Climate risk management

Financial institutions are under increasing pressure to demonstrate how they are managing climate-related risks and opportunities.

This pressure is coming from multiple fronts including intensifying global regulatory scrutiny. In Canada, the Office of the Superintendent of Financial Institutions (OSFI) released the Guideline B-15: Climate Risk Management which sets out expectations for federally regulated financial institutions around governance, risk management and disclosure. These include:

- Establishing appropriate governance and accountability structures to oversee climate-related risks and opportunities.

- Integrating potential impacts of physical and transition risks into strategic planning and decision making.

- Managing climate-related risks and opportunities in line with existing risk appetite and risk management frameworks.

- Using climate scenario analysis to assess potential impacts of climate-related risks and opportunities on risk profile, strategy, and business model.

- Incorporating climate-related risks into capital and liquidity planning processes.

- Publishing high quality and decision-useful climate-related financial disclosures.

Financial institutions should act decisively to stay ahead of these expectations to avoid potential fines, reputational damage and financial loss. Robust climate-related risk management goes beyond compliance. It underscores the strategic imperative to protect financial resilience, enhance stakeholder trust, and unlock emerging business value. Financial institutions need to embed climate considerations across their organisation, which would require strengthening capabilities to identify, assess, monitor and manage climate risks and opportunities.

How can we help

We provide financial institutions with holistic services at every stage of their climate risk management journey.

- Governance: Robust oversight and accountability structures over climate-related risks with clearly established and allocated roles and responsibilities across the organization.

- Compliance readiness and roadmapo Climate risk appetite statement and KRIs

- Target operating model development

- Trainings and capacity building

- Strategy and portfolio decarbonisation: Incorporate climate-related considerations in strategic planning and take appropriate actions to drive Green House Gas (GHG) emissions reductions

- Materiality assessment & horizon scanning

- GHG emissions measurements

- Sustainable finance product development

- Portfolio monitoring tools

- Climate risk management: Embed climate-related risks into existing risk management frameworks, updating processes to identify, assess and monitor and manage risks.

- Integration into existing risk policies (credit, market, operational, liquidity… )

- Climate scenario analysis and stress testing

- Climate risk data assessment and remediation

- Climate risk reporting (metrics & dashboards)

- Disclosures and regulatory reporting: Transparent, decision-useful and comprehensive information on the management of material climate-related risks and opportunities.

- Climate-related financial disclosures

- Climate risk regulatory returns

- Climate transition plan

- Reporting IT tools selection & implementation

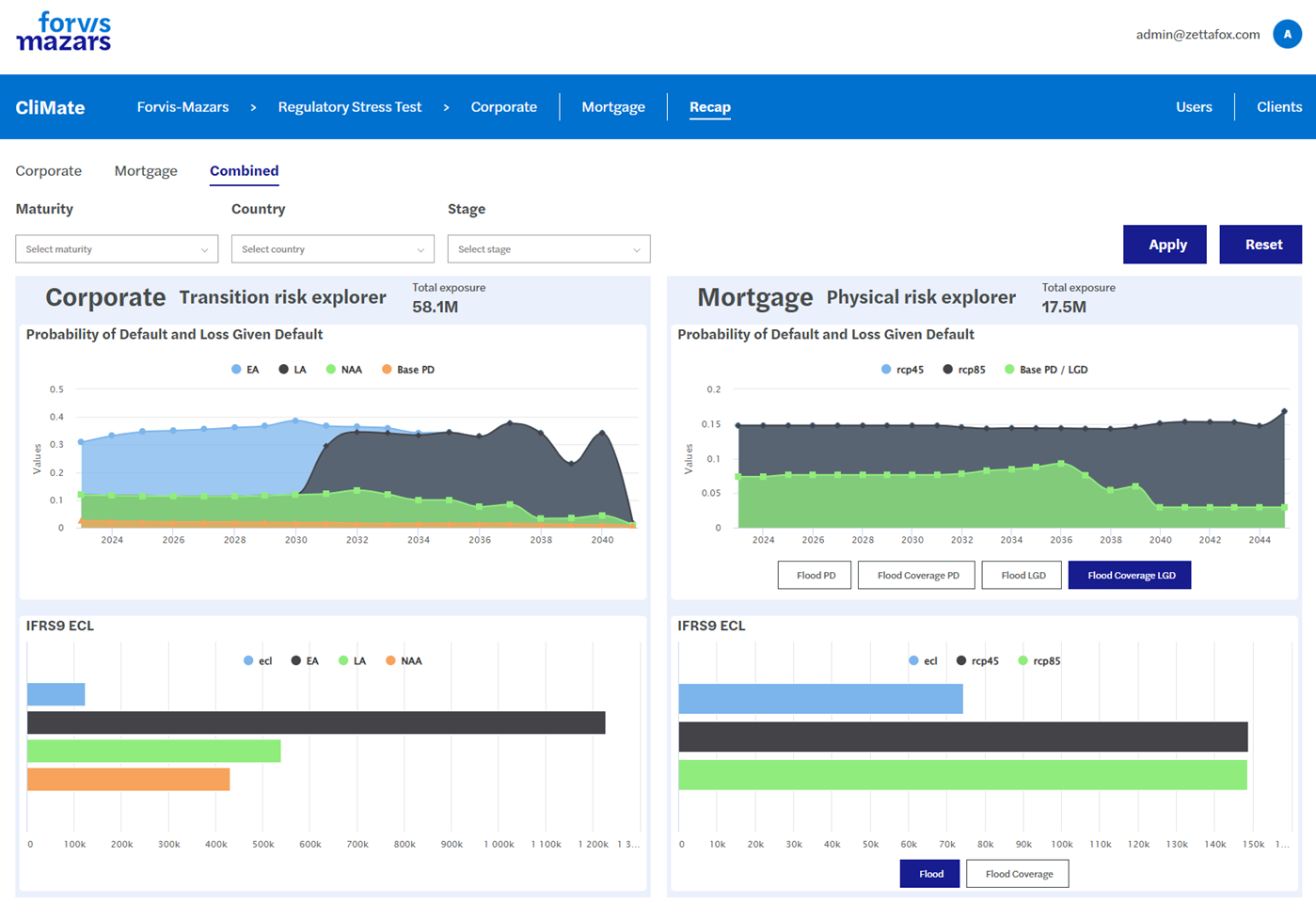

CliMate - Our proprietary climate risk assessment tool

Introducing our in-house climate risk assessment tool, CliMate, a solution designed to empower financial institutions navigate the complex landscape of climate risk. From portfolio visualisation to incorporation into financial risks, CliMate supports financial institutions conduct high-quality climate risk identification and quantification across core assets. It evaluates the impact of climate risks on the institution’s credit risk exposures.

Key highlights of CliMate include:

- Flexibility to select physical and transition risk modules relevant to the bank’s portfolio

- Seamless incorporation into credit risk, as leveraging the bank's existing credit models.

- Advanced comparison functionalities across sectors, portfolios and counterparties

- High transparency with all data points extractable for integration into risk modelling, reporting, disclosures and broader business streams