VAT Committee on single-purpose vouchers in distribution chains

Single-purpose vouchers in distribution chains

Background

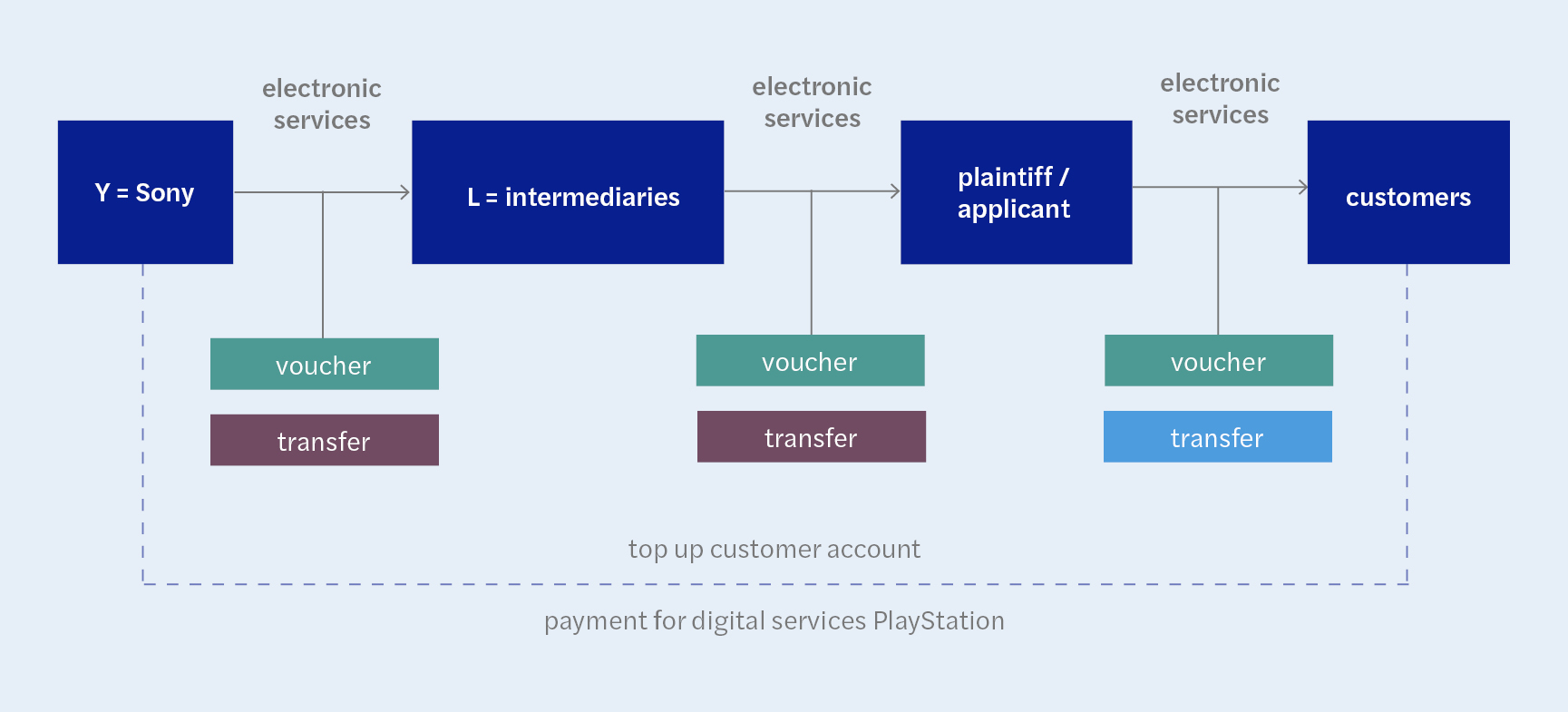

In the "Finanzamt O" case (C-68/23 of 18 April 2024), the plaintiff traded voucher codes (so-called PSN cards) issued by Sony in the UK. These enabled PlayStation customers to top up their customer accounts with Sony and purchase digital services with the credit. Sony transferred the voucher codes to intermediaries in various EU Member States. The intermediaries transferred the voucher codes to the plaintiff, who then distributed them to customers.

The question was whether this was a single-purpose or multi-purpose voucher. According to Article 30a (2) of the VAT Directive, a single-purpose voucher is a voucher for which the place of supply and the VAT due are already determined when the voucher is issued. According to Article 30b (1) of the VAT Directive, any transfer of the voucher in one's own name is then considered to be the performance of the supply offered with the voucher.

When referring the matter to the ECJ, the German Federal Fiscal court (BFH) implicitly assumed that, in a distribution chain, the place of supply for each supply relationship must be determined separately in accordance with the applicable rules for determining the place of supply. Since the recipients of the transfers (the intermediaries) were taxable persons, the place of supply was determined in accordance with Article 44 of the VAT Directive, based on their place of establishment. The problem was that the intermediaries involved were established in different Member States and that, when the PSN cards were issued, it was not clear to which intermediary they would be sold. Assuming that each transfer must be assessed according to the rules applicable to it, the place of supply of the transfers of the vouchers was therefore not clear.

The ECJ ruled that for a single-purpose voucher, only the place of supply to the end customer must be determined at the time of issue. This was the case because an electronically supplied service to a non-business customer pursuant to Article 58 of the VAT Directive is determined by the customer's place of residence and it was essentially ensured that vouchers with the identifier "DE" were only issued to German customers.

However, the ECJ did not expressly state that each transfer transaction must be assessed according to its own rules for determining the place of supply, so that this question was still considered to be in need of clarification.

Guidelines of the VAT Committee

In its Working Paper 1089 of 19 November 2024, the VAT Committee had already stated that the place of supply should always be determined by the circumstances of the specific supply relationship, in particular where the status of the recipient of the supply is decisive. Article 58 of the VAT Directive expressly applies only to non-taxable persons, so it should not be applied B2B. Accordingly, according to the guidelines from the 125th meeting published on 15 July 2025, the members decided almost unanimously that transfer transactions to taxable persons should be assessed in accordance with Article 44 of the VAT Directive if the supply offered in the voucher is a service within the meaning of Article 58 of the VAT Directive.

However, there are also conceivable scenarios in which the place of supply does not depend on the status of the recipient, e.g. in the case of services relating to immovable property, where the place of supply is determined by the location of the property, or in the case of supplies of goods without transport. The VAT Committee decided almost unanimously that in such cases, the place of supply to the end customer could also be applied to the transfers of the voucher. This is a matter to be decided on a case-by-case basis.

In addition, the VAT Committee explicitly deals with prepaid cards bearing the identification of an EU Member State in which electronic services are provided to end customers. If they meet the conditions for single-purpose vouchers at the time of issue, the VAT Committee is almost unanimous in its opinion that any transfer is to be regarded as the supply of the service offered on the voucher. It seems that this is only a clarification since this already follows from the ECJ ruling itself.

Practical impacts

The fiction of supply in the case of single-purpose vouchers only concerns the type of supply, but generally not the place of supply. This clarification is helpful in practice. However, cases in which the place of the supply offered in the voucher does not depend on the status (taxable person or not) of the recipient of the supply still require separate consideration.

The Federal Fiscal Court's follow-up decision on the Finanzamt O case is still pending. Since the Federal Fiscal Court already implicitly assumed in its referral that the place of supply of the transfers is governed by Article 44 of the VAT Directive and the guidelines of the VAT Committee now support this, we do not expect any surprises here.

However, it should be noted that the VAT Committee is only an advisory body whose guidelines are not binding on the Member States. It would be desirable for the Federal Ministry of Finance to (voluntarily) adapt the UStAE to the guidelines of the VAT Committee or to adopt the subsequent ruling of the Federal Fiscal Court if it is as expected.

Author: Nadia Schulte