June 2025 - Analysis of taxation policies for high-income individuals abroad

June 2025 - High-income individuals abroad

Background Analysis

According to the 2024 fiscal data, national tax revenue reached RMB 9.408 trillion, a decrease of 5.6% year-on-year, while non-tax revenue increased by 11.7% over the same period. Against this background, expanding the scope of individual income tax collection — particularly by imposing taxes on the overseas income of ultra-high-net-worth individuals — could serve as one measure to mitigate declining fiscal revenues at both national and local levels.

Target Chinese Individuals for Overseas Taxation

- Those with at least USD 10 million in overseas assets (though this threshold is expected to gradually lower);

- Shareholders of companies listed in Hong Kong, Singapore, and the US.

These individuals may face a tax rate of up to 20% on overseas investment income. Some could incur penalties for late-payment, though final tax liabilities may be negotiable. For example, it may be proposed to offset gains and losses from listed equity investments to reduce taxable income.

The concepts of tax residents and non-tax residents

1. Chinese tax residents

Individuals who have a domicile in China or who do not have a domicile but have resided in China for a cumulative total of 183 days or more in a tax year (e.g., Chinese citizens or foreign nationals with household registration,family ties, or economic interests). Such individuals are a domicile in China; "domicile" refers to habitual residence in China due to subject to Chinese individual income tax on their worldwide income.

2. Non-Chinese tax residents

Individuals who neither have a domicile in China nor reside in China, or who reside in China for less than 183 days cumulatively in a tax year (e.g., individuals with Chinese nationality who do not reside in mainland China long-term), are only required to pay individual income tax on income derived from within China.

3. Determination of resident status under double taxation agreements

An individual's resident status should be determined in accordance with the double taxation agreement. Taking the tax agreement between China and Singapore as an example, the determination is as follows

The individual has a permanent home or vital interests in that country > The individual has a habitual abode in that country > The individual is a national of that country > The competent authorities shall resolve the matter through mutual agreement.

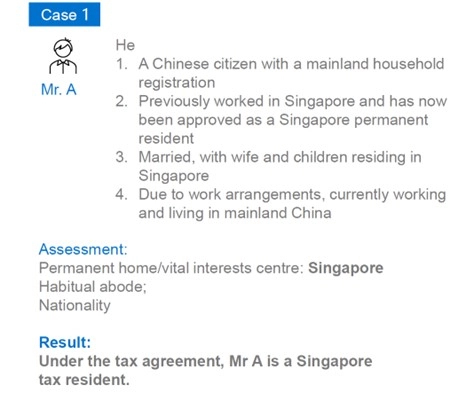

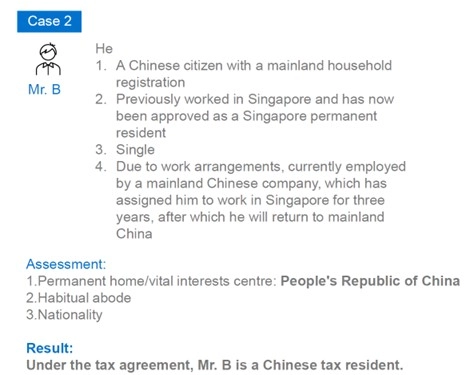

The following two cases are provided for reference:

Tax authority enforcement methods

1. Common Reporting Standard (CRS) issued by the Organisation for Economic Co-operation and Development (OECD)

The CRS issued by the Organisation for Economic Co-operation and Development (OECD) requires financial institutions to conduct due diligence on relevant accounts, identify non-resident financial accounts and record related information. As of 2024, over 150 countries and regions have committed to implementing CRS. The exchanged information includes: identification details of individuals or controlling persons (name, address, tax residence country, etc.), account information (account number, financial institution name, etc.), and financial asset details (account balance, gross income, etc.).

2. Golden Tax System Phase IV

Golden Tax System Phase IV enhances financial supervision, promotes industry information sharing (e.g., finance, customs, market regulation), and establishes precise data profiles for corporate and individual taxpayers to improve the accuracy of tax data verification. For example, individuals receiving large cash payments from third-party companies may be reported to tax authorities by banks.

Reasonable recommendations for Chinese tax residents

Financial self-assessment

1. It is recommended to conduct financial self-assessment from the following aspects:

- Assets and liabilities: Conduct a comprehensive review of personal and family assets and liabilities.

- Business operations: Clarify the nature and sources of income.

- Tax residency status: Confirm whether one meets the criteria for Chinese tax residency and review tax compliance status.

2. Common response methods

- Insurance trust: Combine insurance and trust functions to provide asset protection, tax planning and estate distribution services.

- Tax residency change: Obtain tax residency in low-tax jurisdictions through immigration to optimise tax reporting under CRS rules.

- Insurance products: Select insurance products with low initial cash value to benefit from investment income policies of foreign insurance products.

- Asset reallocation: Transfer assets to other countries or regions and allocate them reasonably according to local policies.

3. Engage experienced consulting institutions to streamline overall tax and financial planning for individuals and families, establishing clear short, medium and long-term objectives.