SAT issues new provisions in the Fourth Resolution of Amendments to the Miscellaneous Tax Resolution for 2025, and in Annex 7

New provisions: 2025 Miscellaneous Tax Resolution

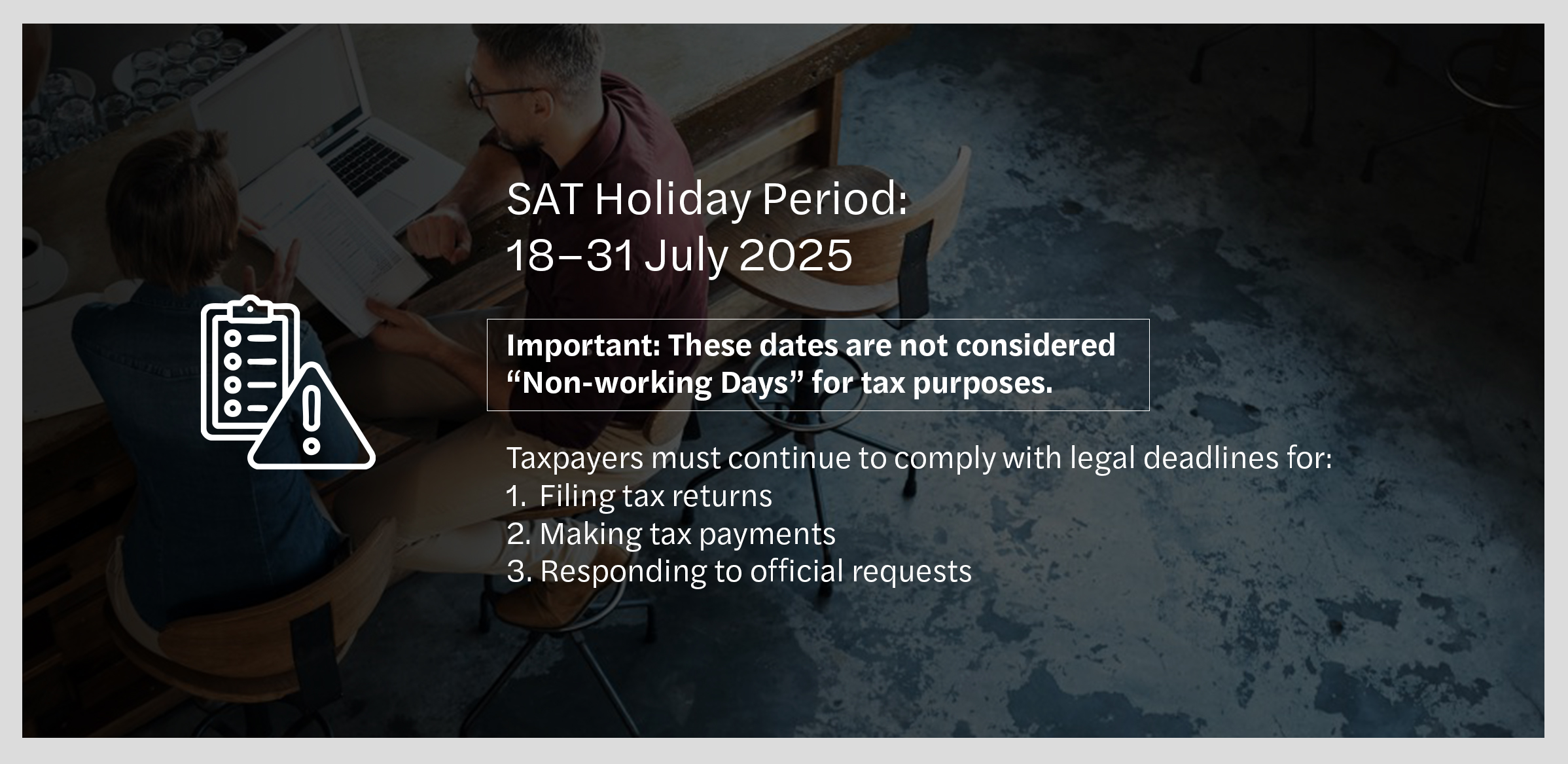

SAT’s official holiday period |

Rule 2.1.6, Section I, in the “Non-working Days” section, has been added to establish the first official holiday period of the Tax Administration Service (SAT) for the year, which will run from 18 to 31 July 2025.

It is important to note that these dates will not be considered non-working days for the purpose of calculating deadlines related to the filing of tax returns and payment of contributions. On the other hand, taxpayers undergoing tax refund procedures or administrative processes before the SAT are advised to plan accordingly to ensure they meet deadlines, respond to information requests, or submit clarifications in a timely manner.

New tax criterion for digital platforms (income tax and VAT) |

Criterion 59/ISR/IVA/N has been introduced, stating that individuals conducting business activities through digital platforms (whether selling goods or providing services) are subject to Income Tax (ISR) on the income they generate, even if they are regarded as workers under the new labour legislation.

With respect to Value Added Tax (VAT), Articles 18-B and 18-K confirm the obligation to apply VAT on income derived from such platforms, even when services are provided by foreign intermediaries.

This criterion clarifies that tax provisions do not alter the fiscal nature of these activities. Individuals will continue to be treated as independent service providers, not subordinate employees, and must comply with the obligations set out in Title IV of the Income Tax Law and Chapters I and III Bis of the VAT Law.

It is worth noting that the “Decree Amending Various Provisions of the Federal Labour Law on Digital Platforms” (Official Gazette, 24 December 2024) granted labour and social security rights to platform workers. However, lawmakers clarified that due to the flexible and intermittent nature of digital work, such activity does not constitute a traditional subordinate employment relationship. As a result, labour rights recognition does not exempt individuals from fulfilling their tax obligations regarding ISR and VAT.

At Forvis Mazars, our tax team includes experienced professionals ready to provide tailored advice on these matters and support both individuals and companies operating under these schemes.