"M&A Valuation Guide" 1: Transaction Valuation and Segmental Analysis of the Pharmaceuticals, Biotechnology and Life Sciences

In this issue of the "M&A Valuation Guide," we will reveal the valuation data behind the industry, providing an in-depth analysis of the valuation logic and M&A activities over the past two years.

Global PBLS Industry M&A Overview

Globally, the Pharmaceuticals, Biotechnology, and Life Sciences (PBLS) industry exhibits significant valuation disparities, particularly in the Chinese market, where certain sub-sectors / segments have valuations several times higher than the global average. How should we interpret the implications behind these figures? With our professional data, you can not only accurately grasp these trends but also understand the underlying logic behind the valuations, allowing you to seize investment opportunities in the market ahead of time.

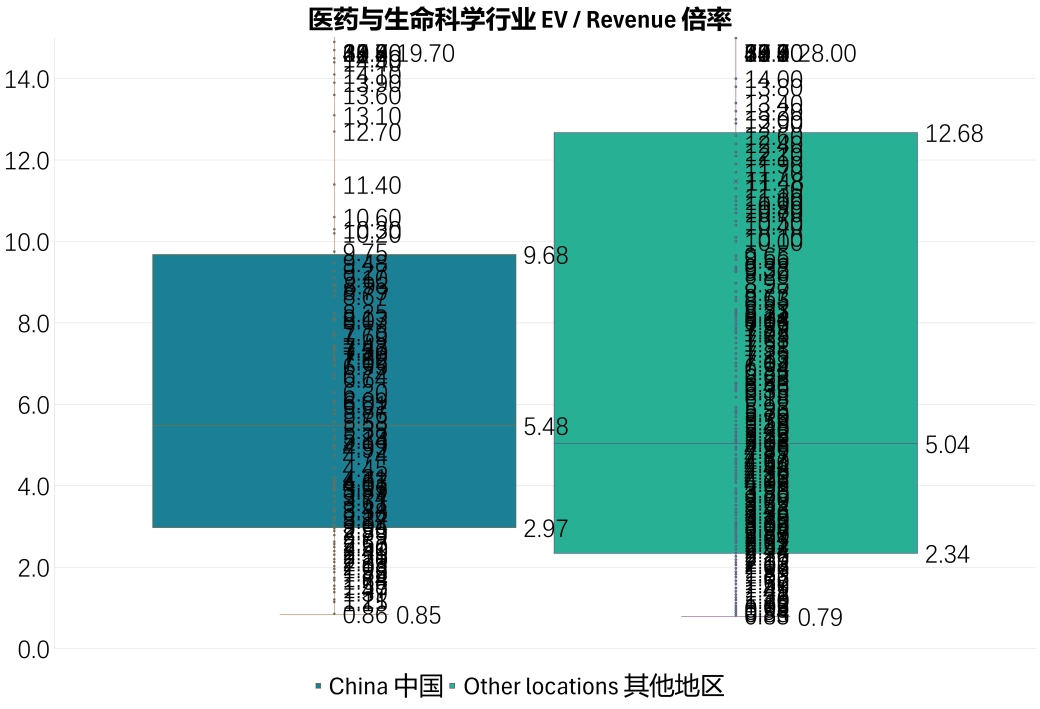

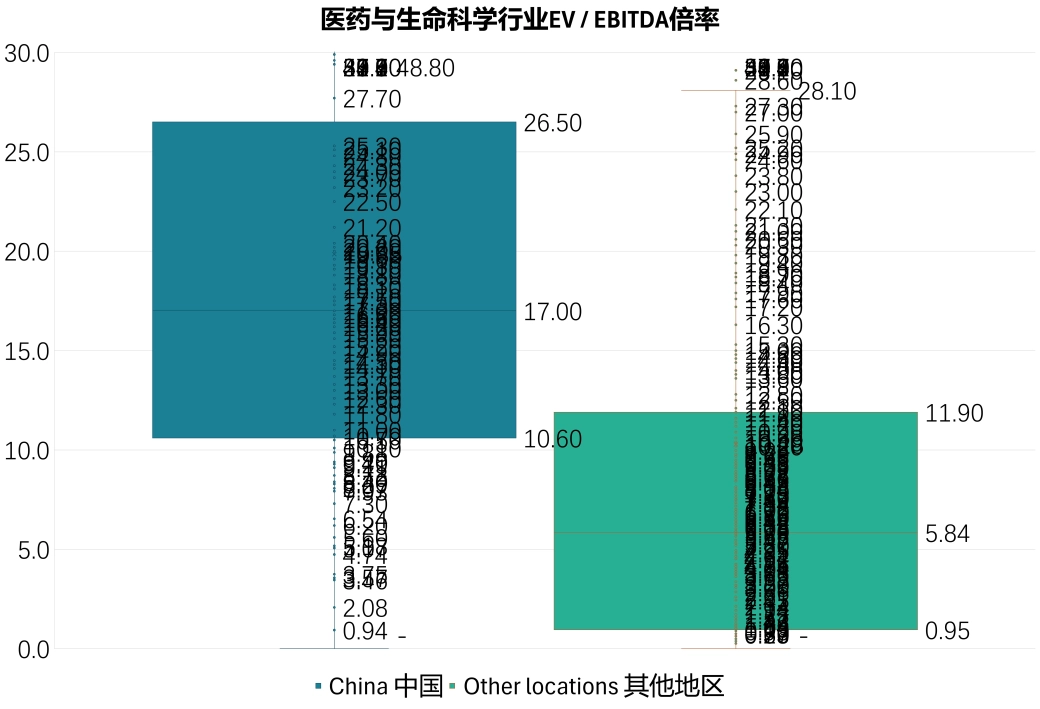

Take the revenue (EV/Revenue) and EBITDA (EV/EBITDA) multiples as an example. Based on historical transaction data, the median transaction multiples in the Chinese market are 5.48x and 17.00x, significantly higher than other regions. The driving factors behind this phenomenon include:

- Rise of Innovative Drugs – Policy incentives and R&D breakthroughs have driven Chinese innovative pharmaceutical companies to become targets eagerly sought after by global capital.

- Acceleration of Industry Consolidation – Leading companies are expanding their pipelines through M&A, creating stronger market barriers.

- Active Capital Markets – Both overseas investors and domestic capital view China as a high-potential M&A market.

In comparison, valuations in the US and Europe are relatively stable, while emerging markets such as India and Southeast Asia show growth potential but have not yet reached the valuation heights of China. Does this mean that investment opportunities in the Chinese market are more attractive? Is there still room for upward movement in the current high valuations?

Sub-sectors / segments: Unique Opportunities in Different Markets

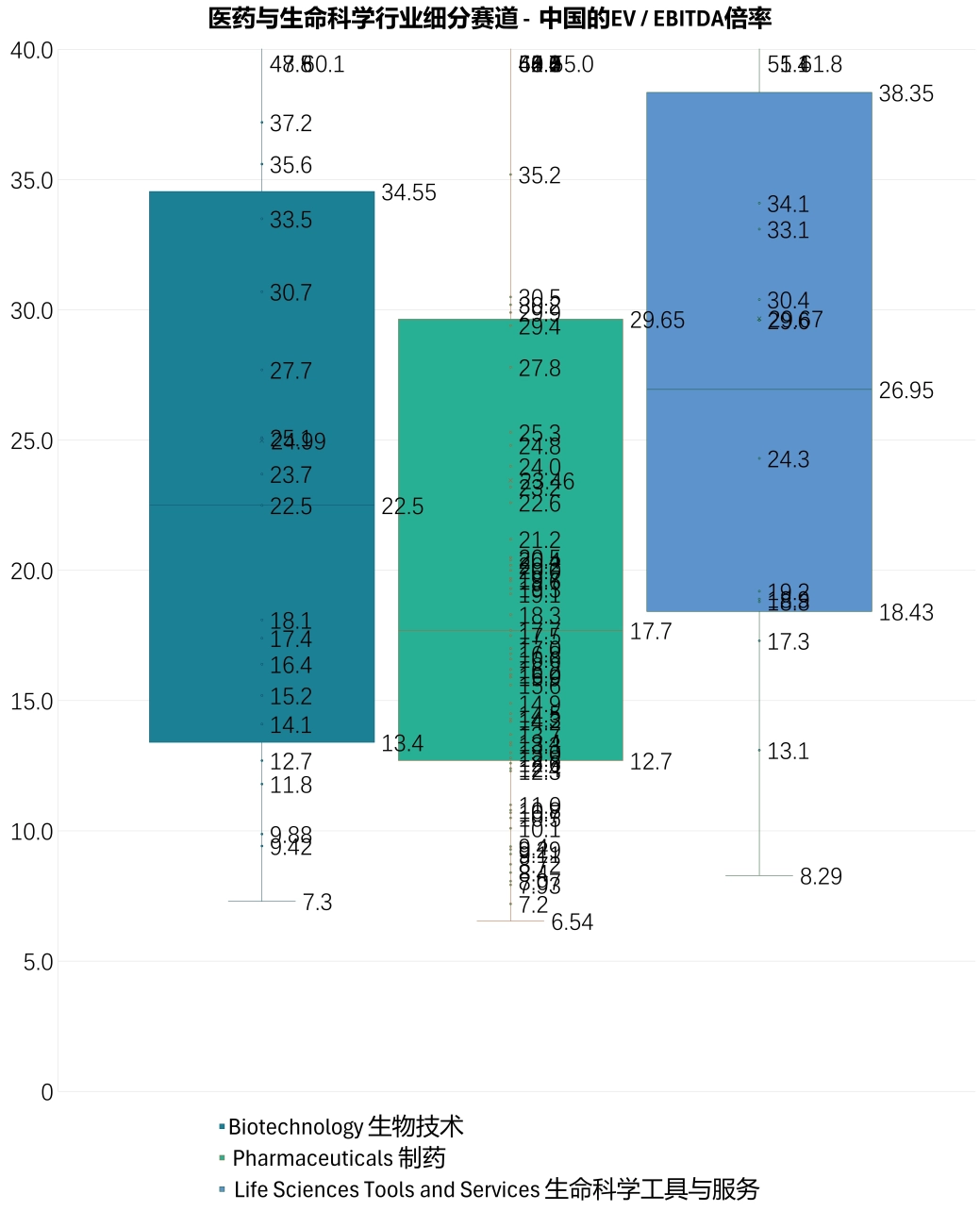

In the global M&A transactions within the Pharmaceuticals, Biotechnology, and Life Sciences (PBLS) industry, the valuation multiples across different sub-sectors / segments display clear differentiation. Which areas are attracting a surge of capital? Which markets have high valuations and are in high demand? Below is an analysis of M&A transactions in three major sub-sectors / segments: Biotechnology, Pharmaceuticals, and Life Sciences Tools & Services. Let the data show you where capital is flowing!

1. Biotechnology – The Innovation Hotspot, Highly Volatile

Valuation multiples vary significantly worldwide, with their volatility closely tied to industry cycles, regulatory environments, and market uncertainties. In the Chinese market, driven by innovative drugs, biotechnology, and government support policies, investment and financing are active, with corporate acquisitions focusing more on technology integration and enhancing R&D capabilities.

Valuation Multiples:

Global EV / EBITDA: 0.565x – 11x (a wide range, depending on the maturity of the technology)

China EV / EBITDA: 13.4x – 34.55x (policy incentives + market heat = high valuations)

2. Pharmaceuticals – The King of Innovative Drugs, Intensified Generic Drug Consolidation

M&A transactions in the pharmaceutical industry are centered around innovative drugs and biologics. High-valuation deals are mainly concentrated in breakthrough therapies, while the generic drug and active pharmaceutical ingredient (API) sectors show a trend of industry consolidation. In the Chinese market, the rapid development of innovative drugs has kept transaction valuations at high levels.

Valuation Multiples:

Global EV/EBITDA: 5.6x – 19.30x (Innovative drugs elevate overall valuations)

China EV/EBITDA: 12.7x – 29.65x (Innovative drugs continue to drive high valuations)

3. Life Sciences Tools & Services – The New Darling of Capital, Soaring Valuations

The Life Sciences Tools & Services sector is driven by technological innovation and market demand, with valuations consistently remaining high. In the Chinese market, supported by favorable policies and the rise of local companies, transaction valuations are notably higher than global levels. M&A activities primarily focus on advanced technologies and data-driven businesses.

Valuation Multiples:

Global EV/EBITDA: 10.60x – 30.93x (Overall valuations show steady growth)

China EV/EBITDA: 18.43x – 38.35x (Exceeding global levels, capital chasing hotspots)

Accurate Data to Help You Master Market Trends and Opportunities

Overall, the M&A trends in the PBLS industry are driven by market demand, technological breakthroughs, and capital flow. Valuations in the Chinese market are generally higher than those globally, with innovation capabilities, policy support, and industry chain integration driving rapid growth in the sector. In the future, cross-border investments and technological synergies will further accelerate industry consolidation, enhancing corporate competitiveness. If you wish to learn more about the detailed valuation data of the PBLS sector and develop accurate investment strategies, we can provide you with comprehensive data support and in-depth analysis.

(The data and analysis in this article are for reference only. The data has been selectively filtered, and due to market and data collection limitations, it does not cover all transaction scenarios. Please exercise caution when using it in key decision-making processes.)

More "M&A Valuation Guide" Sharing:

- Transaction Valuations and Segmental Analysis of the Pharmaceutical and Life Sciences Industry

- Transaction Valuations and Segmental Analysis of the Software and Services Industry

- Transaction Valuations and Segmental Analysis of the Media and Entertainment Industry

- Transaction Valuations and Segmental Analysis of the Technology Hardware and Equipment Industry

- Transaction Valuations and Segmental Analysis of the Air Cargo and Logistics Industry

- …

Contact