The FCA proposes mandatory sustainability reporting rules from 1st January 2027

The FCA issued consultation paper (CP26/5) on 30th January 2026. This proposes to replace the TCFD reporting regime for commercial equity listed companies with reporting under the UK adopted versions of the ISSB’s standards S1 and S2. This will apply from 1/1/2027.

What’s the issue?

Commercial equity listed companies (but not investment trusts or companies which only list debt) are currently obliged to include a report on the impacts of climate change on their business under the TCFD framework. This framework is being replaced with the UK adopted version of the International Sustainability Standards Board’s (ISSB’s) standards S1 (general sustainability disclosure requirements) and S2 (climate-related disclosures). Though there will be some significant transitional exemptions to ease the burden of change, this will, over time, require a step up in the depth and breadth of sustainability reporting.

Background

The UK government and FCA have long been supporters of the ISSB’s standards, because they will create a global consistent benchmark for sustainability disclosures, and have committed to adopting its standards. The Government will publish the UK adopted versions of the ISSB’s standards in February. We expect the UK adopted version to make only small amendments to the standards in areas such as effective dates and transitional provisions preserving international consistency as far as possible.

What does this mean?

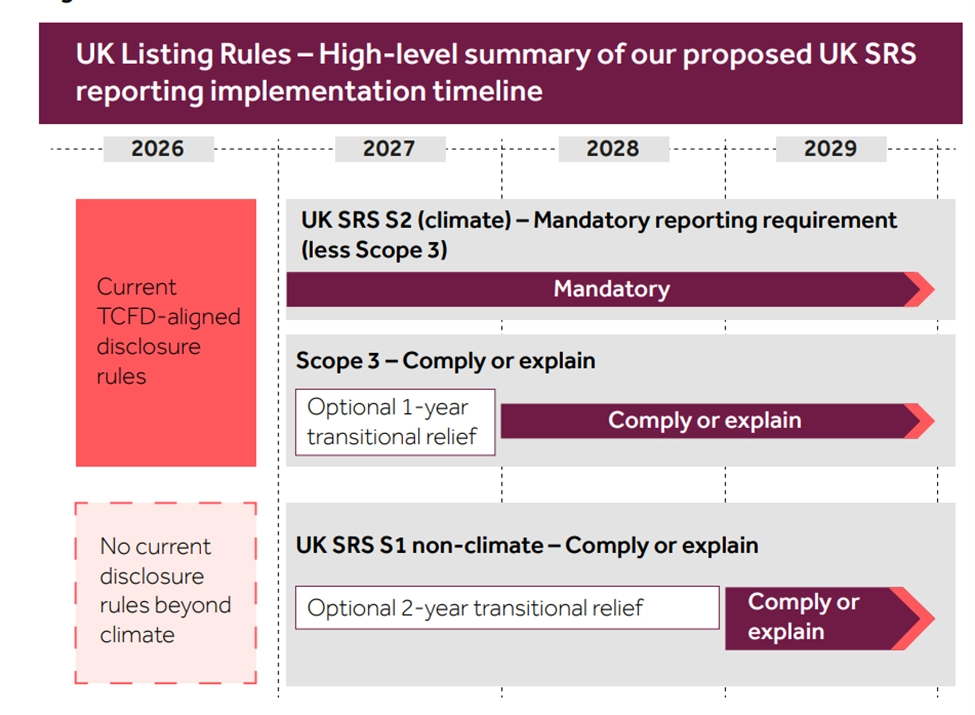

From years starting after 1st January 2027 listed companies will have to replace their current reporting under the TCFD framework with reporting under UK SRS S1 and UK SRS S2. This will initially focus on the requirements of S2, which covers climate reporting but bring in broader sustainability reporting under S1 over forthcoming years. Below is a diagram showing timelines.

The Government is currently digesting the responses to its Transition Plan consultation, and has not, at present, made producing a transition plan mandatory. The FCA are proposing though, that listed companies include a statement in their annual report explaining whether they have disclosed a climate-related transition plan, and where it can be found.

Who is it applicable to?

Principally commercial equity listed companies on the main exchange of the London Stock Exchange (but not investment trusts, companies which list only debt or those listed on AIM.

Where can I get more guidance?

We would expect the FCA and or FRC to issue more guidance in this area in due course. We also intend to post a brief summary of the areas in which S1 and S2 add to the existing TCFD requirements when the final version of UK adopted ISSB standards is available.