IFRS S1 and S2: now mandatory for issuers in Mexico

IFRS S1 and S2 for issuers in Mexico

The National Banking and Securities Commission (CNBV), through the ‘Resolution modifying the General Provisions applicable to broker-dealers’ and the ‘Resolution modifying the General Provisions applicable to credit institutions’, adjusted rules/criteria related to sustainability.

Main changes

The amendments cover, among other criteria, the following:

- Securities issuers and other stock market participants are required to provide sustainability information to the CNBV for the registration of their stocks in the National Securities Registry.

- Such information should be aligned with the IFRS Sustainability Disclosures Standards (IFRS S1 and S2) issued by the International Sustainability Standards Board (ISSB).

- Sustainability reporting will be required from 2026 onwards, with 2025 information.

Transitional provisions

It is important to note that the sustainability information indicated by these amendments, provisions, standards, objectives and benefits will not require external auditor assurance in 2026 (with 2025 annual information). However, for the year 2027 (with 2026 information), there must be limited assurance and, for subsequent years, it will be necessary to have reasonable assurance.

|

"These changes represent a huge and challenging step forward in Mexico. There is much to be done and it will be very important to do a real exercise of reflection on the risks and opportunities if companies are to sustain their operations in the long term".

Ushuaia Guadarrama Sustainability Director |

Objectives and next steps

These amendments aim to improve transparency and risk management in the stock market by promoting sustainable practices. Some of the objectives are:

- Drive capital flows towards investments that foster economic development by promoting environmental and social sustainability, transparency and long-term strategies in financial and economic activity.

- Encourage sustainable investments and improve transparency and efficiency in the Mexican stock market.

- Provide the investing public with better decision-making tools and promote the growth of the Mexican stock market.

- Improve transparency, risk management and sustainability in the Mexican stock market.

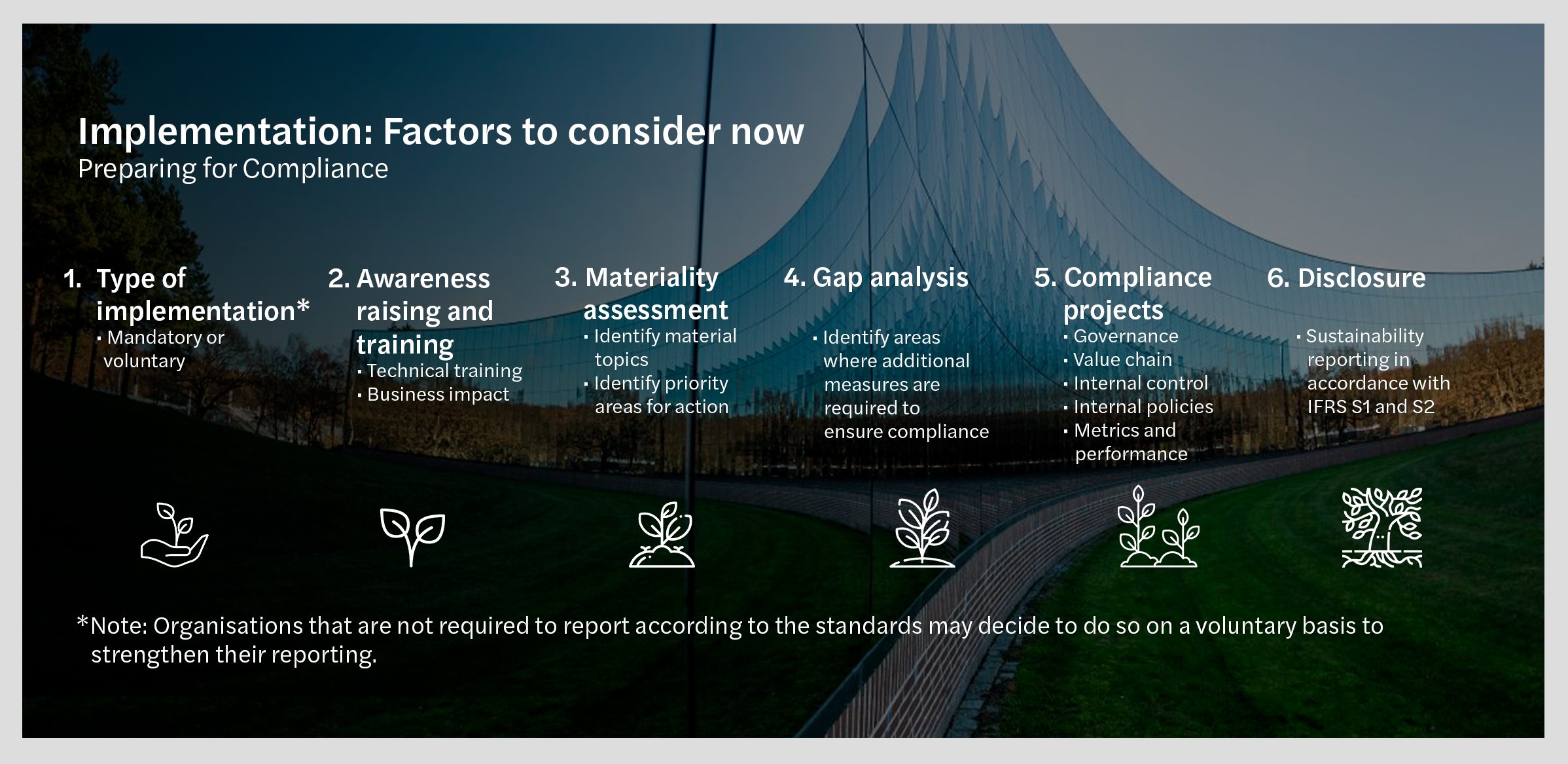

The next steps are to prepare for regulatory compliance, considering the following elements:

Your company can anticipate its role and become a strategic driver for sustainability and its own performance, through the following actions:

- Incorporate sustainability, including risk and opportunity management.

- Updating data reporting and governance processes.

- Improving systems, processes and controls.

- Improving data production and compilation.

- Communication and tone of sustainability reporting.

At Forvis Mazars we are dedicated to supporting companies on their sustainability journey. We provide comprehensive guidance on understanding the requirements of the IFRS sustainability disclosure standards, among other topics, ensuring that organisations comply with the standards and take full advantage of the opportunities these standards present.

Source: RESOLUCIÓN que modifica las Disposiciones de carácter general aplicables a las emisoras de valores y a otros participantes del mercado de valores. Diario Oficial de la Federación 28/01/2025.