IFRS 18 presentation and disclosure for insurers

IFRS 18 presentation and disclosure for insurers

For insurance companies, the Standard contains specific presentation requirements as well as some practical challenges. In the article below we answer some FAQs about the IFRS 18 application by insurers.

1. What insurers need to do to apply IFRS 18?

The key changes brought by IFRS 18 will require insurers to:

- Group income and expenses in the statement of profit and loss (PL) into 3 categories: operating, investing and financing, as well as adding 2 new subtotals: Operating profit and Profit before financing and Income tax.

- Provide additional disclosure on Management-defined performance measures (MPMs) including reconciliation to the line items of the PL.

Insurers will also need to revise some disaggregation and aggregation grouping, for example adding additional disclosure of expenses by nature.

2. What should insurers include within the operating category?

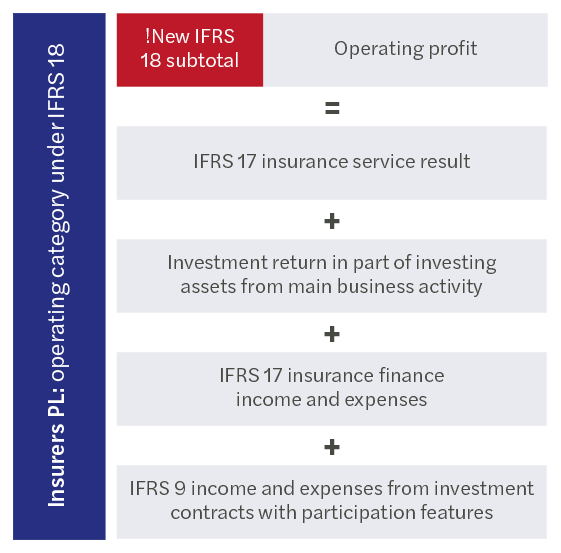

The operating category comprises income and expenses from all the main business activities. Along with the underwriting activity and claims handling, insurers invest in assets and incur insurance finance income and expenses as part of their main business activity. Therefore, for insurance companies operating profit subtotal will include:

- Income and expense from insurance contracts in scope of IFRS 17 (incl. insurance service result and insurance finance income and expenses).

- Income and expenses from investment contracts with direct participation features in scope of IFRS 9.

- Income and expenses from investing in financial assets as part of insurers’ main business activity.

3. What should insurers include within the investing category?

Insurance companies shall classify the following income and expenses as part of the investing category:

- Investments in associates, joint ventures and unconsolidated subsidiaries accounted for applying the equity method.

- Other assets generating a return independently from insurers’ main business activity, for example, rental income.

Insurers will exclude income and expenses from investing in financial assets as part of their main business activity and include it in operating profit. If as part of their main business activity insurers invest in associates, joint ventures and unconsolidated subsidiaries accounted for by applying the equity method they will need to classify income and expenses from these investments as investing category.

4. What should insurers include within the financing category?

Insurance companies shall classify as part of the financing category:

- Income and expenses from liabilities that arise from pure financing transactions, for example, a bank loan.

- Interest expenses on other liabilities (excluding insurance contracts liabilities or liabilities under investment contracts with participating features), for example, lease and pension liabilities.

Insurers will exclude insurance finance income and expenses from financing activity and include it in operating profit.

5. How will the new requirements on Management-defined performance measures impact insurers?

Previously IFRSs didn’t contain any requirement to reconcile alternative performance measures to the line items of the primary forms in the financial statements. IFRS 18 requires disclosing the management-defined performance measures (MPMs) in a separate note and a reconciliation to the closest subtotal ortotal in PL required by IFRS standards. Many UK insurers are already advanced in reconciling the alternative performance measures to the line items in the financial statements and, therefore can build up on the existing practice of reconciliations.

Introducing more prominence to the operating profit subtotal and the requirement to reconcile MPMs might change the insurers’ perspective on various performance measures that are linked to the operating profit, including adjusted operating profit that meets the MPM definition. Insurers’ operating profit will include the investment result that is often volatile making the operating profit volatile as well. The market response to this practical challenge is removing mark-to-market valuation results from the adjusted operating profit.

6. Expenses by nature vs by function: what are the new requirements for insurance expenses?

IFRS 17 requires insurers to present insurance service expenses by function. IFRS 18 will require to disclose in a single note: the amount of depreciation, amortisation, employee benefits and impairment losses included within insurance service expenses and other operating expenses. Under IAS 1 insurers already present a similar reconciliation, however, IFRS 18 requires this reconciliation to be more disaggregated presenting the split between insurance service expenses and other operating expenses for each type of ‘by nature’ expense.

Get in touch with our financial services experts

To speak to our experts about the IFRS 18 presentation and disclosures, get in touch using the form below.

Our Accounting technical services contact