Taxing unimproved land in Metropolitan Melbourne

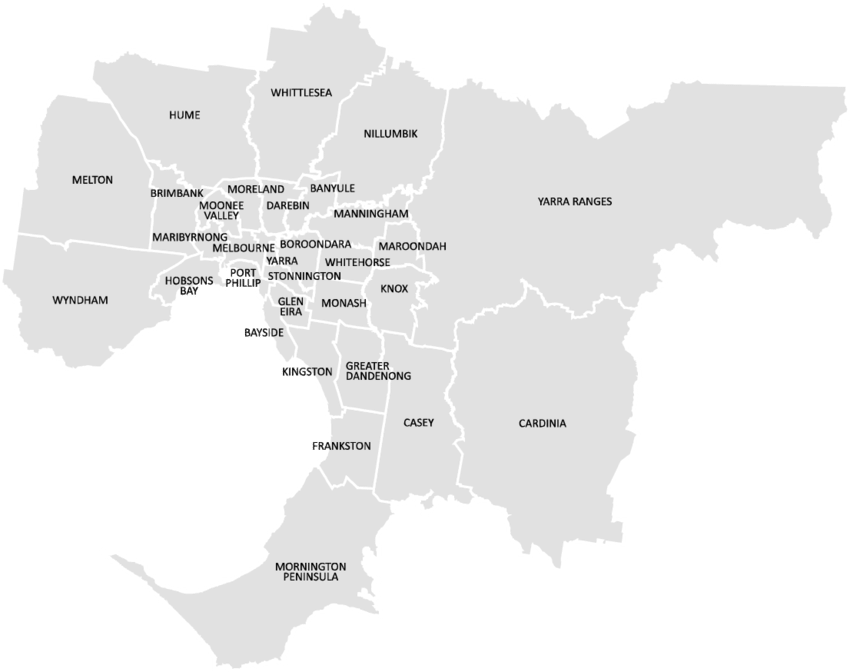

The map below defines metropolitan Melbourne. Look closely, as you may be surprised how much of Victoria is included. If you hold a vacant block within these borders, you need to be aware of this tax.

Who will be taxed?

· Do you own vacant (unimproved) land inside metropolitan Melbourne?

· Have you held this property continuously for five years or more as at 31 December 2025?

If the answer is ‘yes’ to both, you’ll likely be subject to this tax, unless some of the narrow exemptions apply:

· The land is intended mainly to be used or developed for a non-residential use and there is a reason acceptable for the land not yet being so developed, or

· The land is capable of being lawfully used as a commercial residential premises, or

· The land is capable of being lawfully used as a residential care facility or for supported residential services or a retirement village, or

· The land adjoins a principal place of residence (PPR), is owned and used the by the owner of the PPR land and enhances the PPR land, or

· The land cannot be used for residential purposes because of the physical features of the land, or

· Any matter which prohibits the lawful use of the land for residential purposes e.g. planning scheme, environmental condition or restrictive covenant.

How much will you pay?

The tax is levied at 1% of the land. This tax is in addition to the regular land tax. This means if your vacant land is valued at $500,000, for example, you’d pay an extra $5,000 per year as vacant residential land tax, on top of your regular land tax obligations.

If you own residential land that was vacant in 2025, you must notify the Victorian State Revenue Office by 15 February 2026. If you believe your land is exempt, you need will still need to notify the Victorian government to apply for an exemption

Notifications are made on this link https://www.e-business.sro.vic.gov.au/vacantlandtax/identity

How do I find out more?

The Victorian State Revenue Office website has more information. If you think your land may fall under any of the exemption categories, or you’re unsure about your obligations, it’s a good idea to seek professional advice. For assistance, please contact your usual Forvis Mazars advisor, or contact your local office below.

| Melbourne – Michael Jones | Sydney – Stephen Baxter |

| +61 3 9252 0800 | +61 2 9922 1166 |

Author: Michael Jones

Published: 1 December 2025

Please note that this publication is intended to provide a general summary and should not be relied upon as a substitute for personal advice.

All rights reserved. This publication in whole or in part may not be reproduced, distributed or used in any manner whatsoever without the express prior and written consent of the Forvis Mazars, except for the use of brief quotations in the press, in social media or in another communication tool, as long as Forvis Mazars and the source of the publication are duly mentioned. In all cases, Forvis Mazars’ intellectual property rights are protected and the Forvis Mazars Group shall not be liable for any use of this publication by third parties, either with or without Forvis Mazars’ prior authorisation. Also please note that this publication is intended to provide a general summary and should not be relied upon as a substitute for personal advice. Content is accurate as at the date published.