Changes in foreign trade for 2026 in Mexico

Changes in foreign trade for 2026 in Mexico

1. General Rules on Foreign Trade (RGCE) for 2026

- Date of publication in the Official Gazette (DOF): 27 December 2025

- Effective date: as from 1 January 2026

The following highlights some of the key topics:

Addition of sections XLIX and L to Rule 1.3.3

Two new grounds for suspension in the importers’ register have been introduced, relating to errors or omissions in the customs guarantee (account or letter of credit) and the issuance of a resolution for the use of false tax receipts.

Incorporation of Rule 1.4.14

This rule requires customs brokers to compile a mandatory and detailed electronic file for each client, with the aim of ensuring secure and transparent operations. The file must include, among other items:

• Identification details,

• Photographs of the premises where activities are carried out,

• Documents proving ownership or possession of the property and assets

• Tax ID (RFC)

• Tax status certificate

• Declarations under oath by both the client and the customs broker confirming that there are no links with taxpayers listed under certain provisions of Articles 49 Bis, 69, 69-B and 69-B Bis of the Federal Tax Code (CFF).

Addition of Rule 3.1.42

This rule sets out the documents or records that validate a foreign trade transaction, consisting of the electronic file that each customs declaration must include in order to confirm that the foreign trade operation was carried out legitimately. Among the most relevant points are:

- Evidence demonstrating the lawful presence and possession of machinery used for the transformation or storage of goods

- List of workers involved, together with the corresponding CFDIs including payroll supplements

- Documentation supporting the inventory control method applied

Statement under oath

It must confirm that the suppliers or clients involved in the transaction do not appear on the lists under certain provisions of Articles 49 Bis, 69, 69-B and 69-B Bis of the Federal Tax Code (CFF).

Addition of Rule 4.3.22

This rule establishes the obligation regarding virtual operations to request, provide and retain the information and documentation referred to in Article 112, last paragraph of the Customs Law.

Amendment to Rule 6.1.1

First paragraph, concerning the rectification of customs declarations, specifies that importers and exporters may rectify the declaration for administrative or minor errors before activating the automated selection mechanism. In addition, a new condition has been introduced: no resolution must have been issued and notified determining that they issue false tax receipts, in accordance with Article 49 Bis of the Federal Tax Code (CFF).

Modification to Rule 7.1.12

This rule relates to the goods that companies holding the RECE (Annex 28) may import. A second paragraph has been added to specify that companies operating under an IMMEX programme may only import the goods listed in Annex 28 (sensitive goods), provided that they have also been authorised by the Ministry of Economy under their respective programme and that the goods are permitted under the IMMEX Decree and its Annexes.

Update and incorporation of provisions within Chapter 7 of the General Rules on Foreign Trade (RGCE)

These changes affect the requirements, obligations, and grounds for request or cancellation regarding registration under the Company Certification Scheme (RECE), including the following conditions:

- Not having issued false tax receipts

- None of its partners having been convicted of offences that carry a custodial sentence

- Suppliers not appearing on the list of companies published by the SAT under the provisions of Articles 49 Bis, section X, or 69-B, fourth paragraph of the Federal Tax Code (CFF)

- Not having administrative sanctions for the import or export of goods

2.Miscellaneous Tax Resolution (RMF) for 2026

- Date of publication in the Official Gazette (DOF): 28 December 2025

- Effective date: as from 1 January 2026

Relevant updates have been included regarding fees that must be considered in customs operations, such as:

Publication of Annex 4 of the Miscellaneous Tax Resolution 2026

This annex provides the updated fees applicable to customs procedures for the 2026 fiscal year, in accordance with the Federal Rights Law. This adjustment directly impacts the costs to be borne by companies and agents involved in foreign trade operations, including fees for registration, renewal, and other services related to customs certifications and authorisations.

Change in the applicable amount for the payment of Duties

In accordance with Article 40 of the Federal Rights Law for 2026, the applicable amount for the payment of Duties for companies certified under VAT and Excise Tax (IEPS) and AEO (Authorised Economic Operator) has been updated to MXN $40,267 for 2026.

Adjustment to the Customs Processing Fee (DTA) rates

As provided in Article 49 of the Federal Rights Law, this adjustment will have a direct impact on various foreign trade operations. The most relevant include:

- import and export operations under the IMMEX programme,

- domestic and international transit movements

- rectifications of customs declarations

3. Decree amending tariff codes under the Tariff of the Law on General Import and Export Taxes (TIGIE)

- Date of publication in the Official Gazette (DOF): 29 December 2025

- Effective date: as from 1 January 2026

This decree introduces substantial modifications covering various sectors and tariff adjustments, including the following:

- Approximately 1,463 tariff classifications were amended. A significant portion of these changes focuses on strategic sectors to safeguard domestic production.

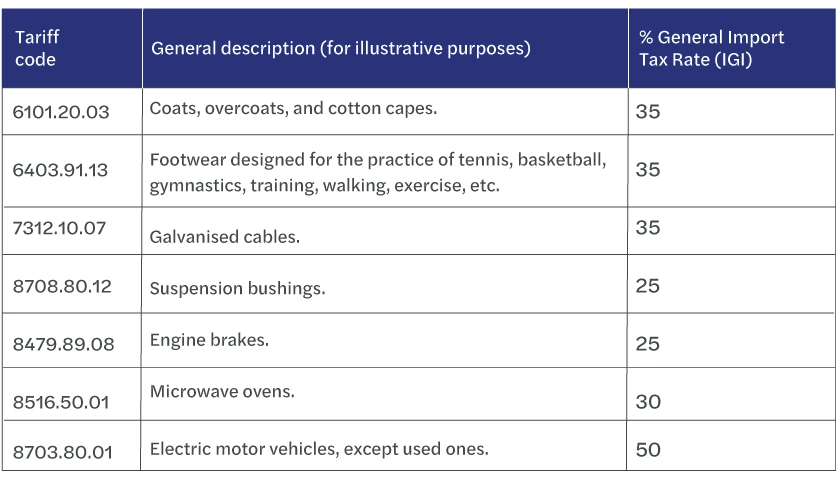

- Some of the affected sectors include textiles and footwear, automotive, plastics and manufactured goods, steel and aluminium, household appliances, furniture and toys, among others. Below are a few examples:

- Under the Decree, the applicable rates for the affected tariff classifications are 5%, 7%, 10%, 14%, 15%, 18%, 20%, 22%, 25%, 30%, 35%, 36%, 45% and 50%, depending on the type of goods and sector.

- It is important to note that applying preferential tariff treatment on imports under the Free Trade Agreements (FTAs) to which Mexico is a party becomes essential in order to mitigate the impact of these tariff rates, provided that the corresponding origin analysis is available.

4. Agreement repealing the automatic export notice for certain goods

- Date of publication in the Official Gazette (DOF): 30 December 2025.

- Effective date: the day following its publication.

The Agreement requiring an automatic export notice for goods such as malt beer, tequila, catalytic converters, automatic data processing machines, memory units and fibre optic cables, published in the Official Gazette of the Federation on 3 June 2025, is hereby repealed.

How can we help?

Our team of Foreign trade specialists is available to provide advisory services and ensure the efficient and timely management of your customs obligations. Together, we can prevent and manage risks as well as resolve disputes.

Forvis Mazars is a leading global network of professional services operating in more than 100 countries and territories. We provide audit and assurance, tax and advisory services worldwide.

Contact us now!