Unpacking (or packing) the data

IFRS 18 Presentation and Disclosure in Financial Statements (‘IFRS 18’), establishes new principles for grouping information in financial statements.

The principles of aggregation and disaggregation are addressed in IFRS 18 to assist preparers to determine the right mix of information that will assist users in understanding the financial statements.

New grouping principles

The principles of aggregation and disaggregation involve:

- aggregating similar line items together,

- disaggregating dissimilar line items,

- ensuring that these processes result in primary financial statements and notes that provide useful, clear summaries and material information, and

- without obscuring material information.

The role of primary financial statements and notes

The primary financial statements and notes now play a key complementary role. IFRS 18 clarifies the previously undefined roles of primary financial statements and the notes (unlike IAS 1), which guides the application of aggregation and disaggregation principles.

The aim of primary financial statements is to provide structured, useful summaries of an entity's financial position and performance, enabling users to gain an understandable overview for comparisons and to identify areas requiring further detail in the notes.

The notes enhance the material information in the primary statements necessary for understanding the primary statements and to supplement the primary statements with additional details required by IFRS® Accounting Standards.

Materiality

Material information requires disaggregation. If a line item isn't presented separately in the primary statements, then the material information must be disclosed in the notes.

Examples that have dissimilar characteristics to warrant separate presentation in the primary financial statements (for a useful summary) or, if not provided in the primary financial statements, material disclosure in the notes, are noted below in figure 1 and 2:

Figure 1 and 2: Disaggregation examples

Faithful representation relating to groupings

According to IFRS 18, the way a preparer labels and describes line items (whether a total, subtotal, or line item in the primary statements, or a disclosure in the notes) must faithfully represent its underlying characteristics.

Faithfully representing an item means providing all the descriptions and explanations a user needs to understand it. In certain situations, this includes clarifying the meaning of the company's terminology and detailing the methods used for grouping (aggregating) or breaking down (disaggregating) assets, liabilities, equity, income, expenses, and cash flows.

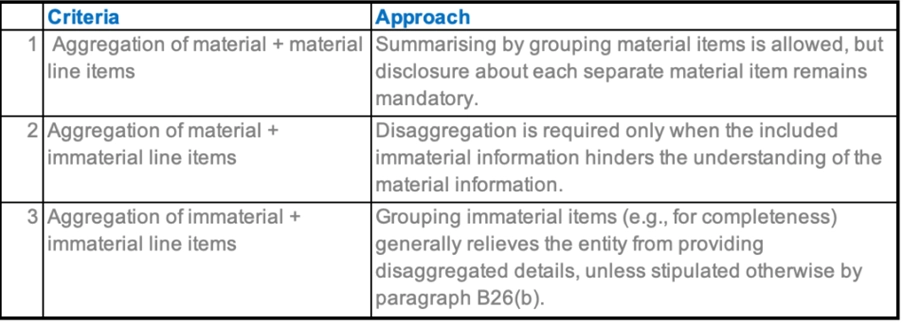

Recognising that reported items often combine individual transactions, therefore material and immaterial amounts are potentially grouped together. In such instances, IFRS 18 provides preparers with the following guidance for the primary financial statements or the notes:

The use of the label ‘other’

Preparers may only use the label 'other' when a more informative description isn't possible. To achieve better labelling and to avoid using ‘other’ as labelling:

- preparers should describe aggregated material items by their nature (even if mixed with immaterial ones), and

- preparers should describe aggregated immaterial items either by their shared characteristics (if similar) or by their mixed nature (if dissimilar).

In rare instances where no label more informative than 'other' can be found, the preparer must still adhere to certain requirements. Firstly, for any aggregation labelled 'other', the description used should be as precise as feasible (e.g., 'other operating expenses' instead of just 'other').

Secondly, special consideration is needed if an 'other' category consists solely of immaterial items but sums to a large total. If this large total could lead users to question whether material items are obscured within it, then providing information to address this concern becomes material.

In such cases, the entity is required to disclose further details, for example, by explicitly confirming the absence of material items or by explaining the composition as numerous immaterial items (perhaps noting the nature and size of the largest one).

In conclusion…

Entities should proactively consider how they ‘package’ and ‘unpackage’ their material line items. Analysing these grouping principles of IFRS 18 is crucial for the presentation of their primary financial statements and related notes. This process, while requiring judgment and planning, will ultimately enhance financial statement users' understanding of how material and immaterial items are aggregated and disaggregated to reflect the entity's best financial picture.

Author:

Karolina Martin, Director

Want to know more?