Extended Enterprise Risk Management: Point of View

In today’s interconnected business landscape, organizations increasingly rely on a broad network of third parties—including suppliers, service providers, and technology partners—to drive operational efficiency and innovation.

While this extended enterprise model offers strategic advantages, it also introduces a complex web of risks that can impact an organization’s resilience, regulatory posture, and reputation.

According to a 2024 Gartner report, 60% of organizations work with over 1,000 third parties, and nearly 45% have experienced a third-party-related incident in the past two years.

Effective Third-Party Risk Management (TPRM) is essential to identify, assess, and mitigate these risks across key domains such as cybersecurity, data privacy, business continuity, and operational performance.

At Forvis Mazars, we help our customers strengthen their extended enterprise risk management by building pragmatic, scalable Third-Party Risk Management (TPRM) programs that align with global standards and enhance risk visibility.

“Managing third-party risks is critical as organizations expand their ecosystems, exposing themselves to cyber, privacy, continuity, and operational threats”.

At Forvis Mazars, we have outlined four key considerations essential for the success of a Third-Party Risk Management (TPRM) program.

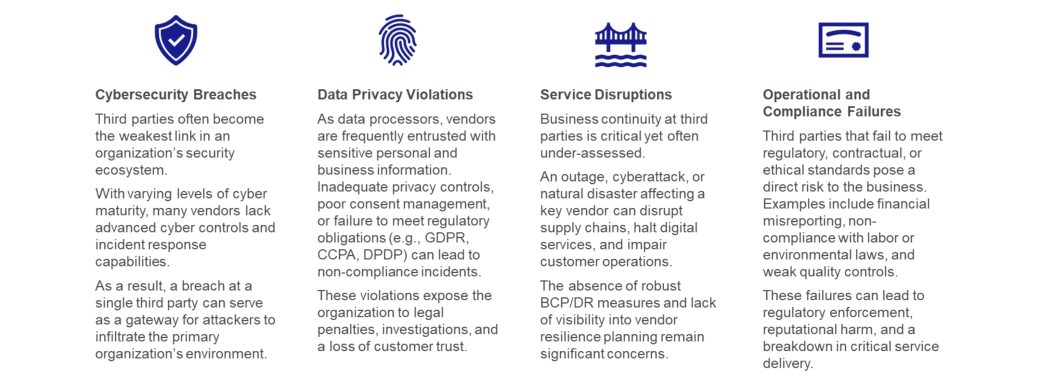

As organizations deepen their reliance on third parties, several critical risk areas emerge that can threaten business resilience, compliance, and trust.

At Forvis Mazars, we have identified four key risks that organizations must address to ensure a secure, resilient, and compliant third-party ecosystem.

In the future, Third-Party Risk Management will evolve into a seamless, integrated function that continuously adapts to changing business landscapes and emerging risks. Powered by AI, machine learning, and automation, TPRM will provide real-time visibility across the entire third-party ecosystem, enabling organizations to identify, assess, and mitigate risks proactively.

Vendor assessments will be dynamic, with predictive analytics driving decisions, and compliance will be automated, reducing manual oversight.

The future of TPRM will be highly collaborative, with businesses and vendors working together in a risk-aware partnership to ensure shared resilience.

“At Forvis Mazars, we believe that embracing these innovations will enable organizations to stay ahead of risk, create stronger vendor relationships, and drive sustainable business growth.”

Call to action:

1.Automate Third-Party Risk Management (TPRM) for real-time monitoring and proactive risk mitigation

Implement intelligent TPRM platforms that continuously assess vendor risks across cyber, operational, and compliance domains. Automation enables real-time threat detection, minimizes manual effort, and supports scalable risk management across a growing vendor base.

2.Strengthen vendor onboarding with dynamic assessments and continuous compliance checks

Transform onboarding into a risk-driven process by incorporating adaptive due diligence based on vendor criticality. Use automated workflows for collecting evidence, verifying certifications, and performing periodic control reviews throughout the vendor lifecycle.

3. Integrate TPRM into enterprise Governance, Risk, and Compliance (GRC) frameworks for holistic alignment

Embed TPRM into existing GRC structures to ensure third-party risks are evaluated in the context of overall enterprise objectives and regulatory requirements. Link TPRM controls and findings to broader compliance and audit mechanisms to enhance visibility and accountability.

4.Make TPRM a strategic business priority through organizational risk awareness

Promote a culture where third-party risk is recognized as a shared responsibility across functions. Drive awareness through training, leadership engagement, and cross-departmental coordination to embed TPRM into daily operations and strategic planning.

Want to know more?