At Forvis Mazars, our specialist R&D tax credit team helps both international and indigenous businesses identify qualifying activities, optimise claims and secure valuable tax incentives that drive innovation and growth.

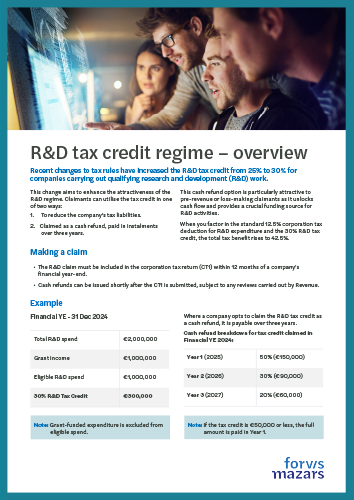

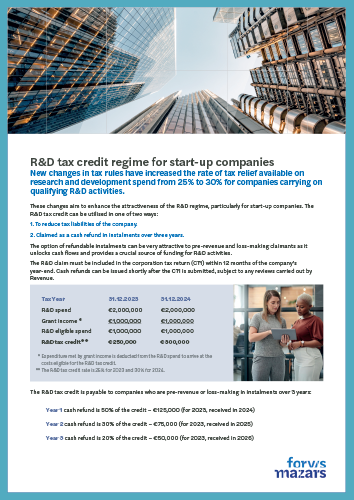

Governments worldwide offer R&D incentives to encourage investment and technological advancement. The R&D tax credit provides for a tax credit or cash refund worth 30%* of your R&D expenditure for activities that can be used to offset corporation tax liabilities or can be refunded directly to the company.

When fully optimised, the total benefit in Ireland can reach 42.5% of qualifying R&D expenditure, combining the 30% R&D tax credit with the standard 12.5% corporation tax deduction.

* The R&D tax credit will rise to 35% for accounting periods commencing on or after 1st January 2026.

Our approach

R&D tax credits and incentives are a key consideration in investment and location decisions. While the benefits can be substantial, identifying and substantiating qualifying activities requires specialist insight across both technical and tax disciplines.

Our dedicated R&D tax team brings together scientific and financial expertise to guide businesses through every stage of the process – from assessing eligibility and compiling documentation to liaising with the Revenue Commissioners during audits and reviews.

We help clients identify qualifying R&D across sectors where innovation may not always be obvious. While laboratory-based “white coat” R&D is clearly eligible, many supporting or process-based activities may also qualify under Irish and OECD definitions.

We support clients across a wide range of industries, including:

We help clients maximise their claims while maintaining full compliance with Irish and international requirements.

Eligible costs and capital expenditure

In addition to direct costs such as wages of R&D staff and raw materials, several other expenses may qualify on a just and reasonable basis, including:

- Overheads attributable to R&D activities

- Outsourced R&D activity carried on by third parties and third-level institutions

- Capital expenditure on plant, machinery or buildings used for R&D

Our team ensures that all eligible costs are properly captured, documented and substantiated to maximise your claim and remain compliant with Revenue guidelines.

Practical revenue support

We have extensive experience supporting clients through Revenue reviews and audits. Our dedicated tax and accounting professionals provide:

- End-to-end guidance throughout the claim process

- Advice on the most appropriate incentives for your business and growth strategy

- Support with compliance, documentation and post-submission follow-up

Our national and international teams maintain strong working relationships with relevant tax authorities, enabling us to navigate complex compliance and reporting requirements effectively.

Forvis Mazars R&D services

Claim preparation & review

- R&D tax credit claims.

- R&D project reviews.

- Review of claims submitted to Revenue Commissioners.

Strategic planning & documentation

- Claim planning to maximise available credits and incentives.

- Drafting applications, project descriptions and financial data summaries.

Audit & authority support

- Advice and support during Revenue audits.

- Follow up with authorities to ensure benefits are realised.

Contact us

Contact us today to discuss how our team can help you access and optimise your innovation incentives.to ensure your company is maximising its research and development credit benefit.