Providing support to Croatian subcontractors in Belgium

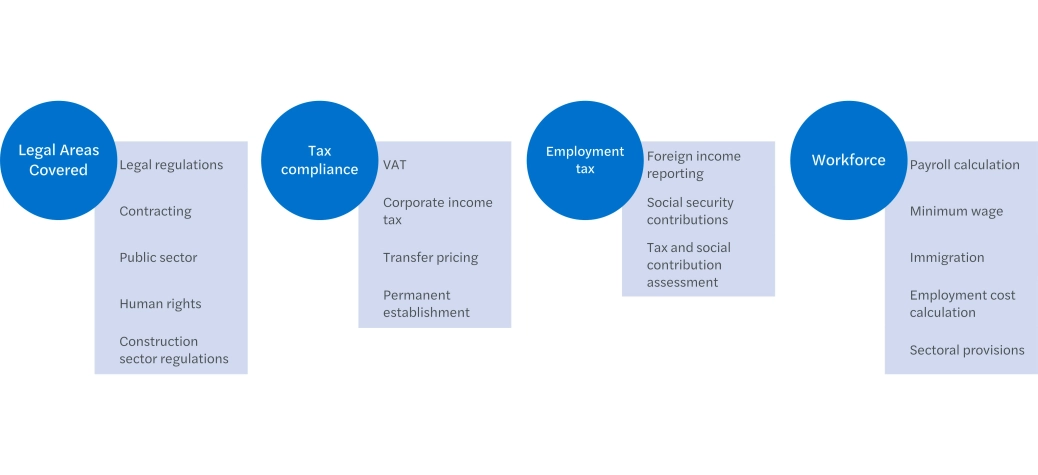

Our goal is to guide you through every step of the process and address all your questions. From compliance support in areas like personal income tax, corporate tax, VAT, labor law, social security and immigration, to advisory and compliance reviews, we ensure a smooth and compliant experience for you and your workforce both in Belgium and in Croatia.

Belgium is renowned for its stringent compliance requirements in the construction industry. Both main contractors and Belgian authorities enforce these regulations rigorously, conducting thorough checks on employment conditions, work permits, social security, and taxation. Non-compliance can lead to significant penalties and project delays. In the past years, several scandals involving illegal employment and human trafficking have been uncovered on constructions sites, prompting Belgian authorities and main contractors to increase on-site inspections/audits to ensure all formalities in the hands of the subcontractor chain are met.

Ensuring compliance is essential for securing your business’s future in the Belgian market. Therefore, it is crucial to be well-prepared and fully compliant when sending workers to Belgium.

Become aware of the need to be and remain compliant

Have you asked yourself the following questions?

- Did you check the minimum wages and sectoral obligations when working in Belgium?

- Did you know that depending on the length of the project in Belgium, you must comply with corporate income tax formalities?

- Are you aware that overtime is limited in Belgium?

- Did you know that daily allowances paid to the workers could be considered taxable salary in Belgium?

If your answer is no to any of these questions, you might not be in compliance with local regulations and you could face severe penalties.

How can we help?

We offer a comprehensive range of services to ensure your company and workforce remain compliant with both Belgian and Croatian regulations. Our expertise includes tax, social security, immigration and labour law tailored to your specific sector needs.

We also facilitate coordination between your company and our offices to streamline the process and ensure all requirements are met efficiently. Our dedicated team of professionals takes a holistic approach supporting you in every step of the way, to ensure your operations in Belgium and Croatia run smoothly and compliantly

Services we offer:

- Compliance services in Belgium and Croatia

- Advisory services

- Project budgeting

Common services our clients request:

- Consulting on the tax treatment of posted workers

- Advice on minimum wage requirements

- Obtaining A1 certificates

- Calculation of hypothetical tax

- Risk analysis of creating a permanent establishment

- Calculation and filing of monthly tax prepayments

- Preparation of posting declarations

- Tax cost estimates (tax and social contribution assessment)

- Annual calculation and reporting of foreign income

With years of experience working with subcontracting companies in the construction industry, Forvis Mazars has gained a deep understanding of the unique challenges and requirements you face when working across borders. Our extensive experience and hands-on support enable us to provide tailored solutions that meet your specific needs. By leveraging our expertise, you can benefit from efficient processes, reduced risks, and enhanced compliance, ensuring the success of your projects in Belgium, both now and in the future.

Partnering with Forvis Mazars in Belgium and Croatia allows you to concentrate on your core business and project management while we handle all regulatory and administrative requirements. Together, we can achieve excellence for your projects in Belgium.

By relying on Forvis Mazars offices in Belgium and Croatia for compliance matters, you can focus on your core business activities