Monthly insolvency statistics – January 2025

Monthly insolvency statistics – January 2025

Corporate Insolvencies

England and Wales

The last 3 months of 2024 showed lower levels of corporate insolvencies than when compared with similar months in 2023.

January 2025 has started to reverse that trend with an 11% increase over the same month in 2024. There were a total of 1,971 corporate insolvencies.

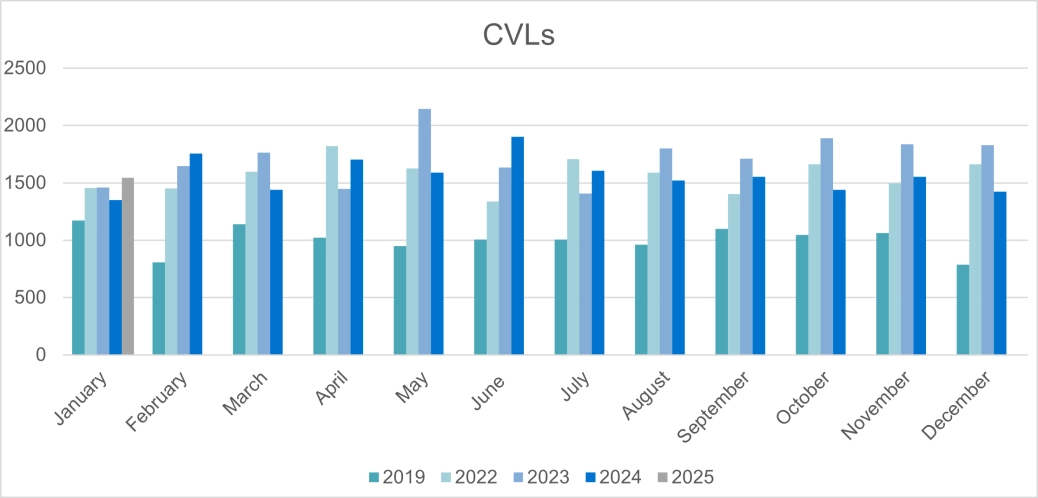

Creditors Voluntary Liquidations (“CVLs”) totalled 1,546, 14% higher than January 2024. CVLs continue to be the most used corporate procedure averaging 1,506 per month for the last 6 months.

Compulsory Liquidations (“WUCs”) totalled 269 and were 5% lower than January 2024. Compulsory Liquidations have increased from a total of 1,969 in 2022, 2,838 in 2023 to 3,238 in 2024.

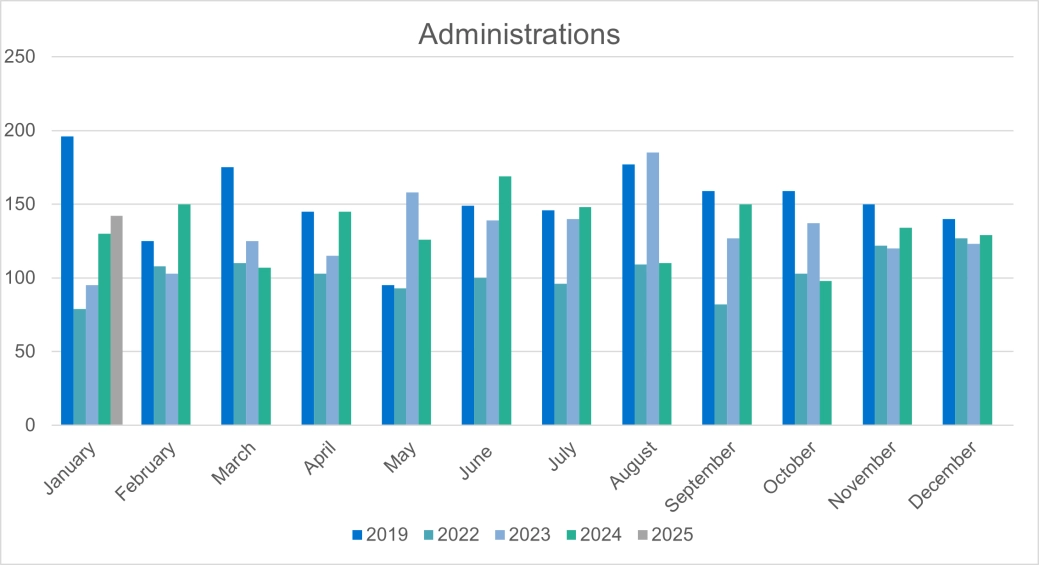

There were 142 Administration appointments which was 9% higher than January 2024. Administrations have averaged 132 monthly appointments over the 2 year period.

There were 14 CVAs in January 2024, 13% lower than January 2024.

Scotland

The statistics in Scotland showed a decrease in appointments for January 2025 where there were 75 company insolvencies registered in Scotland, 15% lower than January 2024. There were 32 Compulsory Liquidations, 37 CVLs and 6 Administrations. There were no Receivership or CVA appointments.

Northern Ireland

In January 2025 there were 28 company insolvencies registered in Northern Ireland, 7% lower than January 2024. This is comprised of 10 CVLs, 15 Compulsory Liquidations and 3 Administrations. There were no receiverships or CVAs.

Personal Insolvencies

England and Wales

There were 9,706 individual insolvencies in January 2025, which was 12% higher than January 2024 and slightly lower than the numbers seen last month (10,045).

The number of Debt Relief Orders (DRO’s) was 10% higher than the number seen last month, although significantly lower than the record high seen in June 2024 (4,353) with 3,847 applications in January.

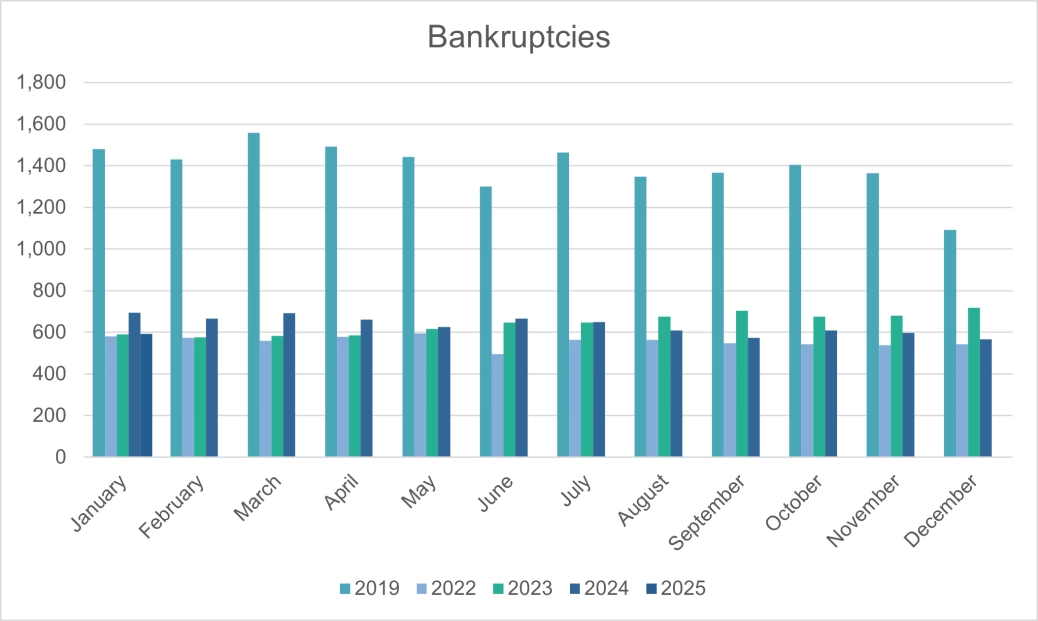

With DRO’s now increasingly being the debt solution of choice for many, bankruptcy numbers have decreased, with the total number of bankruptcies in January (592), being lower than the 2024 monthly average (634), and still significantly lower than pre-pandemic levels.

However, in January there were 169 creditor petitions, showing an increase on the 2024 monthly average of 153, with HMRC leading the push on filing petitions.

Debtors’ applications are being replaced by DRO applications by many of those with liabilities up to £50,000, with debtors’ bankruptcy applications dropping to 423 in January, compared to 545 in the same month last year.

Individual Voluntary Arrangements (IVA) numbers over the past year have been significantly lower than during 2022. The number of IVA’s registered in January was 5% higher than the same month last year (5,037) but notably lower than the numbers seen last month (5,970).

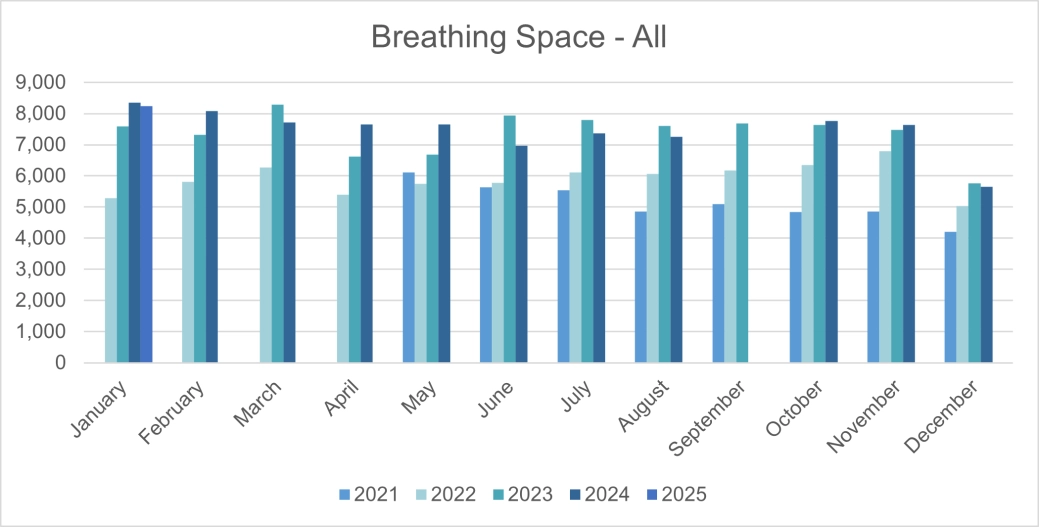

There were 8,240 Breathing Space (BS) registrations in January, a significant increase from registrations last month (5,649). Standard BS registrations stood at 8,150 and there were 90 Mental Health BS registrations.

The numbers continue to indicate a steady rise in BS applications since their introduction, although, this procedure is merely a pause in the process and the individuals concerned will still have to deal with their indebtedness.

The numbers suggest that those exiting a BS application are being sign-posted to a DRO as their chosen exit route once the BS period had expired.

Plans to modernise the current Personal Insolvency framework could result in a single gateway to enable people to access independent, regulated debt advice, via a digital platform, or dovetailed with the current BS scheme, which may see the removal of previous barriers into appropriate and regulated insolvency procedures.

Scotland

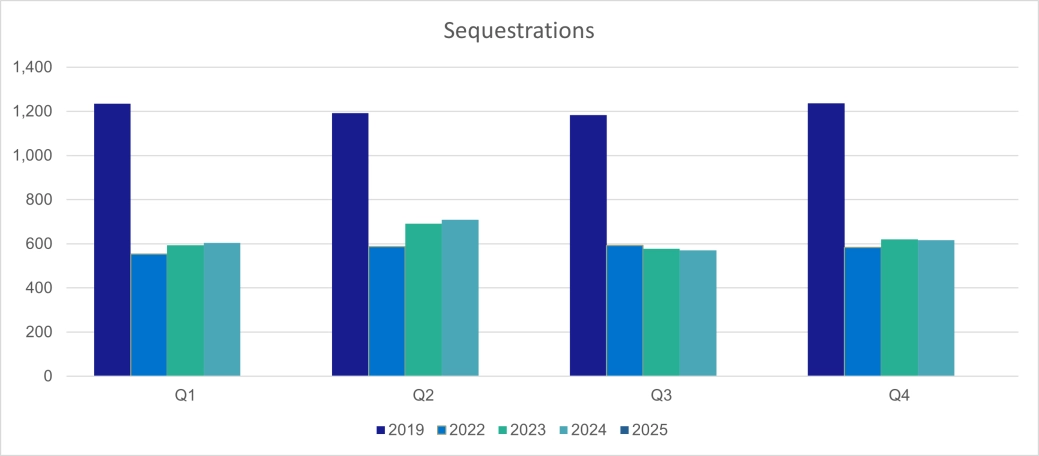

The Accountant in Bankruptcy produces individual insolvency statistics on a quarterly basis. Therefore, the numbers in this section are only updated once every 3 months.

The quarters referred to are calendar year quarters, such that Q4 2024 covers the period 01 October to 31 December 2024. In Q4 2024, there were 1,784 individual insolvencies in Scotland, which was lower than in the same quarter of 2023.

The individual insolvencies were comprised of 1,167 protected trust deeds and 617 bankruptcies (also known as sequestrations), of which 342 went into bankruptcy via the minimal asset process route. The rules regarding bankruptcy differ to those in England and Wales, so numbers of bankruptcies are not directly comparable.

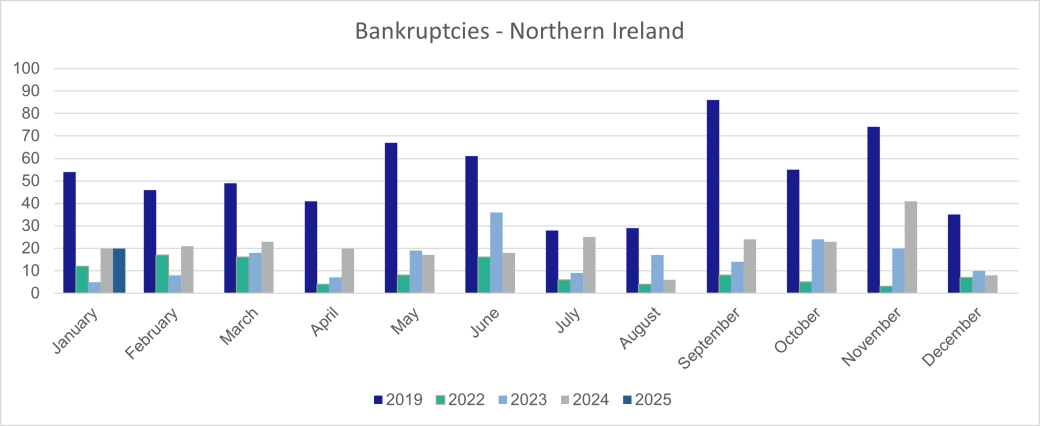

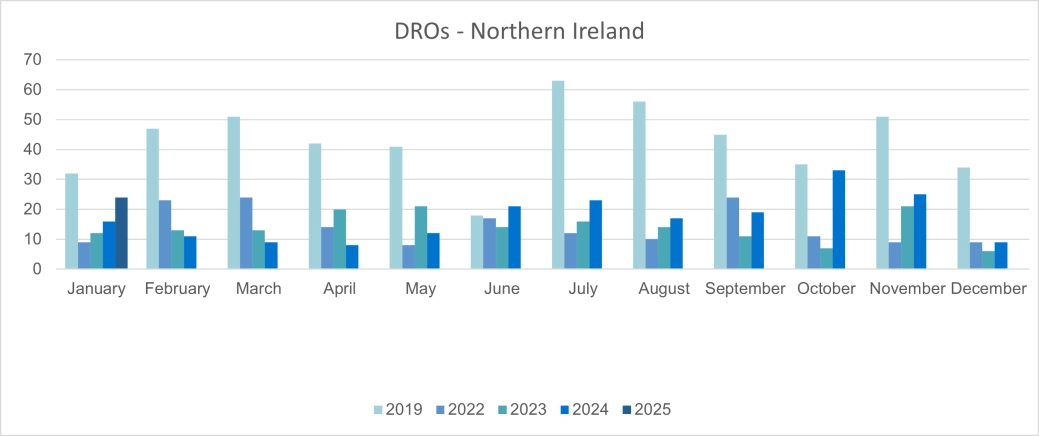

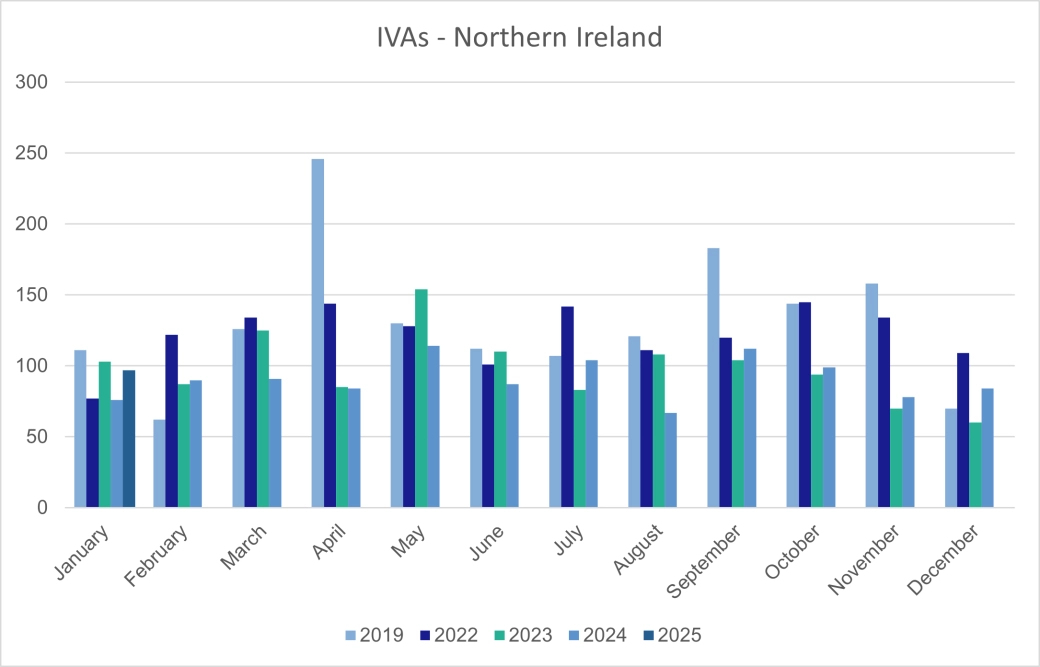

Northern Ireland

In January 2025, there were 141 individual insolvencies in Northern Ireland. This was 26% higher than in January 2024. There were 97 IVAs, 20 bankruptcies and 24 DROs.