Standard Business Reporting in the Netherlands: Assessing the impact on your filing requirements

Standard Business Reporting in the Netherlands

Until now, large entities and their medium-sized subsidiaries were exempt from filing financial statements in a digital format. As of 2025, there are no more exemptions. All legal entities in the Netherlands are required to file their report in either XBRL or inline XBRL (iXBRL) format with the Trade Register of the Chamber of Commerce (CoC).

New requirements

Choice between formats

XBRL is machine-readable code. The iXBRL format allows the the XBRL-data to be embedded within the glossy report that is converted to a browser-document (XHTML). In principle, there is a free choice for companies between formats. This choice is sometimes restricted, as indicated to the below.

The majority of companies coming into scope are expected to use the iXBRL format.

Impact in group situations

Companies making use of the filing exemption (art. 2:403 Dutch Civil Code [“DCC”]) or the consolidation exemption for intermediate parent companies (art. 2:408 DCC) are required to file their parent company’s consolidated financial statements with the Trade Register. In case of a foreign parent company that does not submit its own financial statements to the Trade Register, this filing will also need to be done in iXBRL format. This can no longer be done in PDF.*

* For 2025, there is an exemption for parent company financial statements for companies applying the 408-exemption.

Scope of 2025 changes

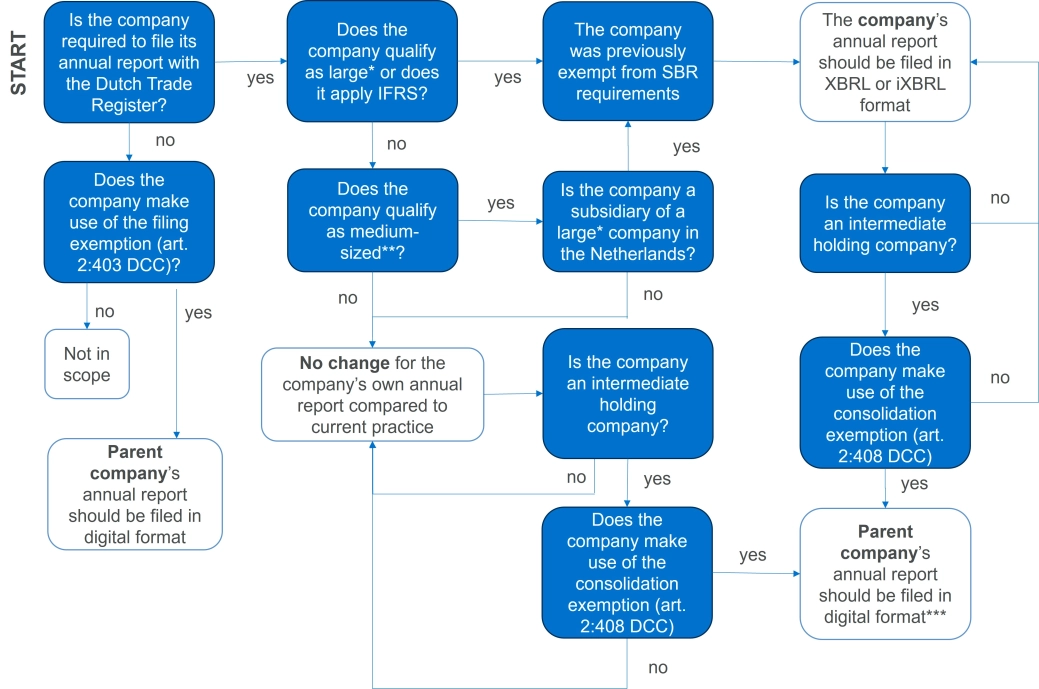

The decision tree below will help you to determine the impact on your filing requirements:

* Large companies meet 2 out of 3 criteria for 2 consecutive periods: 1) Total assets € >25 mln 2) revenues € >50 mln 3) 250+ employees

** Medium-sized companies meet 2 out of 3 criteria for 2 consecutive periods: 1) Total assets € 7,5-25 mln 2) revenues € 15-50 mln 3) 50-250 employees

*** For 2025, there is an exemption for parent company financial statements for companies applying the 408-exemption.

How Forvis Mazars can help you

Our solution

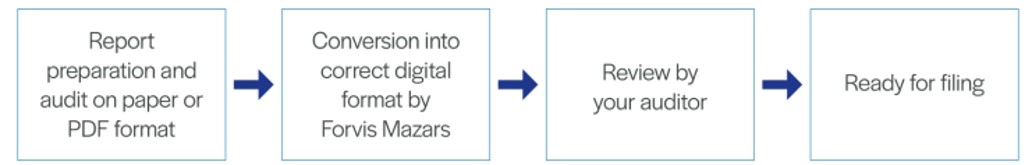

For companies that prefer to outsource these efforts to a third party, Forvis Mazars offers a fully managed solution that ensures your reporting is accurate, compliant and delivered on time with minimal impact on your financial operations.

Whether your digital report is prepared in the XBRL format or the iXBRL format, we have a suitable solution to convert your audited financial statements in PDF or paper format into the correct digital format that can be filed with the Chamber of Commerce. This service covers all relevant aspects: creation of the XBRL instance or iXBRL report package, marking up the information in the report with relevant concepts based on the applicable taxonomy and validation.

In group situations, we can also convert the parent company’s annual report into iXBRL format for you.

The process is outlined below.

Finally, the document will be ready for filing with the Trade Register of the Chamber of Commerce. This filing may be submitted through our secure Signals portal.