"M&A Valuation Guide" 3: Transaction Valuations and Segmental Analysis of the Media and Entertainment Industry

In this issue of the M&A Valuation Guide, we will dive deep into the underlying valuation data of the industry, thoroughly analyze the valuation logic of the sector, and examine the M&A trends of the past two years.

Global Media and Entertainment Industry M&A Overview

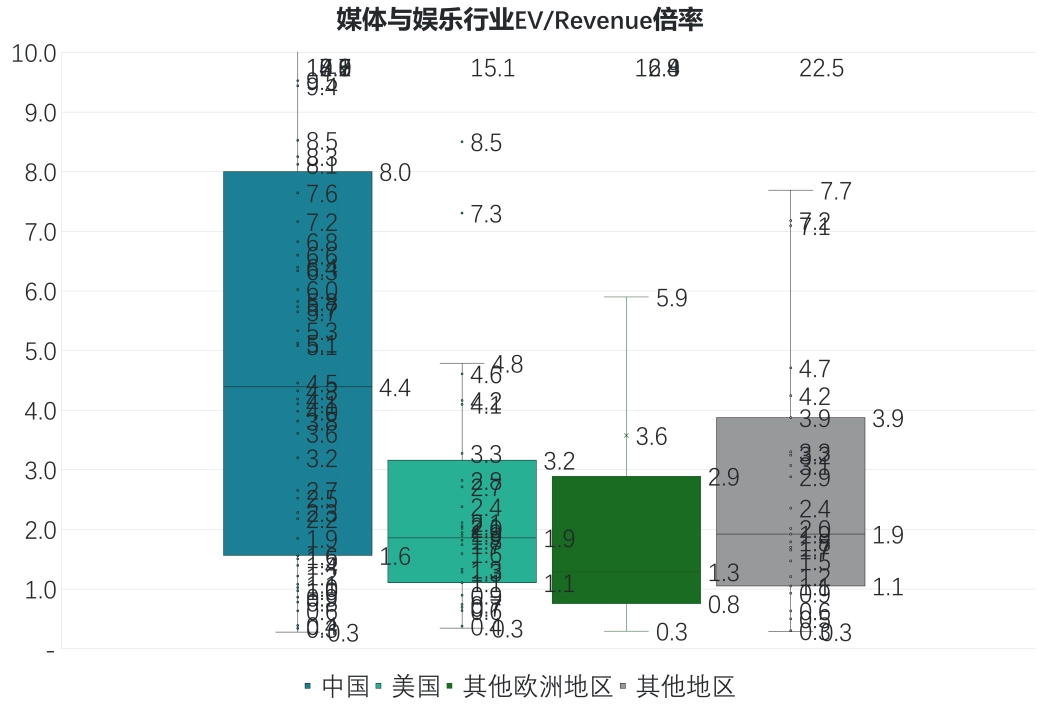

In the global market, the valuation multiples in the media and entertainment industry show clear disparities, especially in China, where the valuations of certain sub-sectors are far above the global average.

Content Innovation Boom:

Driven by strong policy support and innovative creative concepts, Chinese content industries such as film, television, and gaming have become the focus of global capital. The micro-short drama sector has recently become a hot spot for domestic content innovation. Forward-thinking companies, recognizing the potential of this emerging content form, have been actively pursuing mergers and acquisitions (M&A). For example, some short-video platforms have acquired companies specializing in micro-short drama production, which are known for their creative storytelling and efficient production processes. Through these acquisitions, these platforms quickly expanded their micro-short drama libraries, attracting more users.

Accelerated Industry Consolidation:

Leading companies continue to enhance their business portfolios through M&A, building stronger market competitive barriers. Take Huayi Brothers, for example, which has consistently explored innovation in film content creation. To optimize its content business layout in response to market changes, Huayi Brothers has undertaken a series of acquisitions. The company acquired firms with high-quality film production teams and content resources, such as Dongyangmeila, leveraging the creative abilities of renowned directors like Feng Xiaogang to further strengthen its content creation advantages. This approach has allowed Huayi Brothers to diversify its content offerings and enhance its market competitiveness.

However, it is important to note that compared to other industries, foreign investors have been relatively less active in the M&A cases in China's media and entertainment industry from 2023 to 2024. This may be due to a combination of factors, including the unique characteristics of the industry, the policy environment, and global economic conditions.

From the industry characteristics and policy environment perspective,

the media and entertainment industry is highly culture-driven and creativity-oriented. Its content creation needs to deeply align with local cultural contexts and audience preferences, which undoubtedly increases the difficulty for foreign investors to fully understand and navigate the market. This cultural specificity makes investments in this sector more complex, as it requires a nuanced approach to local trends and tastes.

The policy environment is another key factor to consider. In recent years, the Chinese government has continually strengthened its regulations and oversight of the media and entertainment industry. For foreign investors, this means spending more time and resources to ensure compliance, which increases operational costs and potential risks. The evolving regulatory landscape requires a constant adjustment of business practices to avoid potential pitfalls.

The global economic climate has added another layer of uncertainty to foreign investors’ decision-making processes. In 2023-2024, the global economy faced numerous challenges, including slower economic growth in some regions and rising inflationary pressures. As a result, overseas investors have become more cautious, with tighter capital flows and reduced risk tolerance. Many investors now prefer to allocate funds to industries with more stable returns and greater certainty, rather than to sectors perceived as riskier or more volatile, like media and entertainment.

Compared to China, the valuation landscape in Europe and America is relatively stable. When looking at the EV/Revenue and EV/EBITDA multiples, domestic and international markets are showing different trends. Globally, traditional media companies have faced slow growth, and their revenue and EBITDA multiples remain relatively stable. For instance, some long-established newspaper groups in Europe and the U.S., during their digital transformation efforts, have struggled with growth, causing their transaction multiples to remain within a lower and more stable range. The focus in these regions has shifted more towards consolidation and cost optimization as opposed to high-growth opportunities, which has stabilized their market valuations.

Sub-sectors / segments: Unique Opportunities in Different Markets

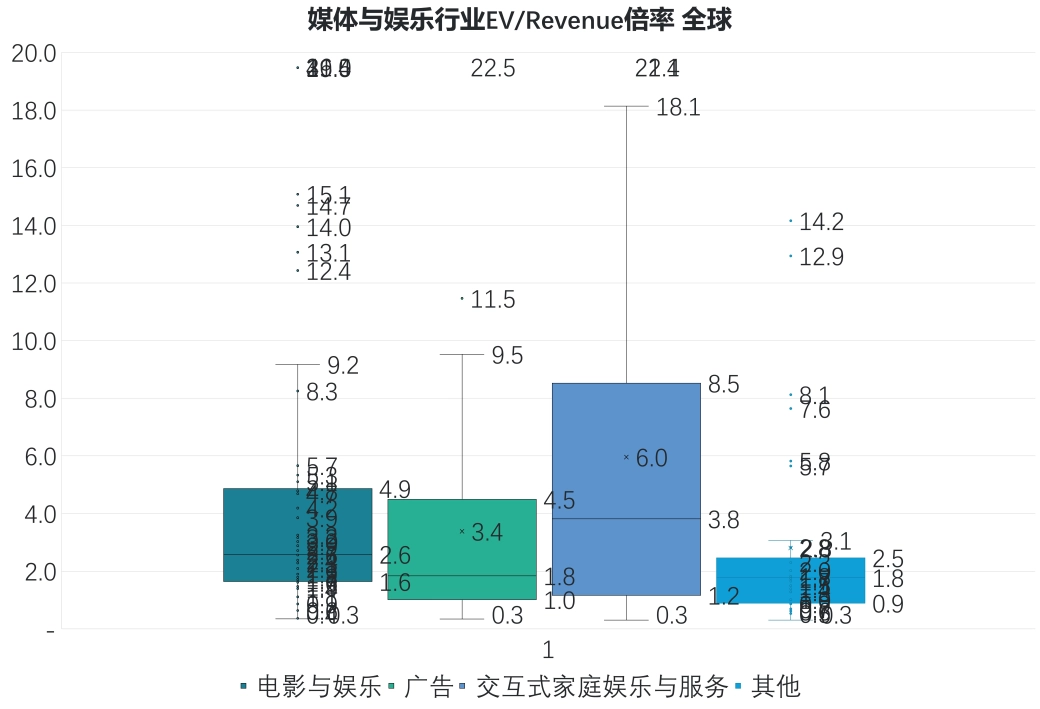

In global media and entertainment industry mergers and acquisitions (M&A), the transactions across various sub-sectors / segments show significant differences.

1. Film and Entertainment - Global Integration, China's Potential Shines

Globally, the film and entertainment industry has seen a continuous wave of M&A transactions over the past two years, with a noticeable trend of large enterprises integrating resources and expanding their business territories. Hollywood, as the core region of the global film industry, has seen particularly active M&A activity. In terms of valuation multiples, the global film and entertainment companies’ EV/Revenue remains relatively stable, ranging from 1.7x to 4.8x. This is largely dependent on factors such as a company’s IP reserves, production capabilities, and market influence. Additionally, it is noteworthy that India’s film and entertainment industry has higher acquisition multiples compared to other global markets.

In the Chinese market, M&A activity in the film and entertainment sector is also relatively frequent. On one hand, film companies with quality production teams and strong IP reserves have become popular targets for acquisition. As China’s film market continues to expand, with box office revenue expected to account for 27% of global total revenue by 2027, both domestic and foreign capital have been increasing their investments in Chinese film and entertainment enterprises. The EV/Revenue for Chinese film and entertainment companies ranges from 2.6x to 5.3x, which is higher than the global average. Some companies with blockbuster production capabilities and strong IP development potential have even higher valuation multiples.

2. Advertising Industry - Integration of Giants, Slow Growth in the Chinese Market

In the global advertising industry, from 2023 to 2024, there has been a trend of integration among large advertising groups. The EV/Revenue for global advertising companies typically ranges from 2.6x to 5.3x. Mature, large advertising groups tend to have relatively high valuation multiples due to their stable customer base and business scale.

In China, the development of the advertising industry has shown a trend of cooling investment enthusiasm in the past two years. The EV/Revenue for Chinese advertising companies ranges from 1.9x to 5.1x. Some companies with innovative marketing models and strong customer resources have relatively higher valuations.

3. Interactive Home Entertainment and Services - Global Expansion and Opportunities in China Driven by Technological Innovation

Globally, the interactive home entertainment and services industry is undergoing rapid transformation, primarily driven by continuous technological advancements. With the widespread adoption of cutting-edge technologies such as 5G, the Internet of Things (IoT), and artificial intelligence, sub-sectors like smart home audio solutions, smart projection systems, and high-definition display devices have become new engines for industry growth. Numerous tech giants and traditional entertainment companies are actively expanding their presence and capturing market share through mergers and acquisitions. In terms of valuation multiples, the EV/Revenue for global interactive home entertainment and services companies ranges from 1.2x to 8.5x. Companies with core technologies and a broad user base tend to have higher valuation multiples.

The interactive home entertainment and services sector in China is also developing rapidly. According to industry research data, the number of home theater-related companies in China has reached around 300,000, and the market size continues to expand. The EV/Revenue for Chinese interactive home entertainment and services companies ranges from 3.8x to 8.5x. Some companies that stand out in areas like technological innovation and content management tend to have even higher valuation multiples.

Accurate Data to Help You Master Market Trends and Opportunities

Overall, the merger and acquisition (M&A) trends in the media and entertainment industry are driven by factors such as upgrading market demand, technological innovation, and shifts in capital flows. The Chinese market stands out globally, with valuations generally higher than the global average. This is largely due to the enhancement of domestic innovation capabilities, from breakthroughs in special effects technology in film production to innovative content models on new media platforms, showcasing strong vitality. The industry chain integration process is accelerating, with leading companies acquiring upstream and downstream companies toenhance their full-chain layout from content creation to distribution, driving rapid industry development.

If you wish to gain deeper insights into the valuation data of the media and entertainment industry, and develop an accurate investment strategy, we can provide you with comprehensive data support and in-depth analysis.

(The data and analysis in this article are for reference only. Due to selective data screening and limitations in market and data collection, not all transaction scenarios are covered, and there may be incompleteness. Please exercise caution when using this information for decision-making in critical processes.)

More "M&A Valuation Guide" Sharing:

- Transaction Valuations and Segmental Analysis of the Pharmaceutical and Life Sciences Industry

- Transaction Valuations and Segmental Analysis of the Software and Services Industry

- Transaction Valuations and Segmental Analysis of the Media and Entertainment Industry

- Transaction Valuations and Segmental Analysis of the Technology Hardware and Equipment Industry

- Transaction Valuations and Segmental Analysis of the Air Cargo and Logistics Industry

- …

Contact