U.S. Tax Desk Newsletter - July 2021

Introduction

Following the Anti-Tax Avoidance Directive regarding hybrid structures (ATAD II), the German legislator introduced new regulation targeting abusive cross-border arrangements. The new rules have just passed the legislative bodies.

The regulation in the ATAD II, which is implemented into national law by Sec. 4k ITA (Income Tax Act / Einkommensteuergesetz), prohibits a deduction of operating expense in constellations in which a hybrid element leads to a deduction of expense in one country, whilst the other country does not tax the corresponding gain (deduction/non-inclusion). Alternatively, Sec. 4k ITA also comes into effect when both countries deduct the expense (double deduction). At last, so-called imported hybrid mismatches are also covered by the new rules. This article will illustrate several constellations which can render operating expenses non-deductible.

Deduction/ Non-Inclusion (D/NI)

Sec. 4k para. 1 S. 1 ITA

Sec. 4k para. 1 ITA prevents the deduction of business expenses in cases of tax mismatches (incongruities) in different countries. This norm specifically targets hybrid financial instruments, which lead to another treatment of transactions.

The following prerequisites have to be fulfilled for Sec. 4k para. 1 ITA to be applied:

- Expenses arising from the use or transfer of capital assets.

- Differing qualification of capital assets in the other country.

- No or low taxation due to differing qualifications in the other country.

There is no definition regarding capital assets available. It is suggested to follow the definition of capital assets in Sec. 20 EStG. This definition would include dividends and other income from shares, investment earnings, interest payments, premiums, and others. Not included in this non-exhaustive list are royalties.

The differing qualification means that the financial instrument is classified as equity in one country and external capital/debt in the other. This definition constitutes a hybrid financial instrument. Alternatively, a different allocation of the ownership can fall under the rule's scope, e. g. Germany views the German entity as the owner, and the foreign country views the foreign entity as the owner.

In the case of low taxation, the deduction of operating expenses is proportionally prohibited. If no/low tax is not the result of the different qualification or allocation, operating expense deduction is not prohibited. If the different qualification between the countries is only temporarily limited and the incongruency will be eliminated in the future, there is an exception from Sec. 4k ITA.

Examples under which a deduction/non-inclusion could occur are:

- Hybrid financial instruments,

- hybrid entities,

- disregarded hybrid payments and

- deemed branch payments

Example 1 - Hybrid financial instrument

A Co is situated in country A is the 100% parent of D GmbH. The parent company finances its subsidiary with a financial instrument. From a German perspective, the financial instrument constitutes external capital/debt, whilst under the foreign perspective (country A) it is treated as equity.

The tax treatment differs between the countries due to the prior difference in classification. Initially, in Germany, the financial instrument would be treated as a deductible interest expense. On the other hand, in the foreign country, a privileged treatment exists due to the classification of the instrument as equity, which results in an exemption from taxation in country A.

According to Sec. 4k para. 1 S. 1 ITA, the deduction of the interest expenses in Germany is denied, as no taxation would arise in country A and in Germany. A deduction is only admissible if the corresponding gains are subject to tax in at least one country. Otherwise, a privileged treatment would arise that could be exploited by setting up cross-border structures.

Example 2 – hybrid entities

The Hungarian entity is treated as a corporation by Hungary and the US, but as a partnership in Germany. The interest that the Hungarian entity receives from granting the loan to the German GmbH is taxed with the statutory tax rate of 9% in Hungary. No taxes arise in the US since the loan is allocated to the Hungarian entity.

The application of Sec. 4k para. 1 ITA on hybrid entities is, despite the different allocation of the loan, not fulfilled because Hungary would apply the regular tax rate. Hence, the GmbH is allowed to deduct the expense arising from the interest payments.

If on the other hand the US would also opt for a different tax treatment that results in low or no taxation, the deduction of the expense could be denied since the paragraph does not limit its definition of the "different tax qualification" to one country. If Sec. 4k para. 1 ITA would apply, the GmbH could not deduct the interest expense.

Sec. 4k para. 2 ITA

The subsequent paragraph (Sec. 4k para. 2 ITA) applies for disregarded hybrid payments and deemed branch payments.

The prerequisites are:

- Existence of an expense,

- no effective taxation of the corresponding gain,

- differing qualification of the taxable person or the underlying obligation, that leads to no effective taxation.

In contrast to the preceding regulation, Sec. 4k para. 2 ITA is not only applicable to expenses arising from the use or transfer of capital assets but all expenses. Interest expenses, royalties, rental expenses and service charges can all fall under Sec. 4k para. 2 ITA. Depreciation would also fall under the definition of an expense under Sec. 4k para. 2 ITA.

For the application of para. 2, it is necessary that there is no taxation in either of the countries in question. The regulation does not cover specifications regarding the country and the amount. In the case of low taxation, the norm would not apply.

The same causality between the different qualifications and the effective taxation as in para. 1 is a prerequisite for Sec. 4k para. 2 ITA. No tax has to arise due to the different treatment of the taxable person (or the transaction) in the countries in question.

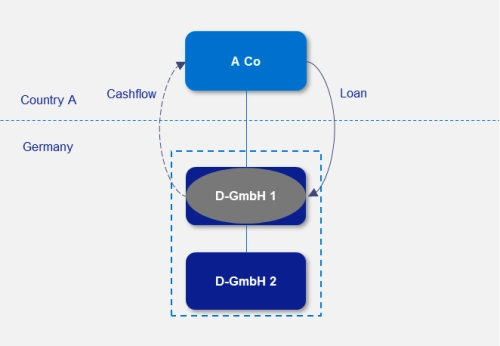

Example 3 - Disregarded hybrid payments

The corporation situated in country A grants a loan to its subsidiary in Germany. There is a tax group in place between D-GmbH 1 and its subsidiary D-GmbH 2. D-GmbH 1 is treated as transparent from the perspective of country A (so-called disregarded entity), but as a corporation in Germany. Country A subsequently does not tax D-GmbH 1.

The interest on the loan would be deductible in Germany and can be offset within the tax group between D GmbH 1 and D GmbH 2. However, in country A, the D GmbH 1 would be seen as a disregarded entity, which means it is transparent for tax purposes. Therefore the dividend cannot be taken into account in country A, and the payment from the German entity would not be subject to tax. Constellations like this fall under Sec. 4k para. 2 ITA. Under Sec. 4k para. 2 ITA, the interest expense is not deductible in Germany because the transaction would not be subject to tax in any country.

Sec. 4k para. 3 ITA

The Sec. 4k para. 3 ITA covers reverse hybrid, diverted branch payments, and disregarded branch structures. Expenses under this norm are not deductible as a business expense if the following prerequisites are fulfilled:

- the corresponding profits to the expense are not subject to taxation in any of the countries

- due to an allocation or attribution, which is different from German law.

The Sec. 4k para. 3 ITA does not come into effect if there are other reasons for the effective non-taxation other than an allocation or attribution different from German law.

Example 4 - Reverse hybrid

The corporation in country A is the sole shareholder of both the entity in country B and the GmbH in Germany. B Co grants a loan to the GmbH for which it receives interest.

This example covers the attribution to different legal entities. The example is similar to Example 2, but in this case, B Co is classified as a corporation by country A and as a transparent partnership by country B. The interest payments are deductible in Germany. Additionally, they are not included for tax purposes because the payments are deemed to be generated by B Co from the perspective of country A and, therefore, not taxed in country A. There is also no inclusion in country B because B Co is seen as transparent, and there is no nexus for tax liability in country A, i.e. a permanent establishment.

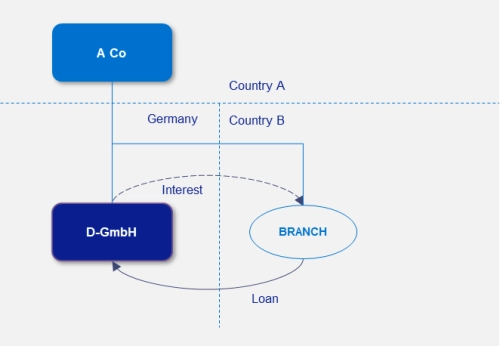

Example 5 - disregarded branch structure

Examples 5 and 6 both cover the different allocation to PE's.

The corporation in country A is the sole shareholder of the GmbH in Germany. Moreover, the A Co has a branch in country B from which it grants a loan to the D-GmbH.

A disregarded branch structure exists in this case because the branch does not fulfill the prerequisites of a PE from the perspective of country B, which leads to a non-taxation of the interest income in country B. However, from the perspective of country A, the branch is viewed as a PE, which constitutes a tax subject. Thus there are no tax consequences in country A.

Example 6 – diverted branch payments

This example has the same structure as example 5. It differs only because both countries A and B view the branch as a PE, but the allocation of the interest payment differs. Country A deducts the expense since it belongs to the PE in country B. On the other hand, country B allocates the expense to the parent company in country A, which leads to no tax effects in both countries.

The Sec. 4k para. 3 ITA takes countermeasures against the effective non-taxation in the preceding examples. The interest payments from Germany to country B are no longer deductible in Germany because the corresponding gains are not subject to tax in any of the countries in the structure.

Double Deduction (DD)

Sec. 4k para. 4 ITA

Sec. 4k para. 4 ITA prevents the same expenses from being deducted in both countries (double deduction). There is no hybrid element necessary for Sec. 4k para. 4 ITA to come into force. The only prerequisite is the deduction of the expense in both countries. The expenses have to reduce the tax base in the other country for Sec. 4k para. 4 ITA to be applied.

Example 7

The German limited company has a subsidiary in country A. A Co is seen as transparent in Germany, whereas treated as a corporation in Country A, which leads to a double deduction of the interest expense.

On the other hand, Sec. 4k para. 4 S. 2 ITA would not be applicable if a rule comparable to Sec. 4k para. 2 ITA leads to a non-deduction in country A. Germany will allow the deduction to prevent a double non-deduction in both countries.

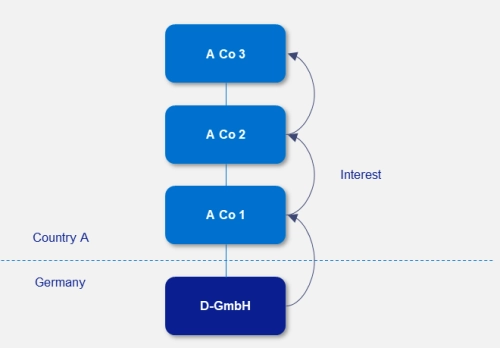

Imported Hybrid Mismatches

Sec. 4k para. 5, 6 ITA

Imported hybrid mismatches are regulated in Sec. 4k para. 5 and 6 ITA. They occur when a hybrid structure is transferred into another jurisdiction through a non-hybrid element.

They occur incorporate group structures and can include both Deduction/Non-Inclusion and Double Deduction cases. Sec. 4k para. 6 ITA also applies to structures between related parties. Like in the preceding cases, the deduction of operating expenses is denied. In this case, however, the risk of multiple refusals of deduction must be taken into account.

Mazars View

As the examples have shown, the new German rules on hybrid mismatches are not easy to apply. Many uncertainties and ambiguities remain for multi-national enterprises.

Nevertheless, these new rules will have a deterrent effect on enterprises using aggressive tax structures. They will be an essential part of the multi-national effort to stop tax avoidance and abuse.

Contact us