Tax Ruling Analysis

TR 280

Background

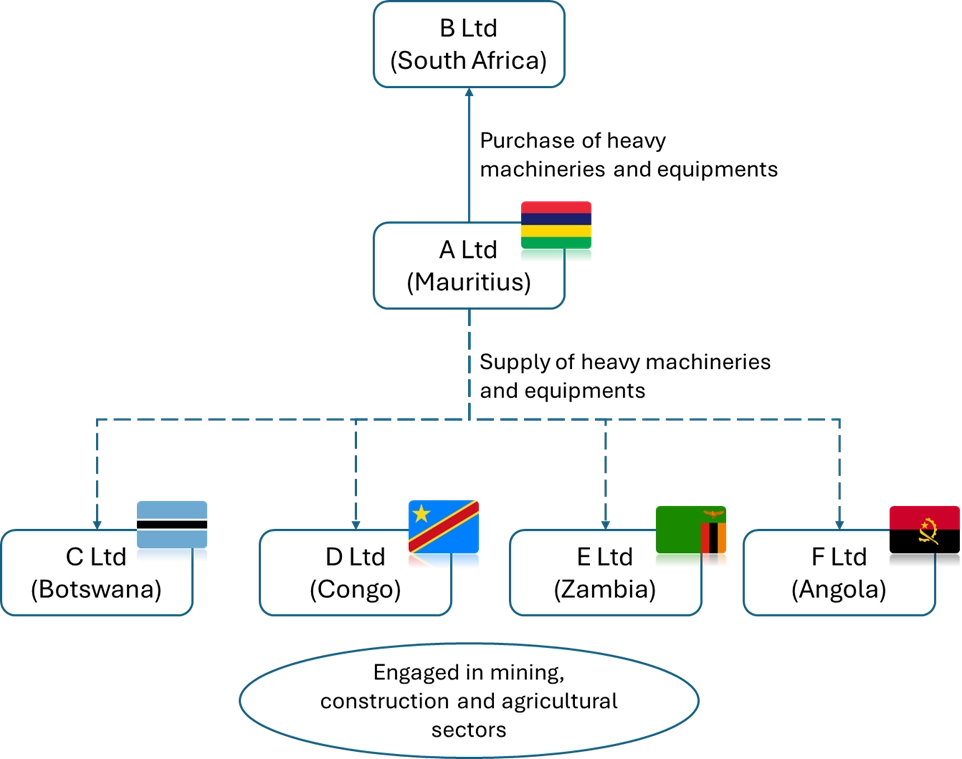

A Ltd, incorporated in 2016, holds a Global Business License (GBL) issued in Mauritius. The company is engaged in the rental and sale of heavy machinery and moving equipment to clients primarily located in various African countries.

As part of its operations, A Ltd purchases or leases equipment, which is subsequently sold or sub-leased to its clients. In cases where equipment is leased, the arrangement is structured as a finance lease, whereby ownership of the equipment is transferred to the lessee upon payment of the final instalment. This structure aligns with the principles of amortised sales under finance leasing.

A Ltd’s principal supplier is B Ltd, a company based in South Africa.

The business model is illustrated as follows:

In substance, the equipment is purchased by A Ltd, but instead of being shipped to Mauritius, it is delivered directly to A Ltd’s clients in their respective countries.

(ii) Point at Issue –

The key issue is whether A Ltd qualifies for the preferential tax rate of 3% under Section 44B of the Income Tax Act 1995 (ITA 1995), based on the chargeable income derived from the export of goods.

(iii) Ruling

Based on the facts presented, the Ruling Committee of the MRA concluded that, pursuant to Section 44B of the ITA 1995, A Ltd is eligible to be taxed at the reduced rate of 3% on the portion of its chargeable income attributable to the sale of equipment, including finance leases, where the goods are delivered directly from the manufacturer to the end client

(iv) Forvis Mazars Opinion

Under ITA 1995, the definition of exports of goods includes “international buying and selling of goods by an entity in its own name, whereby the shipment of such goods is made directly by the shipper in the original exporting country to the final importer in the importing country, without the goods being physically landed in Mauritius”.

The facts of A Ltd’s operations fall within this definition. However, it is critical that appropriate documentation is maintained to substantiate the classification of the transactions as international trading. Such documentation may include, but is not limited to:

- Bill of Lading (B/L) or Air Waybill (AWB) showing direct shipment from the exporting country to the importing country, with A Ltd identified as the consignee or shipper, depending on the transaction structure.

- Sales contracts demonstrating that A Ltd is acting in its own name and not as an agent.

- Purchase and sales invoices clearly identifying A Ltd as the buyer and seller.

Failure to maintain the necessary documentation may result in the MRA denying eligibility for the 3% tax rate.

TR 283

(i) Background

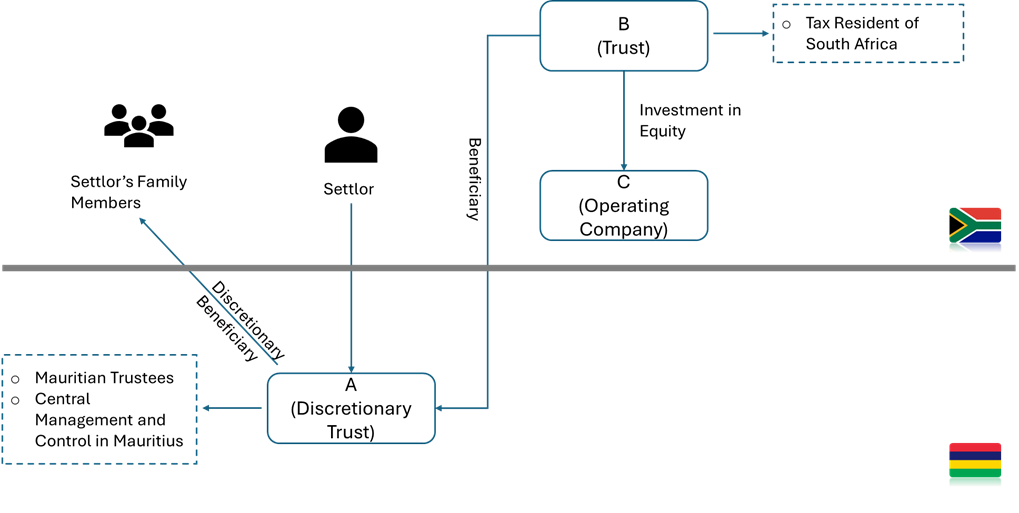

Trust A is a discretionary trust established in July 2024, with a South African resident as the settlor. The trust is administered by Mauritian trustees, and its central management and control (CMC) is located in Mauritius. The beneficiaries of Trust A are the members of the settlor’s family.

Trust B is a trust established and tax resident in South Africa. It currently holds equity investments in Company C, an operating company based in South Africa, which is expected to generate dividend income in the foreseeable future.

Trust B has resolved to appoint Trust A as one of its beneficiaries, and intends to make both capital and revenue contributions to Trust A.

A schematic representation of the transaction flow is provided below:

Income received by A

Trust B is expected to receive dividend income from its equity investment in Company C, on which a 20% withholding tax will be levied in South Africa. The net dividend proceeds will subsequently be contributed to Trust A in Mauritius.

In addition, Trust B anticipates the disposal of certain equity holdings in Company C. Any resulting capital gains will be subject to capital gains tax in South Africa. Following the payment of applicable taxes, the net sale proceeds will be remitted to Trust A in Mauritius.

(ii) Point of Issue –

Based on the background provided, the following issues were put to the Ruling Committee of Mauritius Revenue Authority (MRA) for clarification:

o Characterization of Distributions

Will the distributions received by Trust A from Trust B be treated as dividends in accordance with Section 46(4) of the Income Tax Act 1995 (ITA 1995)?

o Eligibility for Partial Exemption

If the distributions are treated as dividends under point (1) above, will they qualify for the partial exemption regime available under the ITA 1995?

o Foreign Tax Credit Claim

Can Trust A, if it so elects, claim a foreign tax credit on the distributions received from Trust B under the Double Taxation Agreement (DTA) with South Africa, given that the underlying income has already been subject to withholding tax on dividends in South Africa?

o Taxability of Untaxed Foreign Donations

Are donations received from a foreign jurisdiction, which have not been subject to any taxation, liable to tax in Mauritius at the standard corporate tax rate of 15% in the hands of Trust A?

(iii) Ruling

Considering the facts presented, the Ruling committee concluded as follows:

The distributions received by Trust A from Trust B, a trust established and tax resident in South Africa, will not be classified as dividend income under Section 46(4) of ITA 1995.

Consequently, the 80% partial exemption under the ITA 1995 will not apply to such distributions received by Trust A from Trust B.

However, Trust A may claim a foreign tax credit in respect of foreign-source income on which tax has been suffered abroad.

Furthermore, donations received from any source are considered income under Section 10 of the ITA 1995. Such amounts must be included in the computation of Trust A’s chargeable income and will be subject to tax at the rate specified in Part IV of the First Schedule to the ITA 1995.

Forvis Mazars Opinion

Section 46(4) of ITA 1995 provides that any distribution made by a trust to its beneficiary shall be deemed to be a dividend in the hands of the beneficiary. In the present case, Trust B, a trust established in South Africa, intends to distribute funds to its Mauritian beneficiary, Trust A.

While Section 46(4) applies to distributions made by Mauritian resident trusts, it is noteworthy that the MRA has taken the position that distributions received from a foreign trust do not fall within the scope of this provision. Accordingly, the distribution from Trust B is not treated as a dividend for Mauritian tax purposes.

In its communiqué issued on 1 July 2022, the MRA clarified that where distributions are made by foreign fiscally transparent entities to Mauritian residents, the income retains its original character upon receipt in Mauritius. As such, capital gains distributed by a foreign fiscally transparent entity to a Mauritian resident are treated as capital gains and are therefore not subject to income tax in Mauritius.

However, in the present case, Trust B is not regarded as a fiscally transparent entity. As a result, the above interpretation concerning the retention of income character does not apply.

Consequently, the 80% partial exemption typically available on dividend income under the Income Tax Act would not be applicable to this distribution.

Trust A may claim the tax suffered in South Africa as a credit against the tax liability arising on the dividend income in Mauritius.

The donation was treated as gross income under Section 10(1)(g) of ITA 1995 and as such would be subject to tax at the rate of 15%.

Want to know more?