IASB publishes an exposure draft on accounting for dynamic interest rate risk management activities

Because of the complexity of this new accounting model, the IASB has set an exceptional 240-day comment period, which will end on 31 July 2026. The IASB’s request for comments also invites preparers to participate in a fieldwork designed to test the implementation of the model based on their own particular circumstances.

This article aims to summarise:

- the context and objectives of these proposed amendments;

- the architecture of the new accounting approach proposed by the IASB;

- the methods used to account for and measure dynamic interest rate risk management activities;

- the principles applicable in case of discontinuation;

- the proposed transition requirements for the new model;

- the new disclosure requirements.

The IASB’s exposure draft and supplementary documentation are available here.

Background and objectives

What is dynamic risk management?

Dynamic risk management is a practice mainly found in financial institutions.

Given their core activities (granting loans, collecting deposits and issuing long-term insurance contracts), these institutions are exposed to uncertainty regarding their future earnings due to the unpredictability of interest rate fluctuations: this is known as the interest rate risk.

For banking institutions, for example, this risk arises from a combination of:

- a rate mismatch on the balance sheet: a different rate structure for assets and liabilities (fixed rate/variable rate) creates uncertainty about the level of the bank’s future net interest margin. For example, if all of the bank’s assets are fixed-rate while all of its liabilities are variable-rate, then the bank is exposed to a deterioration in its net interest margin in the event of an interest rate increase;

- a mismatch in nominal value and maturity on the balance sheet: future liquidity requirements and future liquidity excess involve refinancing or replacement transactions which, in the event of a rate mismatch, may create uncertainty about the level of the bank’s future net interest margin. For example, assuming that transactions are exclusively fixed-rate, if all assets are recovered simultaneously in 10 years and liabilities are due in one year, then the bank is exposed to a deterioration in its net interest margin in the event of a rate increase during year 1, as the refinancing it will put in place in one year’s time will have a higher interest rate.

The objective of dynamic risk management (also known as asset and liability management) is to:

- quantify the interest rate risk generated by all current and future transactions (assets, liabilities and future transactions, where appropriate); and

- reduce this risk to a level compatible with the risk appetite of the institution’s shareholders through the use of interest rate derivatives.

Why a new model?

Since IFRS 9 – Financial Instruments first time application, the transitional provisions give the option, for hedge accounting, to apply either the principles of IFRS 9 or continue to apply those of IAS 39. Many financial institutions have chosen to continue applying the principles of IAS 39 in order to document their interest rate hedging derivatives in portfolio hedging relationships.

This transitional provision was intended to give the IASB sufficient time to develop a new accounting model for macro-hedging relationships before the definitive removal of IAS 39.

This is because the current hedge accounting provisions (IFRS 9 / IAS 39) only allow for the documentation of hedging relationships based on closed and stable portfolios of hedged items. They struggle to accurately represent dynamic risk management strategies in which an entity manages interest rate risk on a net basis arising from the aggregation of open portfolios that evolve over time as a result of new business, repayments and interest rate repricing.

The exposure draft proposes a new accounting framework called Risk Mitigation Accounting (RMA) to better reflect the economic effect of dynamic interest rate risk management strategies in financial statements. In the absence of such a model, the removal of IAS 39 by the IASB would create an accounting mismatch between the method used to measure derivatives for risk mitigation purposes and that used for the underlying portfolios that generate the repricing risk.

The repricing risk is the risk that the benchmark interest rate for financial assets and liabilities will reprice at different times, for different amounts and/or on the basis of different benchmark rates. It therefore primarily concerns financial institutions such as banks and insurance companies, which generally manage their interest rate risk with a dual objective: to reduce both the variability of future cash flows and the variability of the fair value of the underlying portfolios.

Scope of application

The model is designed for entities whose activities generate financial instruments exposed to interest rate repricing risk and which mitigate this risk on a net basis using interest rate derivatives.

It is applied at the level at which the entity manages the repricing risk on a net basis (e.g. by currency, by group entity or by the benchmark interest rate to which the instruments are exposed).

Its application is optional and it may only be applied if the entity formally documents its risk management strategy and the terms and conditions for applying the RMA model. However, if an entity within the scope of the RMA decides not to apply the model, it must provide information in the notes on its exposure, its risk management process and how its risk management activities are reflected in the financial statements.

Architecture of the proposed model

Compared with current hedge accounting provisions, the RMA introduces new concepts that structure the accounting treatment of dynamic interest rate risk management activities. The exposure draft therefore suggests the addition of a new chapter to IFRS 9, following that relating to hedge accounting.

Underlying portfolios

The following are eligible:

- financial assets measured at amortised cost or at fair value through equity;

- financial liabilities measured at amortised cost;

- future transactions, which may include firm commitments, expected reinvestments or refinancing of existing operations, and future transactions that are highly probable.

Financial instruments measured at fair value through profit or loss and equity instruments are not eligible, as they do not give rise to the accounting mismatch that the model is designed to address.

Furthermore, the stable portion of demand deposits may be treated as fixed-rate liabilities if exposed to a repricing risk on a portfolio basis.

Net repricing risk exposure

The entity aggregates the exposure resulting from the underlying portfolios by future maturity band, based on the expected repricing dates. These dates are determined on the basis of factors such as contractual characteristics and behavioural assumptions.

The measure chosen to quantify exposure must reflect internal risk management practices (for example, the gap expressed in nominal terms or the sensitivity of the economic value of equity).

Designated derivatives

Only interest rate derivatives with an external counterparty (e.g. swaps. FRAs, futures, options) are eligible.

Net written options and derivatives whose fair value changes are dominated by risks unrelated to interest rates are excluded, except in the particular case of a written option profile that offsets an option buyer position.

Risk mitigation objective

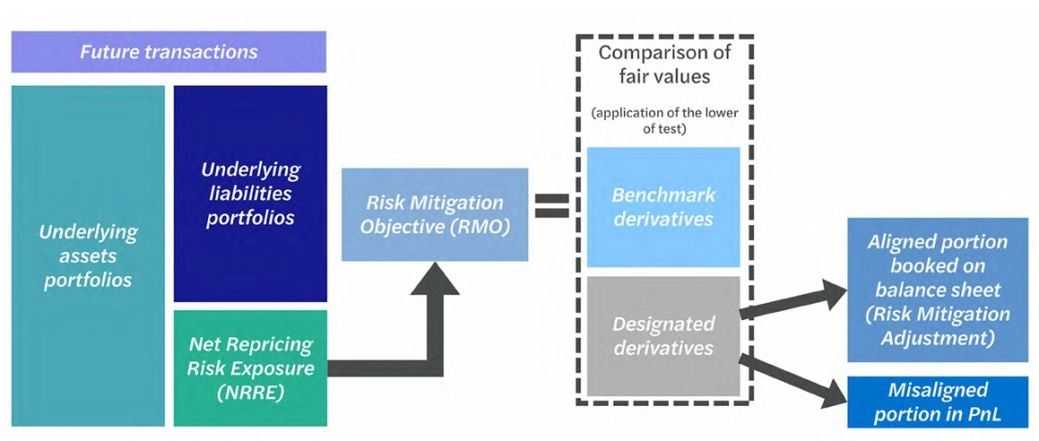

The risk mitigation objective is the absolute amount of net exposure to repricing risk to be mitigated, by maturity band. It is influenced by the position of designated derivatives and may not exceed the net organic exposure, i.e. before taking account of the effects of designated derivatives.

It is expressed using the same measures that management uses to quantify exposure and is updated each time the entity carries out risk management activities, i.e. uses interest rate risk derivatives to hedge its net exposure.

Benchmark derivatives

To measure the risk mitigation objective and monitor it over time, the entity constructs theoretical benchmark derivatives (similar to the hypothetical derivative used in cash flow hedging), which replicate the timing and amount of the mitigated risk, independently of the designated derivatives.

These benchmark derivatives are constructed to have an initial fair value of zero.

In the event of unexpected changes in the net exposure (e.g. early repayments exceeding forecasts), the entity adjusts the benchmark derivatives for the amount exceeding the new net exposure.

Recognising and measuring the risk mitigation adjustment

An alternative accounting policy to hedge accounting

The accounting approach proposed by the IASB in the exposure draft is neither fair value hedge accounting nor cash flow hedge accounting.

This new model requires the measurement of the designated derivatives at fair value against:

- recognition on a separate line in the statement of financial position of a risk mitigation adjustment equal to the portion that effectively mitigates the variability arising from the repricing risk;

- immediate recognition in profit or loss of any remaining portion (similar treatment to that of ineffectiveness in a cash flow hedge)

Recognising the risk mitigation adjustment in the statement of financial position

The risk mitigation adjustment is measured as the lower of the cumulative gains or losses on the designated derivatives, and the cumulative change in the fair value (present value) of the benchmark derivatives.

Thus, if the cumulative gains and losses on designated derivatives exceed the cumulative change in fair value of the benchmark derivatives, the excess is recognised immediately in profit or loss. This excess arises from differences in characteristics between designated derivatives and benchmark derivatives, which may be either structural (e.g. differences in benchmark interest rates or maturity) or arise from unexpected changes in net exposure that required adjustments to the benchmark derivatives (e.g. maturity and/or notional adjustments).

The IASB notes that this item does not meet the strict definition of an asset or a liability in the Conceptual Framework, but that this divergence is necessary to provide information, as it avoids the volatility that would result from recognising gains and losses on designated derivatives in other comprehensive income.

The following diagram summarises the architecture of the model and the recognition principles:

Recycling the risk mitigation adjustment in profit or loss

The cumulative risk mitigation adjustment on the statement of financial position is recognised in profit or loss during the same reporting period as the repricing differences arising from the underlying portfolios in order to mitigate their effect.

RMA excess test

At each reporting date, the entity must assess whether there is an indication that the risk mitigation adjustment might not be realised in full over the mitigated time horizon. This situation would arise if there were unexpected changes in the net repricing risk exposure during the reporting period that have not been fully reflected in the adjustments to the benchmark derivatives.

In such a case, the entity shall determine whether the amount accumulated as the risk mitigation adjustment exceeds the present value of the net repricing risk exposure as at the reporting date.

If the entity identifies an excess amount in absolute terms this amount is immediately recycled to profit or loss with no subsequent possibility to reverse it.

Discontinuation and transition requirements

Discontinuation of risk mitigation accounting

An entity is required to discontinue the use of this approach prospectively when there is a change in its risk management strategy (e.g. a change in the benchmark rate being mitigated, the scope of risk management, or the measurement indicator used to quantify exposure).

However, it may not simply choose to discontinue risk mitigation accounting. Where discontinuation does occur, the entity shall recognise in profit or loss the amount accumulated as the risk mitigation adjustment:

- over time when the entity still expects the repricing differences arising from the underlying portfolios to affect future results; or

- immediately when the entity no longer expects the repricing differences arising from the underlying portfolios to affect profit or loss.

Transition requirements

The proposed transitional provisions in the exposure draft state that the new RMA model may only be applied prospectively. So, on the date of first application:

- entities documenting macro-hedging transactions under IFRS 9 or IAS 39 will be permitted to discontinue the hedging relationship to apply the RMA approach. Remeasurement differences recognised in respect of the pre existing relationship may be spread over the residual hedging period;

- entities that have designated financial assets or liabilities at fair value through profit or loss may revoke this designation to include them in the underlying portfolios of the RMA model (using their fair value at that date as their amortised cost).

Presentation and disclosures (amendments to IFRS 7 and IFRS 18)

Presentation in the primary financial statements

In the statement of financial position, the risk mitigation adjustment will be presented on a separate line, either as an asset or a liability, depending on the direction of the cumulative gains and losses arising from the designated derivatives.

In the statement of profit or loss, the recycling of gains and losses arising from the risk mitigation adjustment will be recognised on a separate line.

Disclosures (amendments to IFRS 7)

New disclosures should be provided in a separate note focusing on:

- the repricing risk management strategy (at what level, how often, with what timing, following what process, etc.);

- the effect of designated derivatives on the amount, timing and uncertainty of future cash flows (designated derivatives schedule, average fixed rate of derivatives, sensitivity analysis);

- the effect of risk mitigation accounting on the statement of financial position and in profit or loss (qualitative and quantitative information on underlying portfolios, designated derivatives, RMA measurement methodology, profile for RMA recognition in profit or loss, etc.).

Classification of gains and losses on derivatives (amendments to IFRS 18)

These amendments are intended to include the designated derivatives from RMA in the provisions relating to the classification of gains and losses on derivatives in the profit or loss statement.

Gains and losses will thus be classified in the same category as income and expenses affected by the managed risk, while avoiding grossing-up.

Conclusion

This exposure draft, presenting a new accounting model for macro-hedging, is the result of extensive efforts initiated in 2018.

The standard-setter aims to:

- better reflect how financial institutions manage the interest rate risk by allowing the hedging of an aggregate net position of open portfolios of assets and liabilities, including demand deposits;

- better reflect the accounting effect of this management by impacting profit or loss only in the event of over-hedging or when a excess is identified on the risk mitigation adjustment;

- establish an approach that is workable for preparers and limits the volatility of equity and hence of prudential own funds through the innovative mechanism of RMA, which is a departure from the IASB’s conceptual framework.

Stakeholders now have until the end of July to submit their comments and a few more months to test it through the fieldwork in order to provide input for the IASB’s future deliberations.

Want to know more?