European Court: Chain transaction involving four parties

EC: Chain transaction involving four parties

Facts

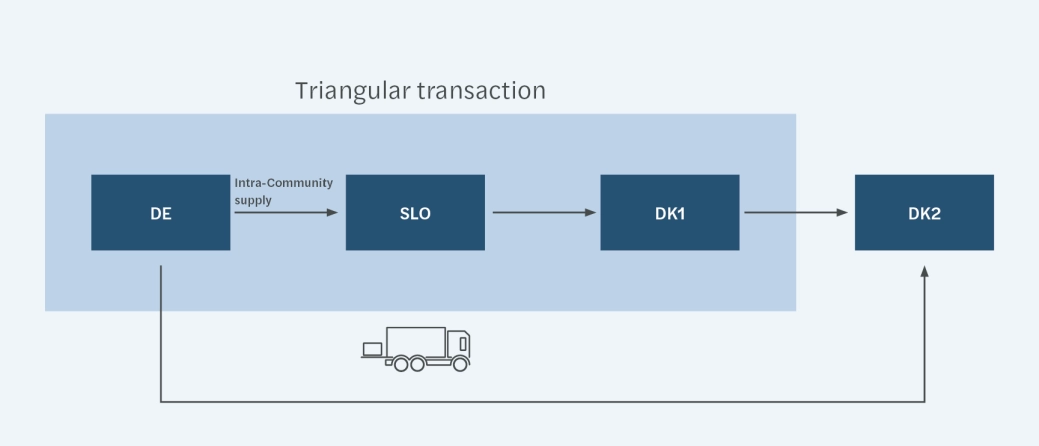

The plaintiff was a company registered for VAT purposes in Slovenia (hereinafter: SLO). It purchased goods from a German company DE and sold them on to three Danish companies (hereinafter referred to collectively as DK1). These companies sold the goods to another Danish company DK2. The applicant SLO arranged for the goods to be transported from Germany to DK2 (not DK1). All the companies used the VAT identification numbers of their respective countries.

The Danish authorities found out that the three DK1 companies had neither declared the acquisition of the goods nor paid VAT. They had neither warehouses nor offices in Denmark and were to be regarded as missing traders.

Background and question referred: triangular transaction

The question was whether this situation fulfilled the requirements for an intra-Community triangular transaction in accordance with Art. 141 of the VAT Directive. This legal institution is intended for chain transactions between two EU Member States with three parties, in which the first supply is the intra-Community supply. Normally, the intermediary would have to register for VAT in the country of destination in order to declare an intra-Community acquisition there and, unless the reverse charge procedure applies, also a subsequent local supply. However, if all parties involved use different VAT IDs, whereby the intermediary's VAT ID must not be that of the country of departure or destination, a simplification applies (subject to further conditions): the intermediary does not have to declare an intra-Community acquisition, and the VAT for the local supply is owed by the customer.

The European Court of Justice had to decide whether such an intra-Community triangular transaction existed between DE, SLO and DK1. The referring court had doubts based on the wording of Article 141 (c) of the VAT Directive, which requires that the goods be "directly dispatched or transported to the person for whom he [i.e. the intermediary] is to carry out the subsequent supply". This can be understood to mean that the goods must physically reach DK1.

EC ruling: Four parties involved are not an obstacle

In its analysis, the EC focuses on the phrase "for whom he is to carry out the subsequent supply” and excludes the part "directly dispatched or transported to the person". Referring to previous ECJ case law, the EC concludes that the recipient of a supply of goods does not have to acquire ownership or physical possession of the goods. The goods were therefore supplies by SLO to DK1. On this basis, the General Court affirmed the intra-Community triangular transaction between DE, SLO and DK1.

The only exception would be if DK 1 had acted abusively and should have known that it was involved in an abusive supply chain; in that case, the triangular transaction rule would not apply.

Evaluation

The analysis of the EC is surprising: the court is examining whether SLO made a supply to DK 1 for VAT purposes. However, given the long-standing and unchanged general definition of supply by the ECJ, there is actually no doubt about this – and it is not the decisive question either. According to the wording of Article 141 (c) of the VAT Directive, a prerequisite for a triangular transaction is that the goods are transported or dispatched directly to the person to whom the intermediary (in this case SLO) makes the subsequent supply. The EC should therefore not have examined whether the goods were supplied to DK 1 (which is undisputed), but whether they were transported directly to DK 1. In our view, however, such a conclusion would be difficult to justify in view of the wording of the Directive, since the goods were not transported to DK 1 but to DK 2.

It is very unusual for a European court to interpret the Directive contrary to its wording. Instead of providing more clarity, the EC has created great uncertainty in this case. It remains to be seen how the national tax authorities and courts will deal with this.

In Germany, section 25b.1 (2) UStAE (administrative guidelines to the VAT Act) currently precludes such treatment in Germany. The Federal Ministry of Finance only recognises intra-Community triangular transactions with more than three parties if the three parties supplying directly one after the other are at the end of the supply chain.

Author: Nadia Schulte