Navigating climate risk

Insights in climate risks needed for strategic decisions

Climate change is no longer a distant threat. It’s a present-day reality. The increasing impact of natural disasters and extreme weather events is already causing billions in damages, disrupting supply chains, and affecting operational performance. These events expose structural vulnerabilities in key sectors of our society. As these disruptions intensify, understanding climate risks becomes not just a matter of compliance, but a strategic necessity.

You can only manage what you can measure. That’s especially true for climate risk. It’s about integrating climate models, policy developments, technological shifts, and evolving societal expectations. It also means understanding how risks interact across sectors and in your value chain. Without this insight, organizations risk steering blindfolded into an increasingly volatile future.

To remain relevant and resilient, organizations should explore forward-looking scenarios and understand how climate-related risks may evolve for their business. Climate risks can stem from physical risks, impacting your assets and operational disruptions, or transitional risks, requiring investments to change your way of working, or even changing your value creation model.

Assessing Physical Risks

Physical climate risks arise from acute events, such as floods, storms, heatwaves, and from chronic changes like rising temperatures or water scarcity. These risks can damage assets, disrupt operations, and increase costs. Forward-looking climate models help anticipate how for instance heat or water stress may evolve over time, forming the basis for the exposure analysis.

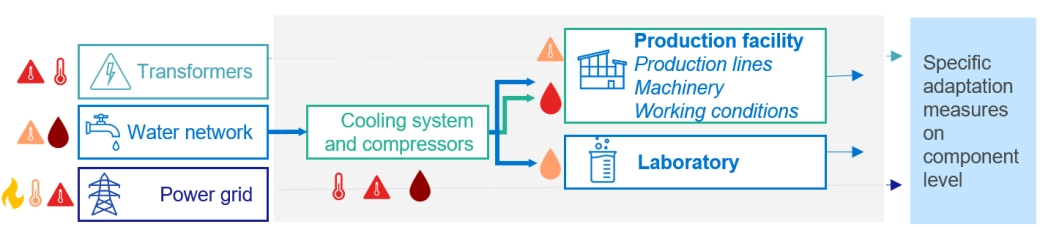

Understanding physical risks starts by assessing how exposed your organization is to climate hazards, and how sensitive your operations are to those hazards. For example, a facility may be in a drought-prone area (high exposure), but the real risk depends on how reliant your production is on water. In case of high reliance by example cooling of machinery there is a high sensitivity.

While many physical risks manifest locally, their consequences can be systemic, disrupting global supply chains, critical infrastructure, or essential services. Recognizing this, the EU introduced the Critical Entities Resilience Directive (CER), requiring organizations that are vital to society to assess and manage physical risks, such as climate risks. Integrating these insights into existing Enterprise Risk Management (ERM) and ISO-management systems strengthens decision-making and integrates climate resilience as part of your core business strategy.

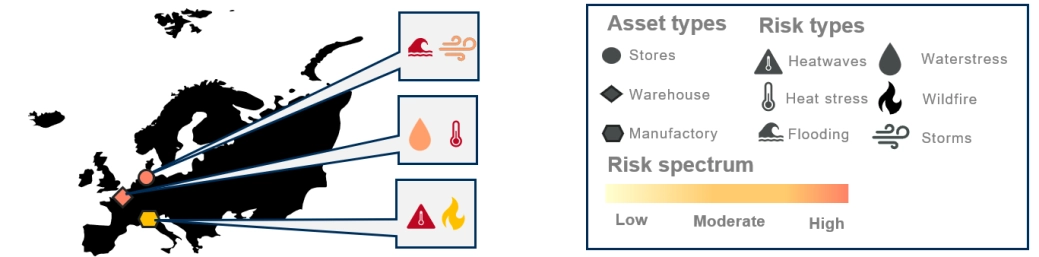

Organizations that embed physical risk into their risk frameworks are better equipped to anticipate disruptions, prioritize investments, and safeguard long-term continuity. Depending on your objectives, physical risk assessments can be conducted at asset level, to screen and prioritize locations across a portfolio. For a more detailed assessment, the underlying components can be assessed to identify vulnerabilities and plan appropriate adaptation measures for your business.

Physical risk assessment on asset level

An asset-level physical risk assessment evaluates risks, such as flooding, heat stress or wildfires, to an entire asset like a building, facility or infrastructure site, therefore shows the general risk of a site.

Physical risk assessment on component level

A component-level physical risk assessment evaluates risks to individual asset components on a specific site, such as the transformers, water network and power grid. This approach requires high data granularity, including engineering specifications, material properties, and localized climate projections. With this assessment in hand, concrete measures can be planned and taken.

Assessing transition Risks

Transition risks and opportunities arise from the global shift toward a low-carbon economy. In the short and medium term, this shift can disrupt sectors and increase operational costs. Over the longer term, it may fundamentally challenge existing business models. Regulatory frameworks are tightening, consumer expectations are rising, and technological innovation is accelerating. These developments unfold differently across sectors and regions. While the pace of change may vary, climate targets are approaching fast. The longer organizations wait, the more abrupt and costly the transition will be, and the less time there is to adapt.

Understanding your transition risks and opportunities starts with knowing where your organization contributes to greenhouse gas emissions, directly through operations, indirectly through supply chains or links to high-emission sectors. For example, a company may not emit much itself but still faces risks if it depends on carbon-intensive suppliers or markets that are rapidly decarbonizing. To identify and assess these risks, organizations need to combine understanding of the current emissions data with insights from policy trends, technological developments, and market dynamics. By applying scenario analysis on for instance energy or carbon prices, companies will have more useful insights in how these can evolve over time under a variety of different scenarios.

Carbon pricing, stricter emission standards, and shifting consumer preferences are already reshaping competitive landscapes. Organizations that anticipate and manage these transition risks today are better positioned to avoid stranded assets, maintain market relevance, and seize emerging opportunities.

Insights and preparation are key

Forward looking information and looking at different scenarios becomes increasingly important. The time that setting targets on reducing greenhouse gas emissions was a competitive advantage are gone. It has become a hygiene factor and an integral part of innovation. Only with sufficient insights, organizations can make thoughtful decisions and invest resources wisely and effectively.