Personal income tax return (PND 91) A Closer Look - November 2025

Contents

- General information and residence rules

- Assessable income to be reported in Form PND 91

- Who must file Form PND 91?

- Personal income tax rates

- Tax allowances and tax exemptions for 2025

- Important dates, tax refunds, and tax payments

- Penalties

- Tax-savings tips that you should know

- Related to dependants

- Related to investments

- Retirement Mutual Fund (RMF)

- Thailand ESG Fund (Thai ESG)

- Impact of investing in an RMF & Thai ESG on tax allowances

- Important note to taxpayers who made investments in RMFs and Thai ESGs

- 2025 updates

- A tax deduction for expenses related to house construction

- A tax deduction of up to 50,000 baht for domestic purchase (Easy E-receipt 2.0)

- A tax benefits of up to 300,000 baht of converting LTF fund to Thailand ESG Extra fund (Thai ESGX)

- Tax deduction of up to 100,000 baht for purchasing artwork

- Tax exemption on capital gains from the sale of cryptocurrency or digital tokens

- Tax deduction to promote Thailand domestic tourism

- PND91 filing retroactively

General information and residence rules

In general, a person subject to personal income tax (PIT) must calculate his tax liability, file tax returns, and pay tax, if any, on a calendar-year basis. Taxpayers are classified as either residents or non-residents of Thailand.

A resident is any person residing in Thailand for a period, or periods, totalling 180 days or more in any tax year. A resident is liable to pay tax on income from sources in Thailand on a cash basis, regardless of where the money is paid, and on that portion of income from foreign sources that is brought into Thailand*. in the same year that the foreign income is derived.

A non-resident is only subject to tax on income from sources in Thailand.

Notes:*Refer to the Revenue Department issued Departmental Instruction Nos. Paw. 161/2566 and Paw. 162/2566 which state that any foreign-sourced income derived by an individual who is a Thai tax resident from 1 January 2024 onward is subject to Thai personal income tax upon bringing that income into Thailand.

Assessable income to be reported in Form PND 91

Section 40(1) of the Revenue Code lists the types of personal income for which Form PND 91 must be filed. This includes income derived from employment, whether fixed or variable, such as the following:

- Salaries and wages;

- Per diems, bonuses, commissions, and gratuities;

- Allowances such as pensions, housing rental allowances, the monetary value of rent-free housing provided by an employer, and the payment of an employee’s debt by an employer; and

- Any money, property, or benefits derived from employment.

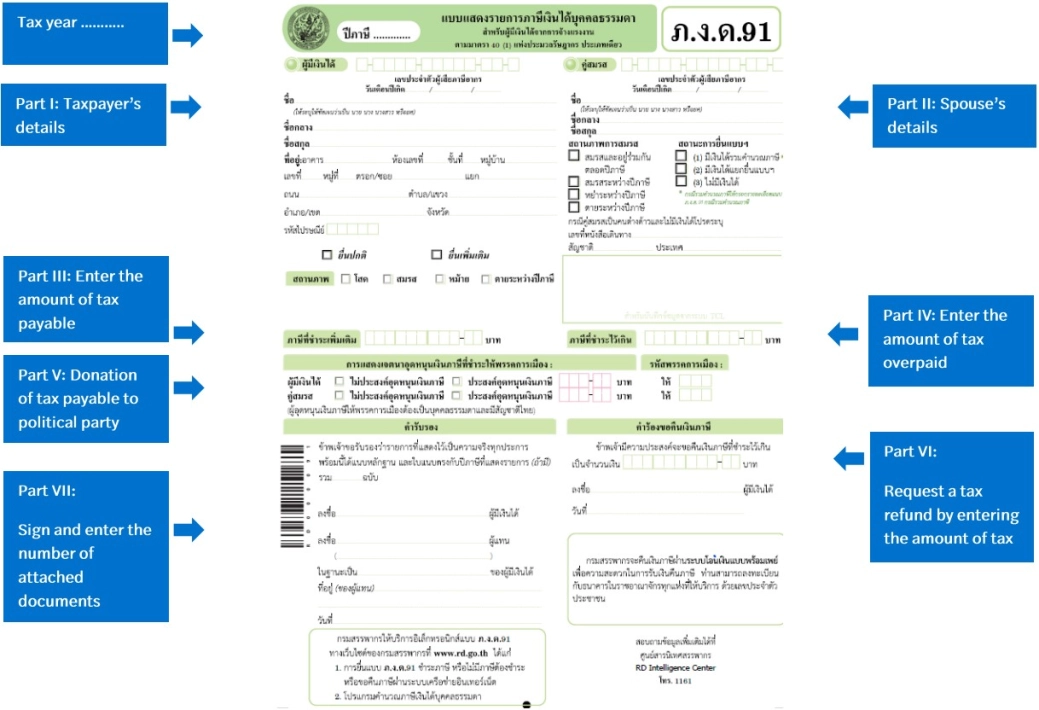

Who must file Form PND 91?

A person must file a PND 91 if they have income as set out in Section 40(1) of the Revenue Code and meet one of the following conditions:

- Single Person

Assessable income exceeding 120,000 baht in the tax year. - Married Person

Assessable income, combined with that of your spouse, exceeding 220,000 baht in the tax year.

When filing Form PND 91, there are 3 options to choose from regarding your filing status:

1. Spouse has income, and you are filing a joint tax return

2. Spouse has income, and spouse will file a separate tax return

3. Spouse has no income

Personal income tax rates

Tax rates for resident and non-resident individuals are as follows (applicable since 1 January 2017):

Taxable Income | Tax Rate | Tax Amount (Thai baht) | Accumulated Tax (Thai baht) |

|---|---|---|---|

0 - 150,000 | 0% | - | - |

150,001 - 300,000 | 5% | 7,500 | 7,500 |

300,001 - 500,000 | 10% | 20,000 | 27,500 |

500,001 - 750,000 | 15% | 37,500 | 65,000 |

750,001 - 1,000,000 | 20% | 50,000 | 115,000 |

1,000,001 - 2,000,000 | 25% | 250,000 | 365,000 |

2,000,001 - 5,000,000 | 30% | 900,000 | 1,265,000 |

5,000,001 and over | 35% |

|

|

Tax allowances and tax exemptions for 2025

Certain deductions and allowances are allowed in the calculation of the taxable income.

Type of Allowance | Amount |

|---|---|

Deductible expenses for income | 50% of income (capped at 100,000 baht) |

Personal allowance | 60,000 baht |

Spouse (with no income) | 60,000 baht |

Child (with income not exceeding 30,000 baht) (Under 20 years of age, regardless of whether he is studying; or under 25 years of age, but he must be studying at a university, either in Thailand or abroad. There is no limit on the number of natural children that can be claimed, but there is a limit of 3 when claiming adopted children.) |

30,000 baht per child

(If both parents have income, each of them can claim the allowance of 30,000 baht.) |

Second child born from 2018 onwards | 60,000 baht per child |

Pre-natal care and delivery expenses | Amount actually paid, but not exceeding 60,000 baht in total for each childbirth |

Parents (with income not exceeding 30,000 baht) (The parent must be at least 60 years old, and must be a Thai national) | 30,000 baht per parent (If the spouse has no income, the taxpayer can also claim the allowance for his/her spouse’s parents.) |

Support of a disabled person (with income not exceeding 30,000 baht) (A disabled person must have an ID card issued under the law on disabled people naming the taxpayer as the guardian) | 60,000 baht per disabled person (A taxpayer can claim the allowance of 60,000 baht for any member of his/her family, i.e., spouse, child, adopted child, parents, and parents of a spouse with no income, including 1 disabled person who is not one of his/her family members.) |

Life insurance premiums for the taxpayer itself* (The policy must be for 10 years or more, and made with an insurer conducting business in Thailand) | Amount actually paid, but not exceeding 100,000 baht |

Life insurance premiums for the spouse (with no income) (The policy must be for 10 years or more, and made with an insurer conducting business in Thailand) | Amount actually paid, but not exceeding 10,000 baht |

Health insurance premiums for the taxpayer itself* | Amount actually paid, but not more than 25,000 baht |

Health insurance premiums for the taxpayer’s parents and spouse’s parents (This must be through an insurer conducting business in Thailand.) | Amount actually paid, but not exceeding 15,000 baht in total |

Provident Fund contributions (PVF)** | Up to a maximum of 500,000 baht, but |

Retirement mutual fund (RMF) **, *** | Up to a maximum of 500,000 baht, but |

Thailand ESG Fund (Thai ESG)*** (The period from 1 January 2024 to 31 December 2027) | Up to a maximum of 300,000 baht, but not exceeding 30% of income. |

Thailand ESG Fund Extra (Thai ESGX) – New purchase*** (The period from 2 May to 30 June 2025) | Up to a maximum of 300,000 baht, but not exceeding 30% of income. |

Thailand ESG Fund Extra (Thai ESGX) – Conversion from LTF**** (The period from 13 May to 30 June 2025) | Up to a maximum of 300,000 baht in 2025 and from 2026 to 2029, the maximum tax deduction is up to 50,000 baht |

Pension life insurance premiums** (The policy must be for 10 years or more, and made with an insurer conducting business in Thailand) | Up to a maximum of 200,000 baht, but |

National savings fund contributions** | Amount actually paid, up to a maximum of 30,000 baht |

Government pension fund contributions** | Up to a maximum of 500,000 baht, but |

Private teacher aid fund contributions** | Up to a maximum of 500,000 baht, but |

Handicapped or disabled person who is a Thai resident, and not more than 65 years old | Exempt from net income, but not more than 190,000 baht |

Thai resident who is more than 65 years old | Exempt from net income, but not more than 190,000 baht |

Severance pay upon dismissal from employment under labour law and state enterprise workers' relations law (Not including retirement or the end of a contract) | Severance pay equal to the wages of the last 400 days of employment is tax-exempt, with a cap of THB 600,000 |

Home mortgage interest | Amount actually paid, but not exceeding 100,000 baht (If the taxpayer jointly takes out a loan with others, each person is entitled to a deduction equally. The total combined amount must not exceed 100,000 baht.) |

Social Security Fund contributions | Amount actually paid |

Charitable contributions | Amount actually donated, but not exceeding 10% of income after standard deductions and allowances. A double deduction is allowed for donations to hospital, educational or charity organizations but not exceeding 10% of income. |

Donations to political parties | Amount actually paid, but not exceeding 10,000 baht. |

Investment in social enterprises | Amount actually invested in shares, but not exceeding 100,000 baht. |

Easy E-receipt 2.0 A tax relief of up to 50,000 baht for domestic purchases of goods or services with electronic tax invoices/receipts and from OTOP or local enterprises. | Amount actually paid up to 30,000 baht for purchases of goods or services from VAT-registered entrepreneurs using the electronic tax system, and up to 20,000 baht for purchases from OTOP and local entrepreneurs made between 16 January and 28 February 2025. |

House construction expenses |

A tax deduction of THB 10,000 per THB 1 million in construction costs paid to VAT-registered contractors is available, up to a maximum of THB 100,000. The construction contract must have electronically paid stamp duty, and construction must begin between April 9, 2024, and December 31, 2025.

|

Purchase of visual artworks to support Thailand’s artwork | A deduction of up to THB 100,000 for purchases made between 1 January and 31 December 2027 from national artists in the visual arts category, artists who have received the Silpathorn Artist Award in visual arts, or artists registered with the Office of Contemporary Art and Culture. |

Tax deduction to promote Thailand domestic tourism | A deduction of up to THB 20,000 for purchases made between 29 October and 15 December 2025 from VAT-registered vendors issuing full-format tax invoices. Additionally, travel to to 55 secondary provinces and designated districts in 15 provinces qualifies for a 1.5x deduction, capped at THB 30,000. |

Notes: * When the allowances, including the allowance for life insurance premiums for the taxpayer, health insurance premium for the taxpayer, as well as savings accounts with attached life insurance policies paid by the taxpayer, are not more than 100,000 baht, the taxpayer can include pension life insurance for the taxpayer, but the total cannot be more than 100,000 baht. The balance of pension life insurance for the taxpayer will be claimed separately, up to 200,000 baht, but not more than 15% of income, and when including other pension allowances, must not exceed 500,000 baht.

** When including the allowance for provident fund contributions (PVF), a retirement mutual fund (RMF), national savings fund contributions, pension life insurance premiums, government pension funds, and private teachers’ aid fund contributions, the amount must not exceed 500,000 baht.

*** To claim a tax deduction for investments in RMFs, Thai ESGs, and Thai ESGXs, taxpayers must submit a request to the respective asset management company. Otherwise to do so will result in the inability to claim the deduction.

**** The conversion of LTFs units to Thai ESGXs must be completed within the specified period and applies to all funds and asset management companies. Investors are required to hold the Thai ESGX units for at least 5 consecutive years. The maximum tax deduction is divided into two phases: up to 300,000 baht in 2025, and from 2026 to 2029, a consistent annual deduction of up to 50,000 baht.

Important dates, tax refunds, and tax payments

Filing date

For income received in 2025, the taxpayer must file Form PND 91 and pay any tax due during the period from 1 January - 31 March 2026. However, the deadline for filing Form PND 91 and paying tax will be extended to 7 April 2026 for taxpayers who submit Form PND 91 through the Revenue Department’s website (e-filing).

Tax refunds

If the taxpayer has overpaid tax, and would like to claim a tax refund, they can submit a refund request when filing Form PND 91. The Revenue Department will consider the request and respond by post (if filing on paper) or on the website (for e-filing). In the latter case, the taxpayer must log into the website to check this. The Revenue Department may ask for additional supporting documents, which must be sent by the specified deadline.

If you are a Thai citizen, the best way to get your tax refund is through PromptPay, using your national identification number.

If you are not a Thai citizen, the fastest way to get a refund is to make sure you have at least one active Thai bank account. Once your tax refund is approved, a tax refund letter (Form Kor. 21) and cashier’s cheque will be sent to the address listed in your tax return. You must then take the tax refund letter and cashier’s cheque, as well as your Thai taxpayer’s ID card and passport, to the bank counter. The tax refund will be remitted to your bank account directly.

Paying tax in instalments

If the amount of tax payable is at least 3,000 baht, taxpayers can ask to pay the tax in 3 equal instalments:

Instalments | Due date | Requirements |

|---|---|---|

1st | 31 March (or the next business day) | 1/3 of the tax + Form PND 91 tax return |

2nd | 30 April | 1/3 of the tax |

3rd | 31 May | 1/3 of the tax |

If the taxpayer fails to make any instalment payment on time, the taxpayer loses the right to pay tax in instalments. The taxpayer must then pay the total amount due, along with a surcharge.

If taxpayers are paying tax in instalments at an area Revenue Department office, the officer will provide the taxpayer with Form Bor Chor 35 (Notice of Tax Arrears).

Penalties

If taxpayers do not submit Form PND 91 by the deadline, a criminal fine of up to 2,000 baht may be charged, and if the taxpayer has tax payable, a surcharge of 1.5% per month (part of a month is counted as a whole month) of the total tax due will be charged.

Tax-savings tips

There are many ways to save your money on your annual tax return, but the two main tax deduction allowances are related to investments and to families.

If you are married and have children, you may have to spend a lot of money on household expenses, tuition fees and so on. In the past few years, the Thai government has provided some tax deductions to encourage people to get married and have children. You may be able to save more on your taxes as a married person than as a single person if you utilize all of the tax deductions for your dependants.

2025 updates

1. A tax deduction for expenses related to house construction

2. A tax deduction of up to 50,000 baht for domestic purchase (Easy E-receipt 2.0)

3. A tax benefits of up to 300,000 baht of converting LTF fund to Thailand ESGX

4. Tax deduction of up to 100,000 baht for purchasing artwork

5. Tax exemption on capital gains from the sale of cryptocurrency or digital tokens

6. Tax deduction to promote Thailand domestic tourism

PND91 filing retroactively

If the taxpayer has completed completing the yearly Form PND 91 but needs to change the information submitted later, you can do so by filing PND 91 retroactively with the Revenue Department.