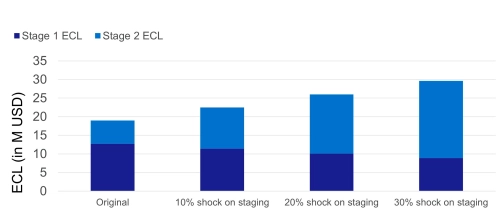

Direct impact - Staging shock

Institutions with high exposure to vulnerable sectors may face rapid Stage 1 to Stage 2 transitions under the SICR framework. The increase in ECL is non-linear due to lifetime provisioning. To assess this risk, we conducted 100,000 simulations, applying random staging shocks across representative corporate banking portfolios.

Our simulations show that even moderate staging shocks can lead to material increases in credit provisions. When just 10% of Stage 1 exposures are moved to Stage 2, total ECL rises by approximately 18%. At the 30% shock level, the increase reaches nearly 56%, with the Stage 2 provisions more than tripling compared to the original baseline. This disproportionate impact highlights the non-linear nature of staging effects: Stage 2 exposures require lifetime ECL, whereas Stage 1 exposures are limited to 12-month losses.

These results are particularly relevant today. Moody’s recently warned that global default rates could surge from under 5% to 8% - a 60% relative increase—if current credit market conditions continue.

For financial institutions, this reinforces the importance of early-stage risk detection, frequent stress testing, and proactive staging governance. Even before actual defaults materialize, the forward-looking nature of IFRS 9 can drive material provisioning changes, especially when geopolitical risks escalate suddenly.

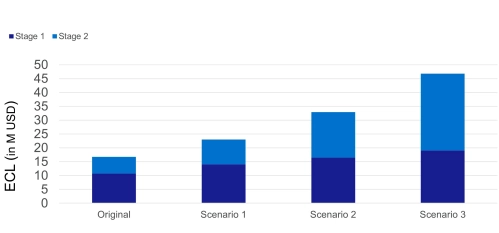

Indirect impact – Macroeconomic variable stress

Macroeconomic variables affect the forward-looking component of ECL models. We stressed exposures using scenario-driven shocks based on various market studies of tariff impacts on the economy. These macroeconomic shocks affected both model parameters (PD and LGD) and staging transitions.

We applied three distinct macroeconomic scenarios reflecting the progressive escalation of trade tensions:

Scenario 1: March 2025 tariffs - Sector-specific disruption, particularly in high-tariff industries such as metals, machinery, and electronics.

Scenario 2: April 2025 tariffs - A broader tariff shock across all imports, leading to general deterioration in economic outlook, employment, and inflation expectations.

Scenario 3: Further escalation – A hypothetical scenario assuming a further increase of tariffs on all major partners, significantly weakening GDP and increasing financial market stress.

Each scenario was translated into macroeconomic variable assumptions, which were then propagated through ECL models. The analysis measured the impact relative to the baseline, i.e. comparing the stressed results to the initial (unweighted) baseline scenario.

The results reveal a compounding effect of the increase in Stage 2 ECL and a worsening of model parameters, amplifying ECL without explicitly changing borrower-level creditworthiness.

These results underscore the importance of assessing both direct and indirect impacts within credit risk frameworks. While direct sectoral shocks may appear more immediate, changes in macroeconomic variables can have far-reaching and compounding effects across portfolios. A robust approach to scenario design and stress testing should consider a broad range of transmission channels to ensure resilience under evolving economic conditions.

Conclusion

"There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don't know. But there are also unknown unknowns. There are things we don't know we don't know."

Donald Rumsfeld

As we navigate through a new era of economic instability, financial institutions must prepare for conditions that few would have anticipated even months ago. The rapid escalation of tariffs, the breakdown of major trading relationships, and the emergence of stagflationary forces are reshaping credit and market risk dynamics across sectors and geographies.

In this context, risk models and scenario frameworks must evolve quickly and proactively. Institutions must broaden their field of vision and stress not only the obvious vulnerabilities but also the second- and third-order effects coming from the interlinks of global dependencies.

Forward-looking credit modelling was designed to anticipate stress before it materializes. This can only succeed when inputs and scenarios are revisited in real-time. Institutions should consider scenarios in creative ways to capture unconventional risks (trying to address potential unknown unknowns).

The current environment requires proactivity, agility, and close alignment between credit risk teams, economists, and senior management. Institutions that wait for clarity may find themselves reacting too late.

Get in touch with our financial services specialists

To speak to one of our banking experts, get in touch below.