"M&A Valuation Guide" 4: Transaction Valuations and Segmental Analysis of Clean Energy Sector

In June 2025, Yuanda Environmental Protection (600292.SH) announced plans to acquire 100% equity in Wuling Power and a controlling stake in Guangxi Changzhou Hydropower via stock issuance and cash payments, establishing SPIC’s domestic hydropower integration platform. Concurrently, Singapore’s Sembcorp Industries completed the acquisition of a 96MW solar plant in Cadiz, Philippines, accelerating its Southeast Asia expansion.

These transactions epitomize the global clean energy M&A wave. Over the past two years, capital has reshaped the energy landscape at unprecedented speed—from Indian PV plants to Norwegian offshore wind, Chinese pumped hydro to Thai biomass power.

1. Global M&A Surge: Structural Divergence Behind the Data

The global clean energy M&A market in 2024-2025 shows accelerated growth amid multi-dimensional divergence. Key data highlights: Solar dominates 52% of total transactions, wind and hydro account for 12% and 7% respectively, emerging sectors (e.g. biomass) comprise the remainder (Source: Capital IQ).

Regional dynamics: Asia leads activity: China, India, and Thailand contribute 44% of global deals. India’s policy liberalization drives record transactions. The US maintains deal scale leadership, while Norway ranks top-5 in activity via specialized offshore wind integration.

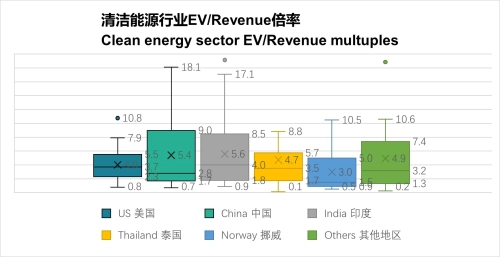

Valuation stratification: China/India projects command 5.5x average Transaction Value/Revenue vs. global average of 4.5x. Wind power median multiple (5.1x) surpasses solar (3.2x), reflecting capital’s repricing of grid synergy value and stability.

2. Regional Battlegrounds: Capital Flows

China: Policy-driven consolidation

2025 marks China’s green power integration year under the “Six M&A Guidelines”:

- Huadian Power establishes 1.8GW pumped hydro storage in Shandong

- SDIC Capital transitions to nuclear asset platform via restructuring

- Hunan Development acquires four hydropower assets after healthcare divestiture

India: Global capital magnet

The clean energy market in India is experiencing a "gold rush" of foreign investment, with clear policy guidance behind the capital frenzy: the Indian government plans to increase renewable energy capacity from 73GW to 450GW, providing a clear investment roadmap for foreign investment. Famous cases include:

- Thailand’s GPSC acquired 41.6% in Avaada Energy (US$450M) for 3.74GW solar portfolio (2021)

North America: Tech-integration premiums

A Texas Delaware Basin and the Gulf Cost 800MW wind portfolio fetched 8x EV/Revenue (early 2025) due to: 1) Green hydrogen integration capabilities, and 2) Direct power supply to data centers.

3. Sector Differentiation: Value Reassessment

Solar: Volume Dominance & Efficiency Revolution

The global solar M&A market demonstrates "high volume, stable pricing" characteristics, accounting for 52% of total transactions with consistent valuation multiples. Core drivers include: 1) module efficiency breakthroughs, and 2) sustained cost declines.

Wind: Premium King with Technical Edge

Wind power leads valuation with a median multiple of 5.1x, driven by: 1) grid synergy premiums (e.g. China Ruifeng’s grid integration project), 2) technology iteration (15MW+ turbines), and 3) hydrogen-ready interfaces, etc..

Comparative M&A Features of Major Clean Energy Types

4. Future Outlook: Policy & Tech Catalysts

Policy multiplier effects

- China’s Six M&A Guidelines cut restructuring costs

- EU’s REPowerEU fast-tracks project approvals

- India’s PLI scheme expands sector coverage

Particular attention should be paid to China’s deepening power marketization reform, which compels enterprises to enhance operational resilience through M&A.

Tech-driven frontiers

- AI-O&M integration: Accenture-Nextira’s predictive system (using satellite/sensor data) boosts plant profits by 15%

- Green hydrogen coupling: Wind projects with electrolyzer interfaces command 20%+ premiums

- Waste-to-energy upgrades: Zhongke’s heat recovery tech delivers 260k tons/year thermal output (Jinzhou project)

Emerging market opportunities:

Southeast Asia/Africa see rising "generation-storage-grid-consumption" integrated deals due to grid constraints. System solution providers become prime acquisition targets.

(The data and analysis in this article are for reference only. Due to selective data screening and limitations in market and data collection, not all transaction scenarios are covered, and there may be incompleteness. Please exercise caution when using this information for decision-making in critical processes.)