Income-tax scrutiny on high-value expenses

Published in Business Standard | March 2025

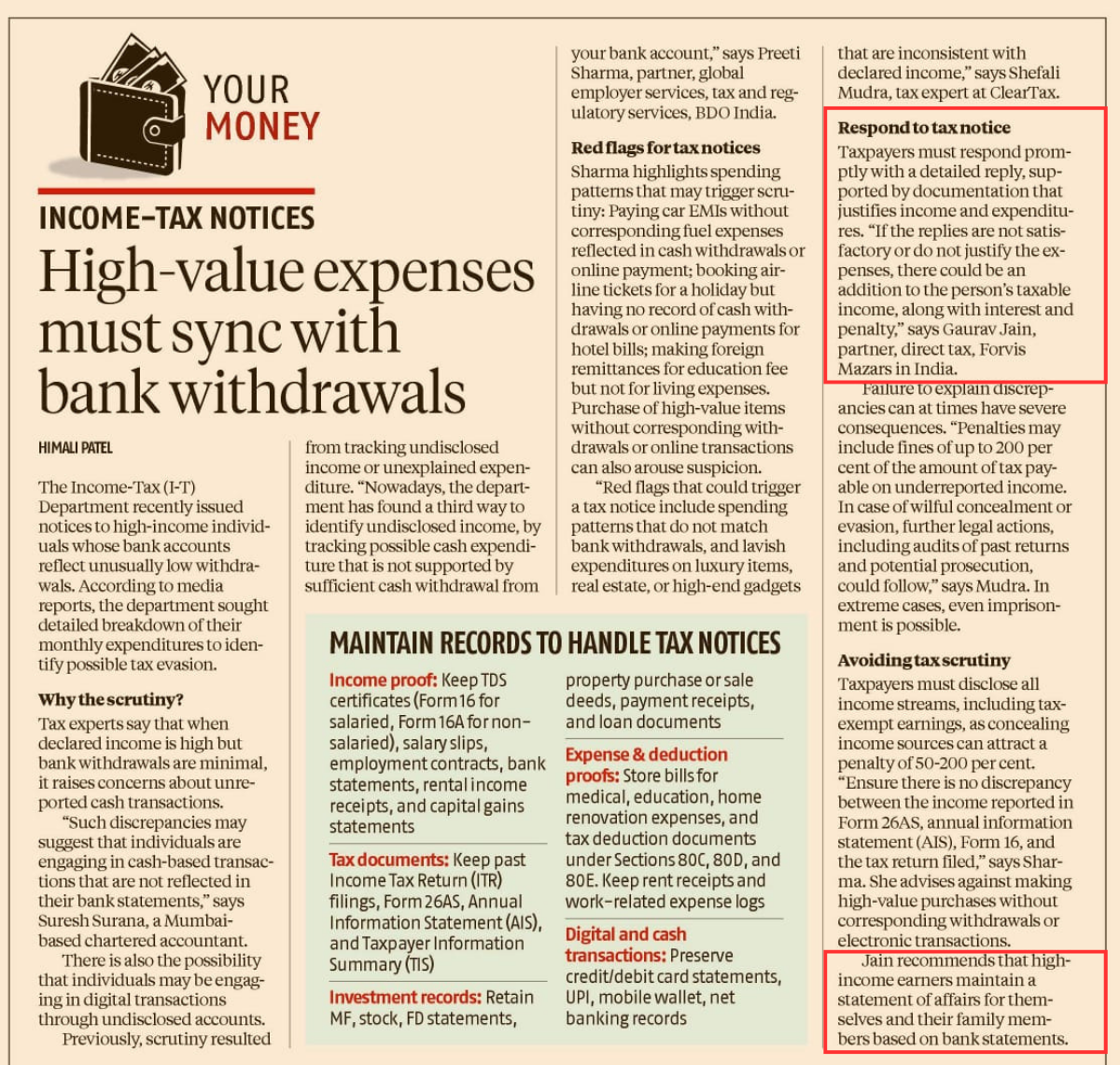

Gaurav Jain, Partner, Direct Tax, shared his insights with Business Standard on the recent Income-Tax notices issued to high-income individuals with unusually low bank withdrawals.

He said, "If the replies are not satisfactory or do not justify the expenses, there could be an addition to the person's taxable income, along with interest and penalty." He also advised high-income earners to maintain a statement of affairs for themselves and their family members.