Over 50 financial services C-suite executives [1] from businesses with a turnover of at least £500 million found that AI adoption is primarily driven by short-term experimentation rather than strategic planning.

Despite all surveyed leaders feeling prepared for AI, the findings show that only 43% of businesses have a well-developed AI strategy, 31% have set clear objectives for its use, and over half (51%) have piloted AI solutions. While financial services firms are extremely confident in their AI readiness, it seems that many have not yet put in place the critical systems and strategies needed for its successful and sustainable implementation.

Financial services firms feel ready for AI

A striking 100% of survey respondents from the Financial Services sector report being ready for AI. This near-universal readiness underscores the critical role AI is expected to play in transforming financial services, driven by the need for enhanced efficiency, risk management, and customer experience.

-

100say they are ready for AI.

-

69expect they will start to realise the benefits of AI within 1 year.

-

51have experimented with AI pilot solutions.

Stronger foundations are required to implement AI effectively and safely

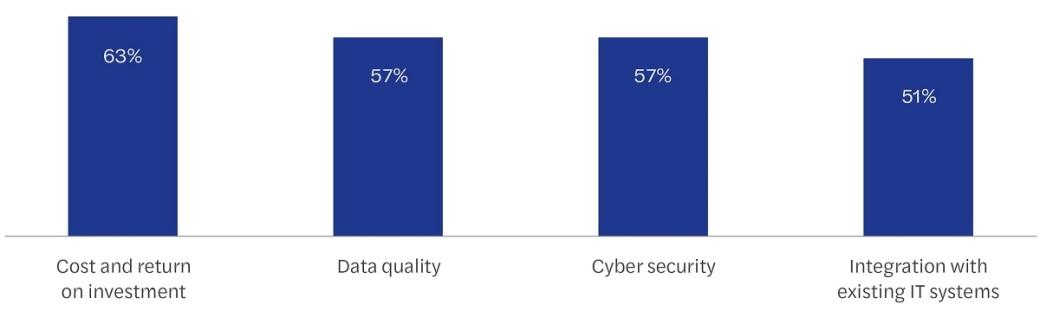

The rush to adopt AI technology often hinders businesses’ ability to build the necessary foundations for successful and safe implementation. For instance, only a quarter of business leaders are actively prioritising investment in data improvements, despite 57% ranking data quality as a top risk to AI adoption.

Barriers to AI adoption in financial services:

Financial services firms' growing focus on AI

Financial services firms are increasingly focusing on trialling AI across various key areas to enhance efficiency and drive innovation.

Key areas to enhance efficiency and drive innovation

- 57% of firms are experimenting with AI to streamline processes and improve accuracy.

- 49% of firms leverage AI to identify and attract top talent more effectively.

- 41% of firms are using AI to accelerate development cycles and improve software quality.

- 37% of firms aim to harness AI's capabilities to derive actionable insights from vast amounts of data.

Human analysis and sector expertise

-

76believe the success of AI depends on human analysis and insight.

-

57identify sector expertise as key to AI success.

The majority of financial services executives believe the success of AI depends on human analysis and insight. This reliance on human intelligence underscores the complexity of financial services and the ever-changing regulatory landscape, which underlines the need for skilled professionals to interpret AI-driven insights. However, just over half of financial services leaders identify sector expertise as key to AI success, suggesting a potential gap in recognising the value of specialised knowledge.

Financial services, like most industries, are still in the early stages of their AI journey. Despite leaders’ confidence, there is still a long road ahead before AI becomes a core part of their broader strategy.

To adopt AI effectively, businesses need a clear, top-down strategy with strong governance to manage investments and risks—whether cybersecurity, ethics, or sustainability. This also ensures responsible data use, protects consumers, and helps prevent companies from falling foul of the increasing legislation surrounding AI.

The financial services sector shows a strong readiness for AI adoption but faces unique challenges, particularly around data quality. Companies that integrate AI into their long-term strategic business plans will be best positioned to unlock its full potential and gain a competitive edge.

Foyaz Uddin

Head of Data and Digital Advisory

Get in touch with our financial services experts

To speak to our experts about AI readiness, implementation and risk management, get in touch using the button below.

Contact us today