Mauritius tax compliance understanding your international reporting duties

This commitment underscores the necessity for businesses and individuals operating within or through Mauritius to exercise due diligence in identifying their specific reporting obligations and to establish sophisticated systems for data collection and accurate reporting. To provide a comprehensive overview of this vital aspect of international tax compliance in Mauritius, this article will explore three key reporting obligations: (1) Country-by-Country Reporting (CbCR), (2) the Foreign Account Tax Compliance Act (FATCA), and (3) the Common Reporting Standard (CRS).

1. Country by country reporting

CbCR is a pivotal component of the Organisation for Economic Co-operation and Development's (OECD) Base Erosion and Profit Shifting (BEPS) Action 13. Its primary objective is to enhance transparency for tax administrations by providing them with a comprehensive overview of how multinational enterprise (MNE) groups allocate their income, pay taxes, and conduct their economic activities across the various tax jurisdictions in which they operate.

Under CbCR, the ultimate parent entity of qualifying MNE groups is mandated to submit an annual report detailing key aspects of their global operations. This report provides aggregated data for each jurisdiction where the MNE group operates, encompassing:

- Financial Data: Including total revenues (from both related and unrelated parties), profit or loss before income tax, income tax accrued, and income tax paid.

- Activity Information: Covering stated capital, accumulated earnings, the number of employees (expressed as full-time equivalents), and the net book value of tangible assets (excluding cash and cash equivalents).

Typically, the CbC Report is submitted to the tax authority of the jurisdiction where the ultimate parent entity is tax resident. Mauritius has implemented CbCR in alignment with international standards, requiring MNEs with a consolidated group turnover exceeding Euro 750 million to comply. Facilitated by international exchange agreements, this report is then automatically shared with the tax authorities of other jurisdictions where the MNE group has a taxable presence and meets certain defined thresholds.

2. Foreign Account Tax Compliance Act

FATCA is a United States (U.S.) federal law enacted in 2010 with the primary goal of preventing tax evasion by U.S. persons holding financial assets in non-U.S. financial institutions. Recognizing the importance of international cooperation, Mauritius has entered into an Intergovernmental Agreement (IGA) with the United States to facilitate the implementation of FATCA.

This IGA is based on the Model 1A approach, which signifies that Mauritian Financial Institutions (FIs) are required to report information on financial accounts held by U.S. persons to the Mauritius Revenue Authority (MRA). The MRA then exchanges this information with the U.S. Internal Revenue Service (IRS) on an automatic basis.

The MRA then exchanges this information with the U.S. Internal Revenue Service (IRS) on an automatic basis.

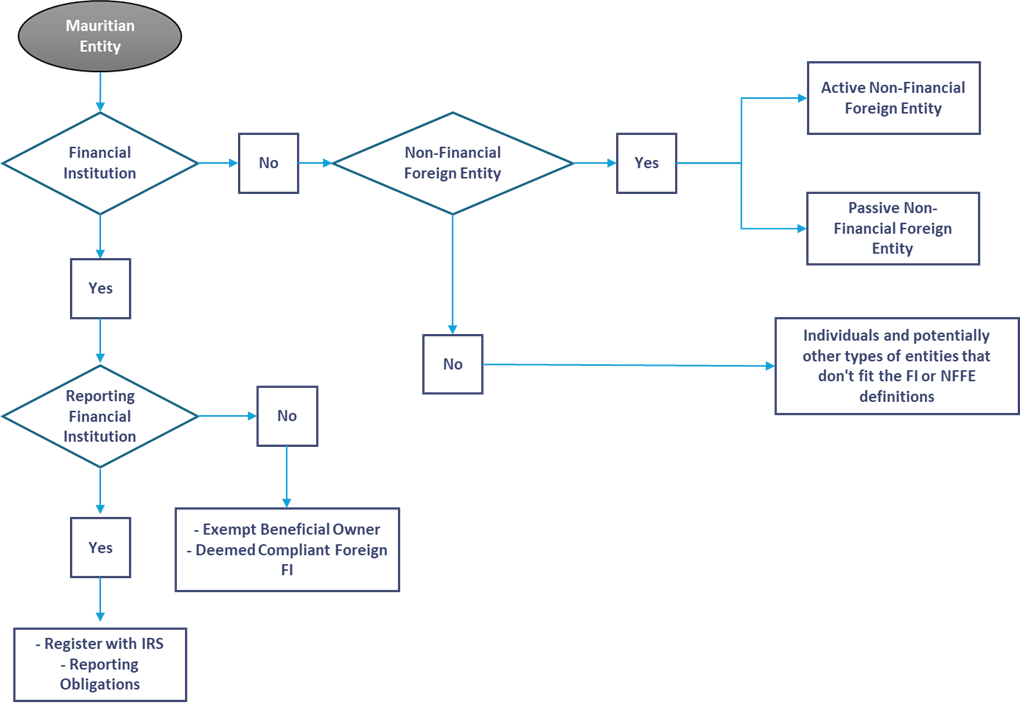

In that respect, Mauritian entities need to carefully assess their activities and structure against the definitions provided in the Mauritius-U.S. IGA and FATCA regulations to determine if they fall within the scope and what their specific compliance obligations are.

3. Common reporting standard

Developed by the OECD and endorsed by the G20, the CRS is a global standard for the automatic exchange of financial account information. Its primary objective is to combat tax evasion by providing tax authorities with greater visibility into financial assets held by their residents in other jurisdictions. Essentially, CRS is the multilateral equivalent of FATCA, significantly broader in scope and involving a vast network of participating countries.

Mauritius has formally committed to implementing the CRS and has established the necessary legal and administrative frameworks to comply with its obligations. This commitment unequivocally underscores Mauritius's dedication to being a responsible and transparent financial jurisdiction on the global stage.

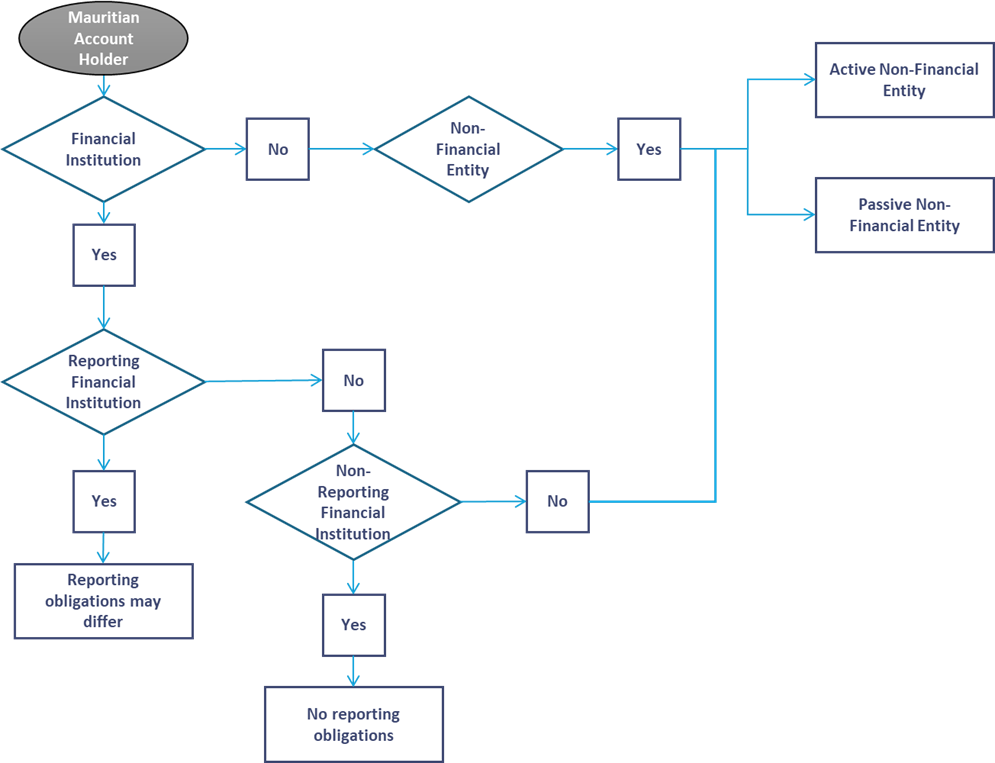

Under the CRS, FIs in participating jurisdictions – including banks, investment firms, and certain insurance companies – play a crucial role. They are required to identify accounts held by individuals and entities who are tax residents in other countries that have also adopted the CRS.

In a nutshell, CRS is a global version of FATCA but broader in scope and involving many more countries

Conclusion

Mauritius's proactive engagement with international tax reporting frameworks like CbCR, FATCA, and CRS demonstrates its commitment to transparency and its role as a responsible global financial centre. Navigating these obligations requires a thorough understanding of the relevant regulations and the establishment of robust internal processes. By embracing these standards, Mauritius continues to enhance its reputation and contribute to the global effort against tax evasion, ensuring a fair and transparent international tax landscape.

Want to know more?