Removal of Entity-Level Principal Adverse Impact (PAI) Disclosures

- Entity-level requirements on PAI and remuneration policies are deleted. Large entities subject to the CSRD will continue reporting impacts under corporate sustainability rules.

- Expected impact: approximately 25% reduction in overall SFDR disclosure costs and estimated annual savings of €56M.

- However, product-level disclosures are simplified to essential, comparable and meaningful data; the new formats are designed to be retail-friendly.

Removal from the scope of application

- Financial advisers and Portfolio managers have been removed from the SFDR scope.

Discontinuation of Articles 8 and 9 as Disclosure Categories

- The current product categorization under Articles 8 and 9 is removed. Products wishing to make sustainability-related claims must comply with one of three new categories.

Introduction of a clear ESG product categorization via a Three-label System

| Sustainable Category (Article 9) | Products investing in undertakings, activities or assets that are sustainable or contribute to environmental and/or social objectives. |

| Transition Category (Article 7) | Products investing in undertakings, activities or assets on a credible path to sustainability while contributing to environmental or social transition objectives. |

| ESG Basics Category (Article 8) | Products integrating sustainability factors beyond risk management consideration in their investment strategy. |

Each category applies minimum criteria, including:

- A 70% investment threshold aligned with the stated sustainability objective or strategy (the remaining investments should not contradict the sustainability related claims of the financial product),

- Common exclusions for harmful activities: Human rights violations, tobacco, prohibited weapons, fossil fuels above set thresholds, activities causing severe environmental harm

Stricter Naming and Marketing Rules

- Only products categorized under the new framework may use sustainability-related terms in names and marketing communications. Non-categorized products may include ancillary sustainability information in disclosures, provided it is not a central element and does not constitute sustainability-related claims.

Exemption of disclosures for closed-ended financial products

- Closed-ended financial products created before the date of application of SFDR 2.0 are exempt to provide disclosures.

Simplified Disclosure Templates

- Reduction of disclosure requirements for Articles 7, 8 and 9 limited to two pages and one page for additional impact-related disclosures under Articles 7 and 9.

Removal of the Sustainable Investment Concept

- The concept of sustainable investment has been removed and as a result, the Do Not Significant Harm (DNSH) principle no longer applies.

- Furthermore, only Articles 7 and 9 pursuing an environmental objective can use impact in fund’s name.

The SFDR 2.0 Proposal represents a structural redesign of the EU sustainability disclosure framework, aiming to deliver clearer, more reliable and more comparable information to investors. By strengthening safeguards against greenwashing, in line with the direction set by ESMA’s Guidelines on fund names, the new regime seeks to enhance trust and transparency across financial products.

Beyond simplifying the framework, the reform is expected to lead to clearer and shorter disclosures for investors, reduce overlap with other EU sustainability reporting rules, lower compliance costs for financial providers, and further strengthen protection against greenwashing.

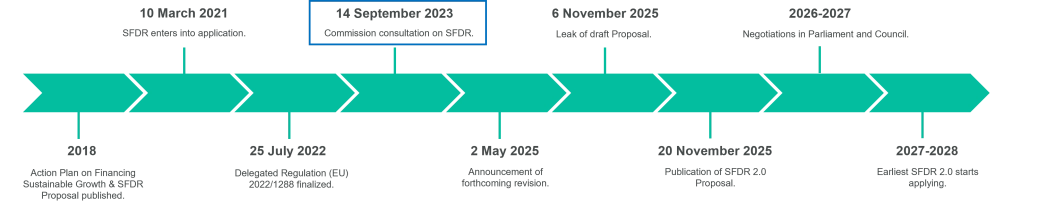

The Proposal will now be examined by the European Parliament and the Council, after which a limited set of implementing acts will specify the technical details and disclosure templates required for application.

How Forvis Mazars can help

Navigating the transition from the existing SFDR framework to the revised SFDR 2.0 regime presents important strategic and operational considerations. Forvis Mazars is well positioned to support financial market participants in managing this transition effectively:

SFDR 2.0 Assessment & Product Categorisation

| |

Transition Strategy & Product Re-Design

| |

Implementation Support

| |

Post-Implementation Assurance

|

Regulatory references

Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) 2019/2088 (SFDR), Regulation (EU) No 1286/2014 (PRIIPs), and repealing Commission Delegated Regulation (EU) 2022/1288 |

Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector |

Commission Delegated Regulation (EU) 2022/1288 of 6 April 2022 |

ESMA Guidelines on funds’ names using ESG or sustainability-related terms (ESMA34-1592494965-657) |

This website uses cookies.

Some of these cookies are necessary, while others help us analyse our traffic, serve advertising and deliver customised experiences for you.

For more information on the cookies we use, please refer to our Privacy Policy.

This website cannot function properly without these cookies.

Analytical cookies help us enhance our website by collecting information on its usage.

We use marketing cookies to increase the relevancy of our advertising campaigns.