Monthly insolvency statistics – April 2025

Monthly insolvency statistics – April 2025

Corporate Insolvencies

England and Wales

Corporate insolvencies totalled 2,053 in April 2025, 5% lower than April 2024.

A continuing trend of a reduction in insolvency appointments when compared to the same month in prior years. However, It should be noted that there is a continuing trend of comparatively higher volumes of Winding Up orders being made.

While Administrations are lower this month there have been a number of CVAs showing a desire of company directors to try a solvent solution over a sale/closure type of process.

Creditors Voluntary Liquidations (“CVLs”) totalled 1,544, 10% lower than April 2024.

Compulsory Liquidations (“WUCs”) totalled 379, 33% higher than April 2024

There were 105 Administration appointments which was 30% lower than April 2024.

There were 24 Company Voluntary Arrangements (“CVA”s) in April 2025, 33% higher than April 2024.

Scotland

In April 2025 there were 101 company insolvencies registered in Scotland, 7% lower than April 2024. There were 51 Compulsory Liquidations, 47 CVLs and 3 Administrations. There were no Receivership or CVA appointments.

Northern Ireland

In April 2025 there were 30 company insolvencies registered in Northern Ireland, 9% lower than April 2024. This is comprised of 11 CVLs, 14 Compulsory Liquidations, two Administrations and three CVAs. There were no receivership.

Personal Insolvencies

England and Wales

There were 10,012 individual insolvencies in April 2025, which was 4% higher than April 2024 and 8% higher than the numbers seen last month (9,586).

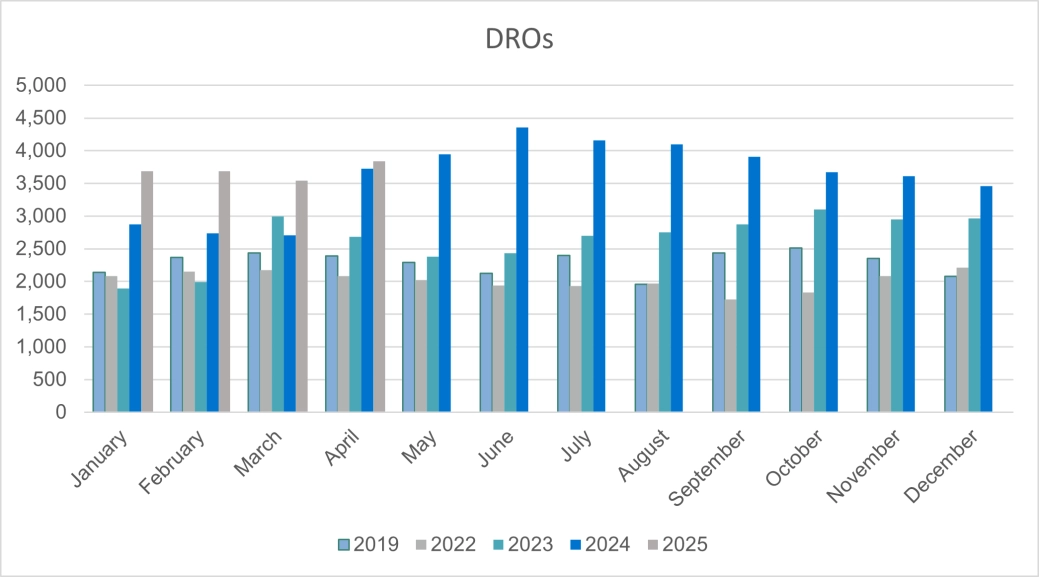

The number of Debt Relief Orders (DRO’s) was very similar to the numbers seen last month (3,544), although lower than the record high seen in June 2024 (4,353) with 3,837 applications in April.

With DRO’s now increasingly being the debt solution of choice for many, bankruptcy numbers have decreased, with the total number of bankruptcies in April (589), being notably lower than the 2024 monthly average (634), and significantly lower than pre-pandemic levels.

In April there were 143 creditor petitions, which was down on the 2024 monthly average of 153, with HMRC leading the push on filing petitions.

Debtors’ applications are being replaced by DRO applications by many of those with liabilities up to £50,000, with debtors’ bankruptcy applications dropping to 446 April, compared to 517 in the same month last year.

Individual Voluntary Arrangements (IVA) numbers over the past year have been significantly lower than during 2022. The number of IVA’s registered in April (5,586) was 7% higher than the same month last year (5,197) and slightly higher than the numbers seen last month (5,113).

There were 7,273 Breathing Space (BS) registrations in April, a notable decrease from registrations last month (8,033). Standard BS registrations stood at 7,170 and there were 103 Mental Health BS registrations.

The numbers indicate a slight pause in the steady increase in BS applications since their introduction, although, this procedure is merely a pause in the process and the individuals concerned will still have to deal with their indebtedness.

The numbers suggest that those exiting a BS application are being sign-posted to a DRO as their chosen exit route once the BS period had expired.

Plans to modernise the current Personal Insolvency framework could result in a single gateway to enable people to access independent, regulated debt advice, via a digital platform, or dovetailed with the current BS scheme, which may see the removal of previous barriers into appropriate and regulated insolvency procedures.

Scotland

The Accountant in Bankruptcy produces individual insolvency statistics on a quarterly basis. Therefore, the numbers in this section are only updated once every 3 months.

The quarters referred to are calendar year quarters, such that Q1 2025 covers the period 1 January to 31 March 2025. In Q1 2025, there were 1,673 individual insolvencies in Scotland, which was 11% lower than in the same quarter of 2024.

The individual insolvencies were comprised of 1,078 protected trust deeds and 595 bankruptcies (also known as sequestrations), of which 299 went into bankruptcy via the minimal asset process route. The rules regarding bankruptcy differ to those in England and Wales, so numbers of bankruptcies are not directly comparable.

Northern Ireland

In April 2025, there were 123 individual insolvencies in Northern Ireland. This was 10% higher than in April 2024. There were 95 IVAs, 16 bankruptcies and 12 DROs.