ‘requirements’ in the definition is expanded below to enable an easier understanding as to whether this will affect your company’s reporting or not. To further simplify the matter, this decision tree provides an illustration as to the considerations to be made whether a performance measure is an MPM that requires disclosure in the financial statements.

Subtotals of income and expenses

IFRS 18 MPM requirements for subtotals of income and expenses focus specifically on a subset of non-GAAP measures. Excluded from these include:

- Measures that are not subtotals of income and expenses, for example,

o financial ratios, like a return on assets or capital, liquidity or solvency;

o free cash flow (the money a company has left over after paying its operating expenses and capital expenditures); or

o net asset value (assets minus liabilities).

- Subtotals of only income or only expenses, such as adjusted revenue or profits; net interest or net rental income.

- The definition also excludes those measures specifically listed in IFRS 18, for example:

o gross profit;

o EBITDA;

o operating profit; or

o subtotals per section of the statement of performance.

While these are not considered MPMs, the Standard does not prohibit their presentation in the financial statements.

Examples of MPMs include adjusted profit or loss, adjusted operating profit, financing result, EBIT, and adjusted EBITDA. ‘Cost of net debt’ seems to be one of the more contentious measures at the moment, with some preparers interpreting ‘cost of net debt’ will almost always be an MPM. While others view and require it to be analysed on case-by-case basis to determine if the presumption can be rebutted causing it not to be an MPM (refer to ‘management’s view of overall financial performance’ below).

If a subtotal that is used in an external financial ratio meets the definition of a MPM measure, then that subtotal itself is also considered a MPM and will require the same disclosures.

Public communication

MPMs are those communicated to the public outside of the financial statements. This would include management commentary, press releases and investor presentations. Oral communications, transcripts of oral communications and social media are excluded. A subtotal relating to interim financial statements can only be an MPM in the interims.

Management’s view of overall financial performance

There is a rebuttable presumption that if management is communicating numbers publicly outside of the financial statements, it is communicating their view of an aspect of the entity’s financial performance as a whole. This can be rebutted with reasonable supportable information that demonstrates that it is not.

Considerations that should be made include:

- Does it demonstrate the entity’s performance as a whole? If it is a subtotal for a reportable segment, it might not be for the whole entity;

- Is it a required metric? i.e.

o Entities listed on the JSE are currently1 required to disclose headline earnings per share in all their communications. While management of one entity could decide that is does demonstrate their view of the entity’s performance, management of another entity may decide it does not and it is only included as it is a requirement.

o government entities are required to disclose metrics such as fruitless and wasteful expenditure and/or net coverage ratio.

IFRS 18 does not require companies to disclose when or why they have successfully rebutted the presumption for specific subtotals used in their public communications.

MPM disclosure

IFRS 18 requires MPM disclosures in the financial statements to provide users with information to understand the aspect of financial performance that management communicates as an MPM, and how it compares to measures already included in the financial statements. The disclosures, detailed in paragraphs 122 – 125 of IFRS 18, are required to be disclosed in a single note within the financial statements. An MPM can be disclosed on the face of the statement of performance if they comply with the IFRS 18 requirements for additional subtotals.

According to IFRS 18, and entity shall disclose the following for each defined MPM:

| Reference | Disclosure requirement | Qualitative / Quantitative |

| Para 123(a) | Explain the MPM and the aspect of the company's financial performance management believes the MPM communicates.

This explanation should detail why management considers the MPM useful for understanding the entity's financial performance. | Qualitative disclosure |

| Para 123(b) | How the MPM is calculated. | Qualitative disclosure |

| Paras 123(c) & B136–B140 | Reconcile the MPM to the most directly comparable subtotal in the financial statements. | Quantitative disclosure |

| Para 123(d) | The income tax and non-controlling interest effect of each reconciling item. | Quantitative disclosure |

| Paras 123(e) & B141 | Explain how the entity calculates the income tax effects in the reconciliation, applying statutory tax rates, pro rata allocations of current and deferred tax and/or other methods. | Qualitative disclosure |

1With the consequential amendment made to IAS 33 effectively no longer allowing an alternative per share measure, the JSE is considering a proposal to change this to a requirement to disclose Headline Earnings in the annual financial statements, and the ‘per share’ number outside, unless it is considered an MPM.

How will this impact preparers of financial statements?

IFRS 18 is effective for annual periods beginning on or after January 1, 2027, with early adoption permitted. On implementation, companies must apply the new requirements to their interim financial statements, restating prior-year comparative data in accordance with IAS 8 Basis of Preparation of Financial Statements, resulting in retrospective application.

To implement transition, a reconciliation of opening balances is necessary. Additionally, IFRS 18 mandates a comparative period reconciliation that involves showing the differences, line by line in the statement of performance, between figures adjusted under IFRS 18 and those originally reported under IAS 1.

To facilitate a seamless transition to the new management performance measure disclosures, management should begin their IFRS 18 implementation project well in advance. Management will need to assess all their performance measures that are publicly reported outside of the financial statements and understand why they are reported. Management will need to assess whether there are measures of income and expenses that communicate what they believe demonstrates the performance of the entity as a whole. Seamless transition will involve identifying relevant measures, determining if measures meet the MPM definition and compiling the necessary supporting information and justifications for both the initial adoption and for the first audit post adoption. The importance of proactive assessment and preparation is crucial to a successful transition.

Authors:

Karolina Martin, IFRS Director and Justine Combrink, Partner