Monthly insolvency statistics – December 2024

Monthly insolvency statistics – December 2024

Corporate Insolvencies

England and Wales

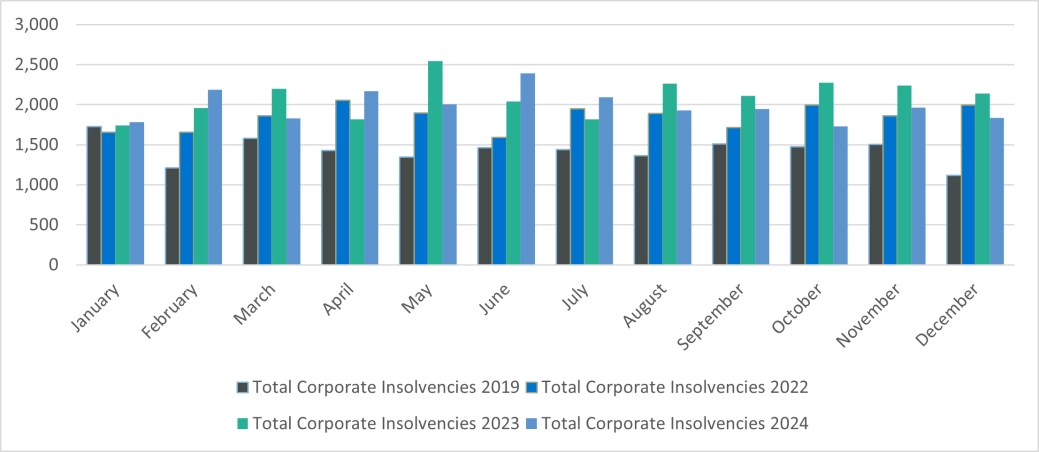

There were 1,291 fewer corporate insolvencies in 2024 than 2023. This may have been as a result of concentration shifting to the Election and subsequent Budget - however with a total of 23,871 procedures it was still the highest for 8 of the past 9 years.

In December 2024, there were 1,838 corporate insolvencies, 14% lower than December 2023.

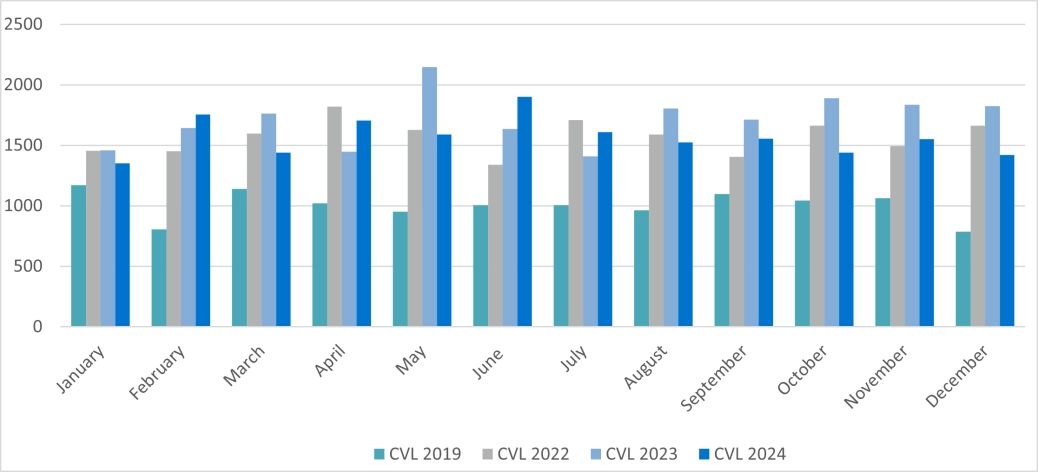

The biggest comparative reduction was for Creditors Voluntary Liquidations (“CVLs”) which totalled 1,421, 22% lower than December 2023.

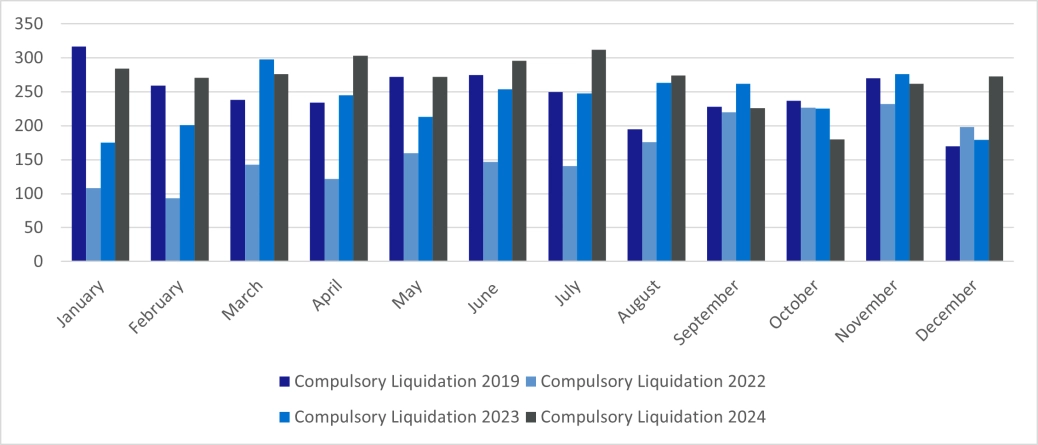

Compulsory Liquidations (“WUCs”) totalled 273 and were 53% higher than December 2023.

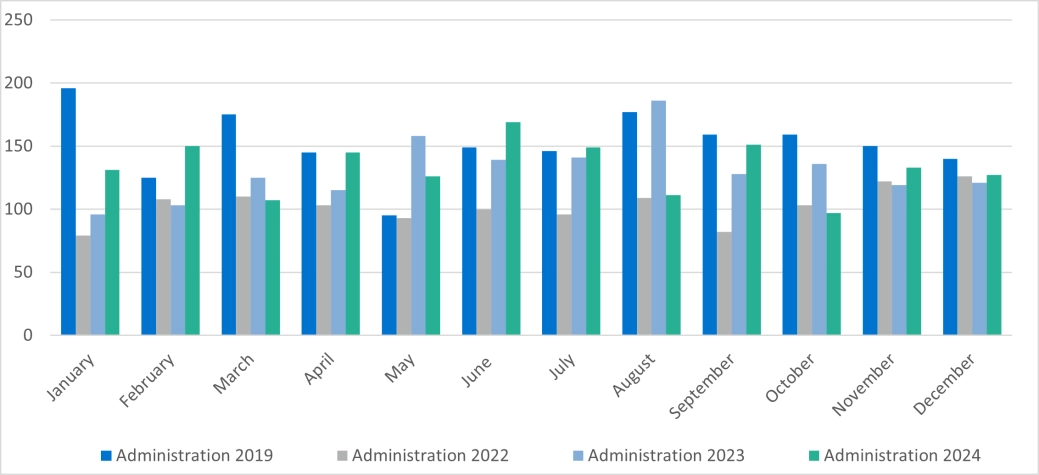

There were 127 Administration appointments being 5% higher than December 2023.

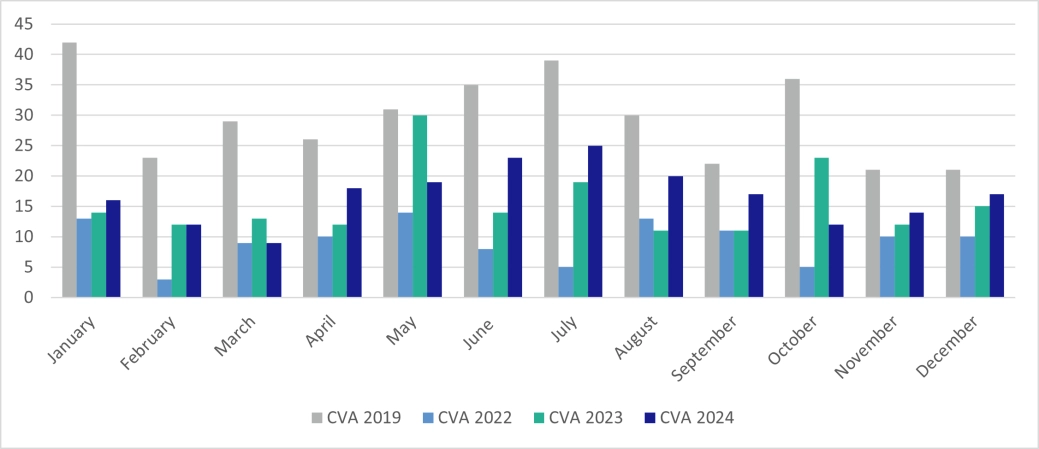

There were 17 CVAs in December 2024, 13% higher than December 2023.

Scotland

The statistics showed the same trend in Scotland for December 2024 where there were 82 company insolvencies registered, 24% lower than December 2023. There were 27 compulsory liquidations, 52 CVLs and three administrations. There were no Receivership or CVA appointments.

Northern Ireland

In December 2024, there were 23 company insolvencies registered in Northern Ireland, 4% lower than December 2023. This was comprised of 17 CVLs, four compulsory liquidations, one administration and one CVA. There were no receivership appointments.

Personal Insolvencies

England and Wales

There were 10,050 individual insolvencies in December 2024, which was 23% higher than December 2023 (8,141) and very similar to the numbers seen last month (10,036).

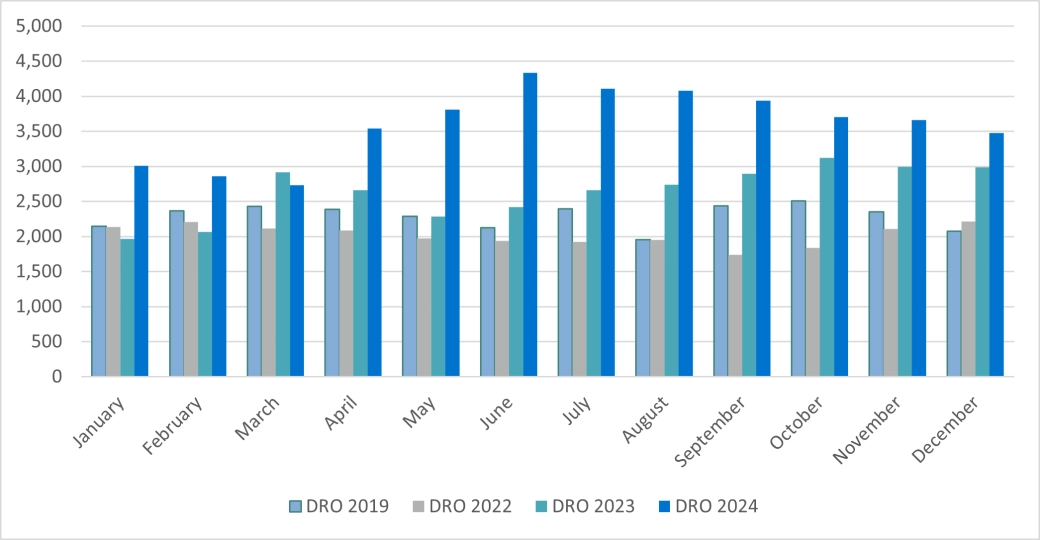

The number of Debt Relief Orders (DRO’s) was 5% lower than the number seen last month (3,659), although significantly lower than the record high seen in June 2024 (4,353) with 3,473 applications in December.

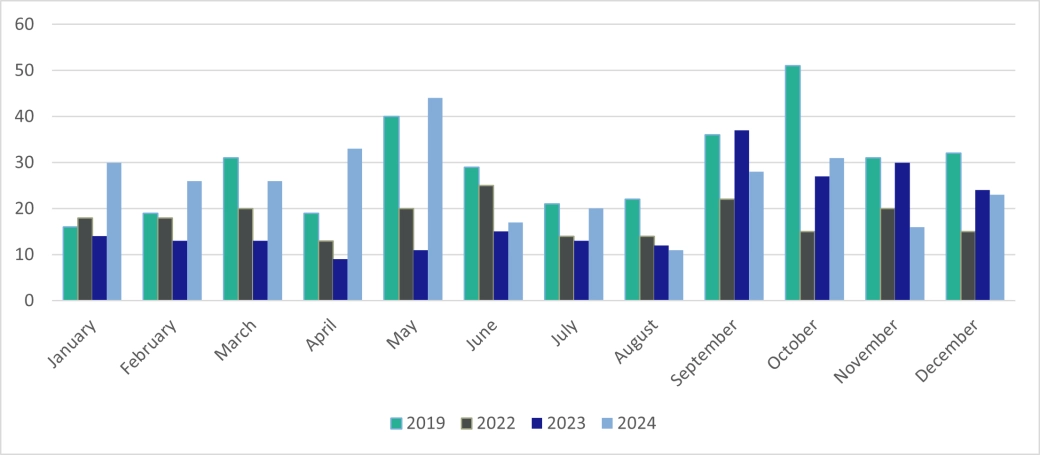

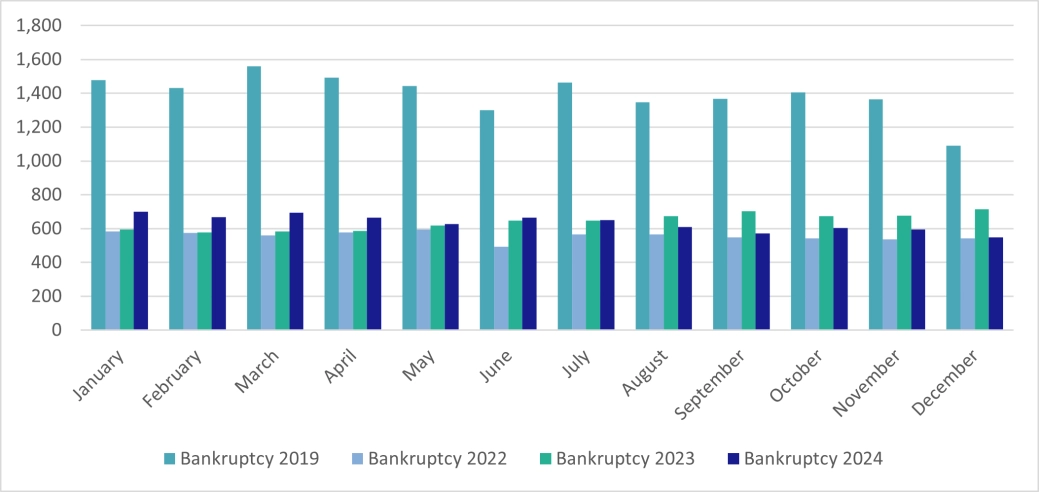

With DRO’s now increasingly being the debt solution of choice for many, bankruptcy numbers have decreased, with the total number of bankruptcies in December (549), being notably lower than the last 12-month average (647), and still significantly lower than pre-covid levels.

In December there were 120 creditor petitions, with HMRC leading the push on filing petitions, showing a notable decrease on the previous 12-month average of 155.

Debtor’s applications are being replaced by DRO applications by many of those with liabilities between £30,000 and £50,000. The numbers are beginning to reflect this, with debtor’s bankruptcy applications dropping to 429 in December, compared to 552 in the same month last year.

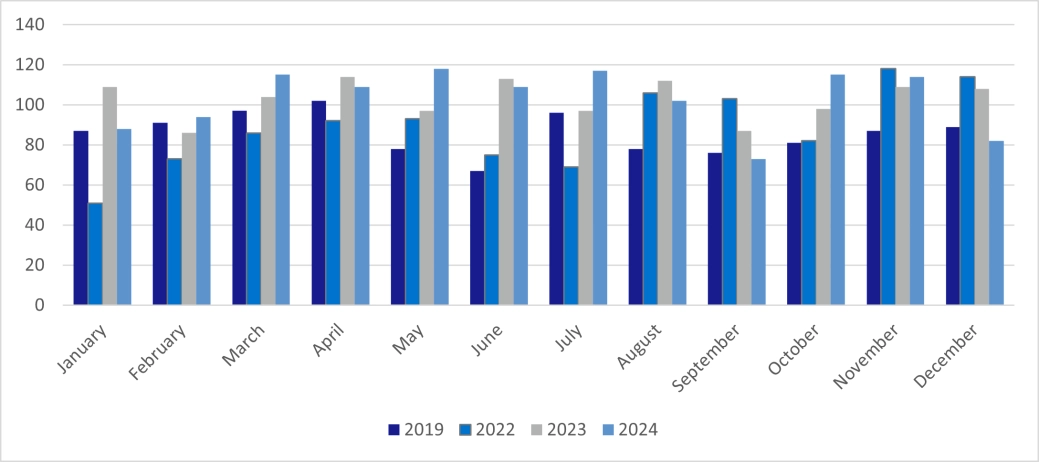

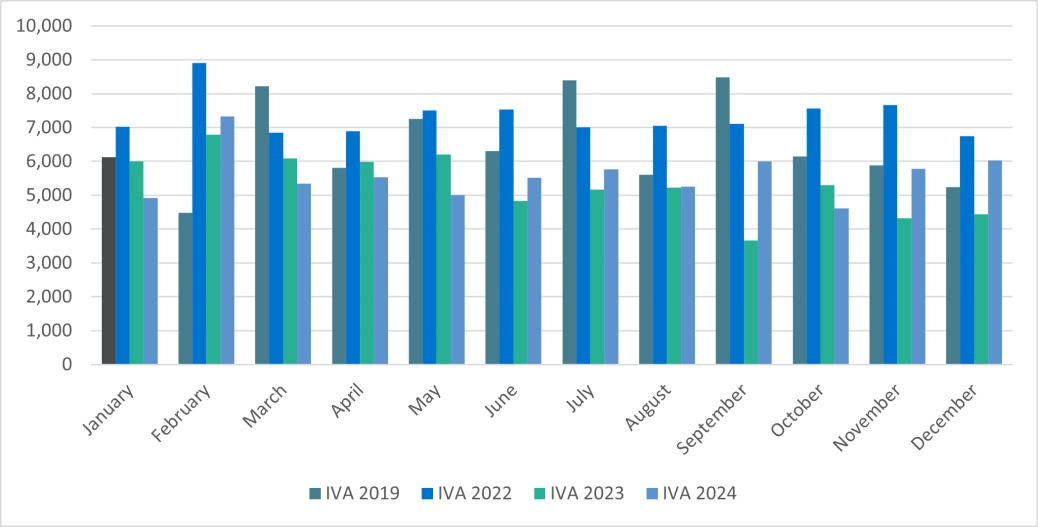

Individual Voluntary Arrangements (IVA) numbers over the past year have been significantly lower than during 2022. The number of IVA’s registered in December (6,028) was higher than the average monthly number seen over the last 12 months (5,459). This month’s figure was 36% higher than December 2023 (4,437) and 4% higher than the previous month (5,781).

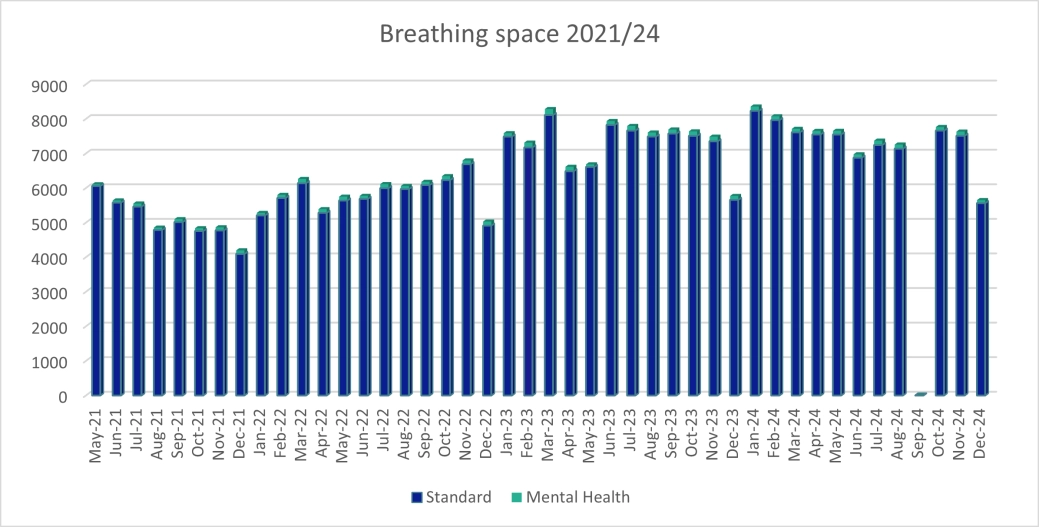

There were 5,650 Breathing Space (BS) registrations in December, which was roughly the same as this month last year (5,769). Standard BS registrations stood at 5,563 and there were 87 mental health BS registrations.

The numbers continue to indicate that BS applications have levelled out, although, this procedure is merely a pause in the process and the individuals concerned will still have to deal with their indebtedness.

The numbers suggest that those exiting a BS application are being sign-posted to a DRO as their chosen exit route once the BS period has expired.

Plans to modernise the current Personal Insolvency framework could result in a single gateway to enable people to access independent, regulated debt advice, via a digital platform, or dovetailed with the current BS scheme, which may see the removal of previous barriers into appropriate and regulated insolvency procedures.

Scotland

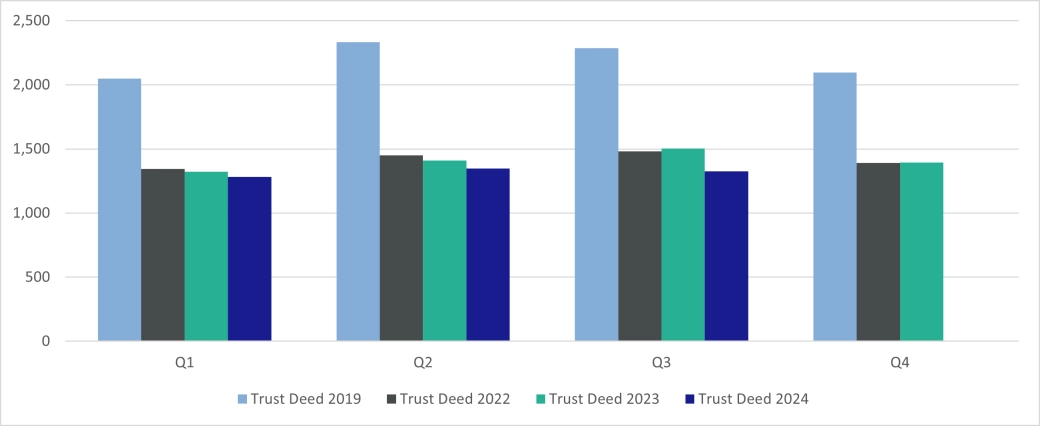

The Accountant in Bankruptcy produces individual insolvency statistics on a quarterly basis. Therefore, the numbers in this section are only updated once every 3 months.

In Q3 2024, the individual insolvencies were comprised of 1,327 protected trust deeds and 564 bankruptcies (also known as sequestration), of which 299 went into bankruptcy via the minimal asset process route. The rules regarding bankruptcy differ to these in England and Wales, so numbers of bankruptcies are not directly comparable.

Northern Ireland

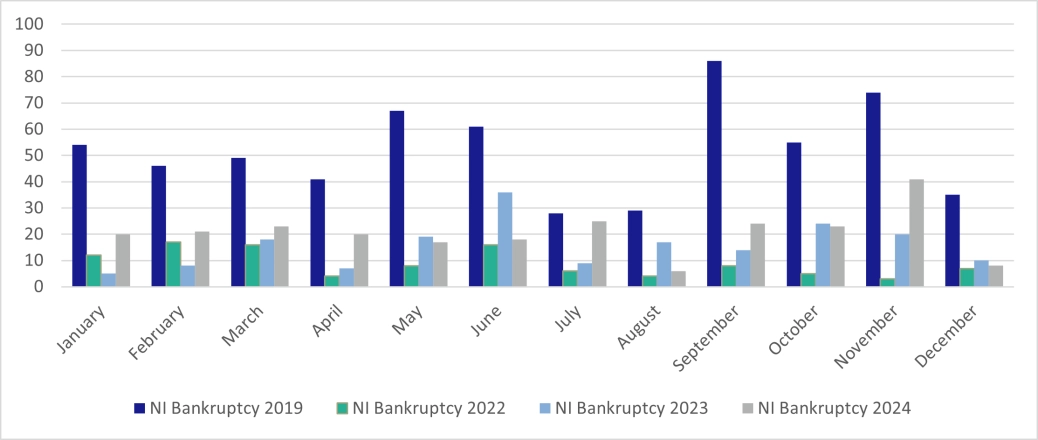

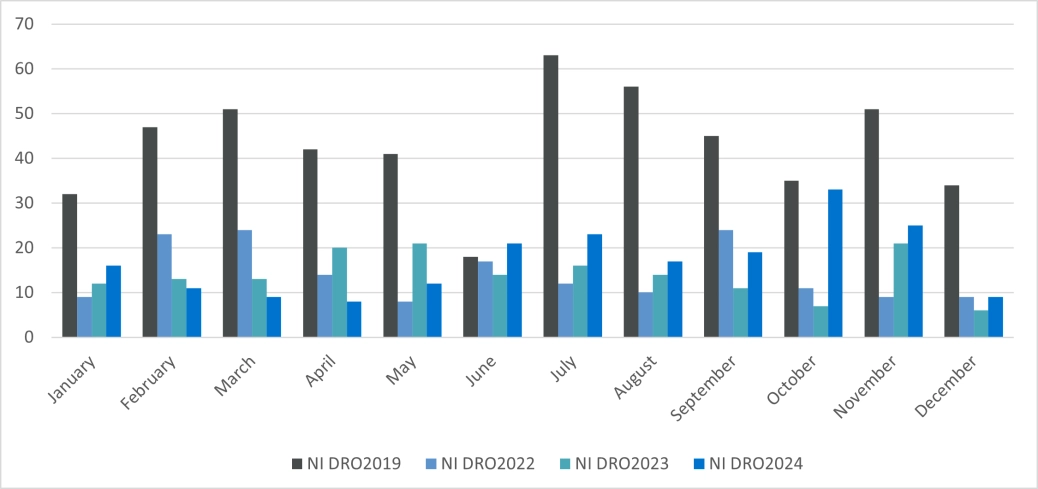

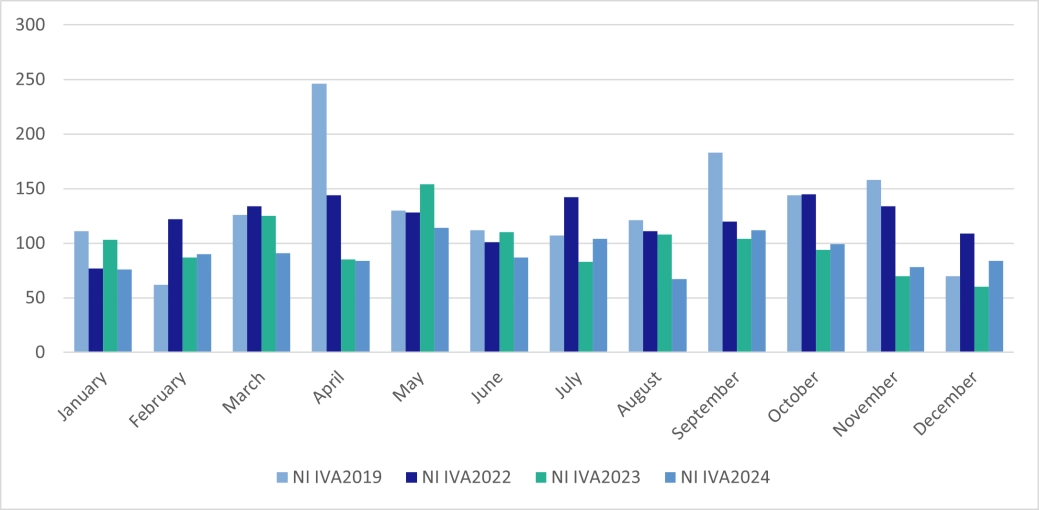

In December 2024, there were 101 individual insolvencies in Northern Ireland. This was 33% higher than in December 2023. There were 84 IVAs, eight bankruptcies and nine DROs.