The Boardroom leak: Forensic readiness against insider threats in deal-heavy sectors

The Boardroom, once considered the trust circle, has transformed. The way its proceedings and meetings are now conducted have seen a drastic shift. Thanks to the evolving regulatory landscape, the rules of engagement have been overhauled to give way to newer ways. With the change, threats pertaining to information leak have significantly increased.

Boardrooms are now threatened — not just from cyberattacks, but also from insiders with privileged access. Threats can originate from both outside cyber attackers and, alarmingly, from insiders with privileged access.

As Boardroom talks move from strategy to execution, leak risks intensify—demanding strong forensic readiness against insider threats.

Protecting insider information as a result of discussions in boardroom is critical and the need is driven by various reasons - regulatory mandates, contemplation of investors and maintaining public trust.

Sectors that play an important role in the economic growth and often prioritised in strategic deals are vulnerable to various threats. Access to confidential board-level discussions about restructuring, investment strategies, or deliberation on financing plans can tarnish not just organisation’s reputation but also disrupt investor confidence and economic continuity.

What is really happening?

Boardroom leak threats are escalating in deal-heavy sectors, where the foundation of success depends on confidentiality, strategic foresight, and maintaining a competitive edge. Mere a single incident of leakage of confidential information can compromise bidding strategies, reveal sensitive financial data, or expose future business plans, giving competitors an unfair advantage. Financial sensitivity, competitive edge and market volatility are top three reasons that propels us for protecting boardroom discussions. Let us look at these reasons in detail:

Boardroom discussions often cover sensitive topics such as mergers and acquisitions, restructuring plans, fund raising, management transitions, and responses to crises.

In 2021, the Securities and Exchange Board of India (SEBI) – the Indian market regulator – alleged that a director of a listed entity had shared unpublished price-sensitive information related to the acquisition of an entity prior to its official announcement. The incident triggered regulatory scrutiny and significantly undermined investor confidence, raising serious concerns around corporate governance practices. Similarly, disclosures regarding equity dilution, sources of funding, or whistleblower complaints discussed during board meeting, if made public, can have adverse implications for companies.

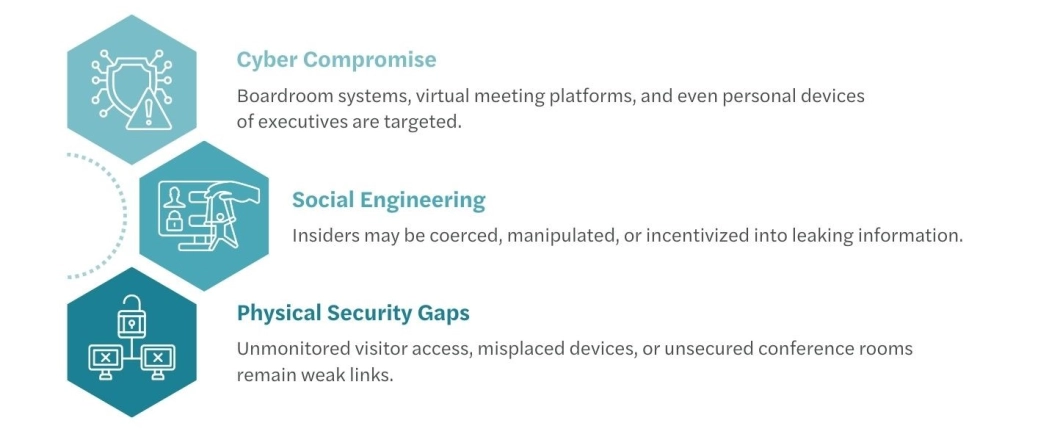

Predators are often seen as using sophisticated ways to get access to confidential discussions, threats evolved from Dictaphones to Digital Espionage. Gone are the days when physical recorders planted under tables posed the biggest risk. Today’s threats are far more sophisticated:

Situations wherein organisations taking up multiple rounds of due diligence, overlapping stakeholder engagement, financial reviews, pre-deal interactions can create ambiguity amongst employees and other stakeholders. This often leads to a desire for deeper insights beyond what is publicly disclosed, inadvertently creating opportunities to exploit confidential information.

It is possible to identify any potential boardroom leak in an organization prior to its occurrence:

In India, leaks of confidential information from boardrooms often fall outside the scope of mandatory reporting requirements, resulting in many such incidents going unreported. Nevertheless, companies are recognising the importance of investigating these breaches internally to identify weaknesses in governance practices.

The first step in addressing such leaks typically involves creating a robust incident response plan. This includes updating internal policies and procedures that will allow companies to initiate investigations, strengthening data protection protocols, and conducting thorough investigations to trace the source of the breach.

A lesson can be learned from a 2006 case involving an IT solutions Enterprise, which was entangled in a boardroom scandal after sensitive details about its acquisition strategy were leaked to the media—allegedly by one of its board members. In response, the Company hired a private investigative firm that employed questionable and potentially illegal tactics, including "pretexting"—impersonating individuals to obtain telephone records of board members.

The incident triggered regulatory scrutiny and led the company to disclose in a filing with the U.S. Securities and Exchange Commission (SEC) that it was cooperating with an official inquiry into the investigators’ conduct. The case remains a cautionary example of the need for ethical boundaries in internal investigations and reputational risks associated with lapses in corporate governance.

How can then organisations prepare themselves to protect, detect and respond to insider leaks before they cause irreversible damage?

Here are some measures:

As organisations grow more consequential and complex, the need to protect boardroom confidentiality has never been greater. Boardroom leaks not only jeopardize companies but can disrupt investor trust, impact public markets, and erode economic stability.

Forensic readiness is no longer a reactive approach — it is a core pillar of governance. Organizations that embed robust prevention, detection, and response mechanisms today will be better positioned to protect their integrity tomorrow.

Get in touch