Monthly insolvency statistics – November 2025

Monthly insolvency statistics – November 2025

Corporate Insolvencies

England and Wales

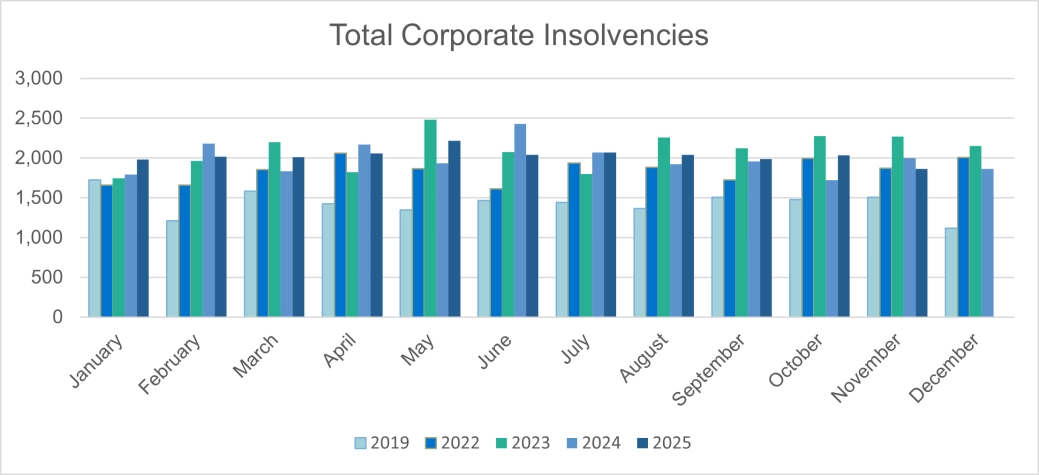

Company insolvencies in November 2025 numbered 1,866, a 7% drop on the previous month, which is interesting as numbers had been trending consistently at circa. 2,050 company insolvencies each month for the first 10 months of the year. Whether this is the beginning of a downward trend remains to be seen; other explanations are possible including the widespread near paralysis of decision making caused by budget speculation. As we come towards the end of the year, the insolvency market - anecdotally - does feel a little quieter.

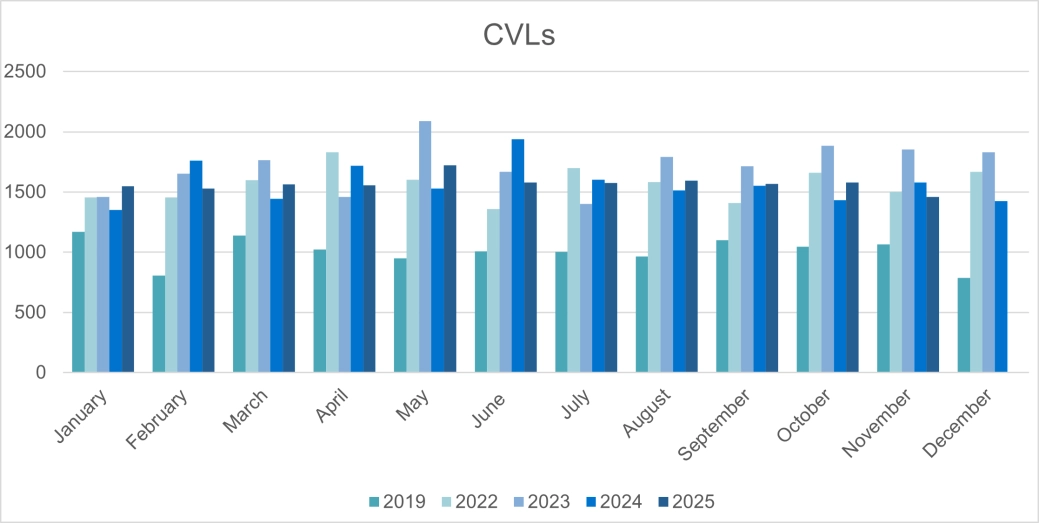

Creditors voluntary liquidations (CVLs) had decreased also, November being the first month that they dipped below 1,500 cases to 1,461 cases (10-month average to October was 1,581 CVLs). Overall, the number of CVLs in 2025 has been similar to 2024, which is below the peak of 2023.

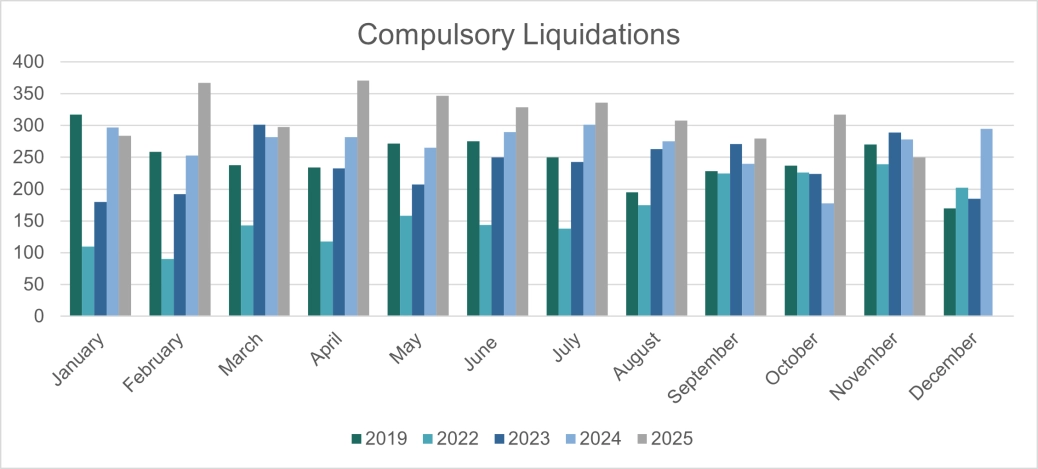

The number of compulsory liquidations in November 2025 was 21% lower than in October 2025 and 10% lower than in November 2024. In 2025 so far, the average monthly number of compulsory liquidations is 17% higher than the 2024 monthly average.

In 2024, compulsory liquidations were at the highest levels since 2014, having increased by 14% compared to 2023 volumes. This continued an increase from record low levels seen in 2020 and 2021, while restrictions applied to the use of statutory demands and certain winding-up petitions (leading to compulsory liquidations).

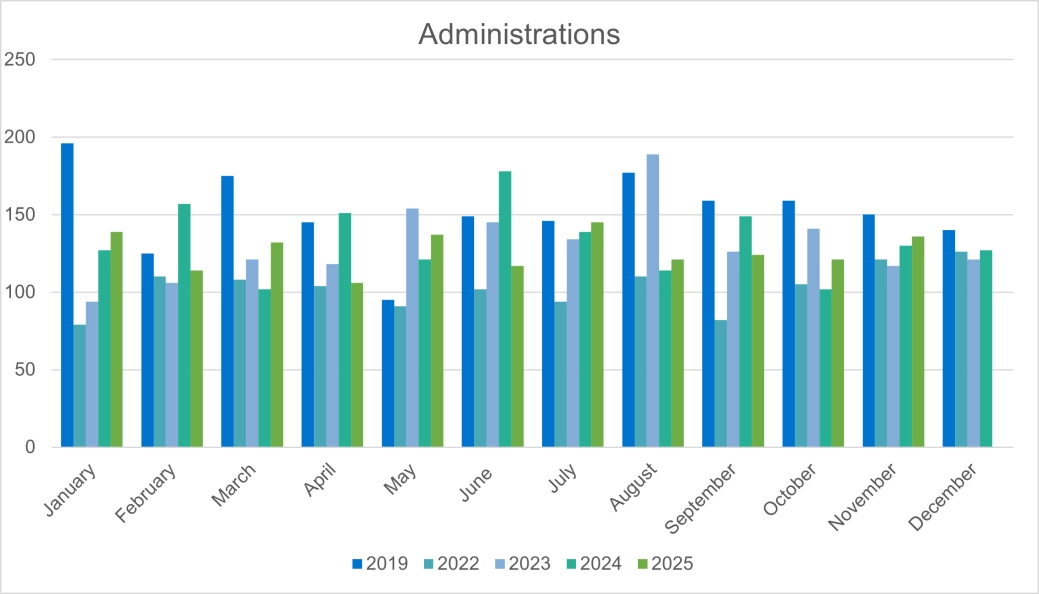

There was an increase in Administrations, the “rescue” process. 136 Administrations was a 12% increase over October, and October was in line with the previous couple of months. As tempting as it is, drawing any conclusions from this increase would be unwise as the numbers have shown volatility in the last 12 months; varying from a low of 106 Administrations in April 2025 to a high of 145 in July 2025. Administrations in 2025 have been at a lower average monthly number compared to 2024.

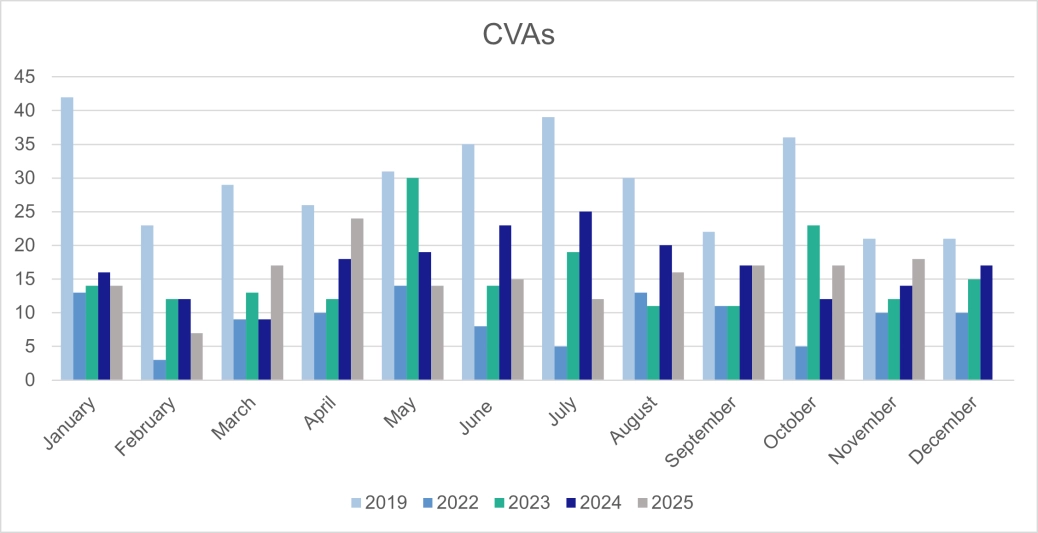

Company voluntary arrangements at 18 cases were in line with prior months. There were two moratoriums during the month and one restructuring plan.

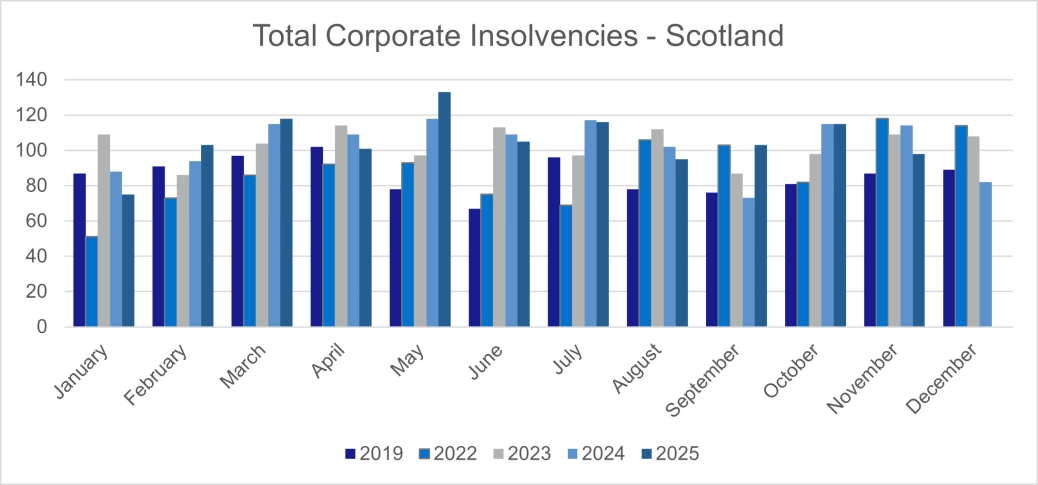

Scotland

In November 2025, there were 98 company insolvencies registered in Scotland, 14% lower than the number in November 2024. The total number of company insolvencies was comprised of 58 CVLs, 33 compulsory liquidations and seven administrations. There were no CVAs or receivership appointments.

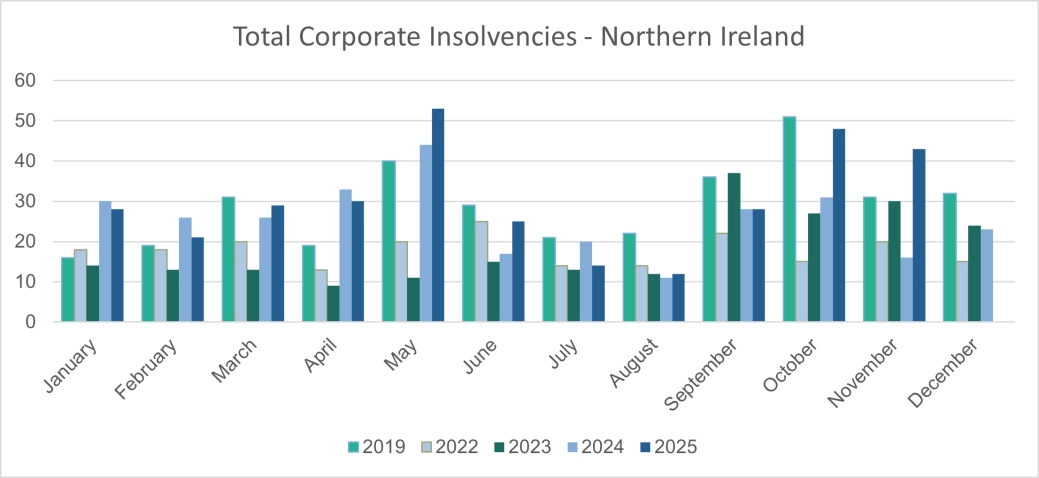

Northern Ireland

In November 2025, there were 43 company insolvencies registered in Northern Ireland, 169% (2.7 times) higher than in November 2024. The total number of company insolvencies was comprised of 33 compulsory liquidations, eight CVLs and two CVAs. There were no administrations or receivership appointments.

Personal Insolvencies

England and Wales

The Insolvency Service adopted a new case management system on 1 November 2025, temporarily reducing processing volumes during its controlled rollout. The true position for insolvency numbers during this period are likely not to be seen until the new year.

There were 9,343 individual insolvencies in November 2025, less than the levels recorded in October 2025 and November 2024.

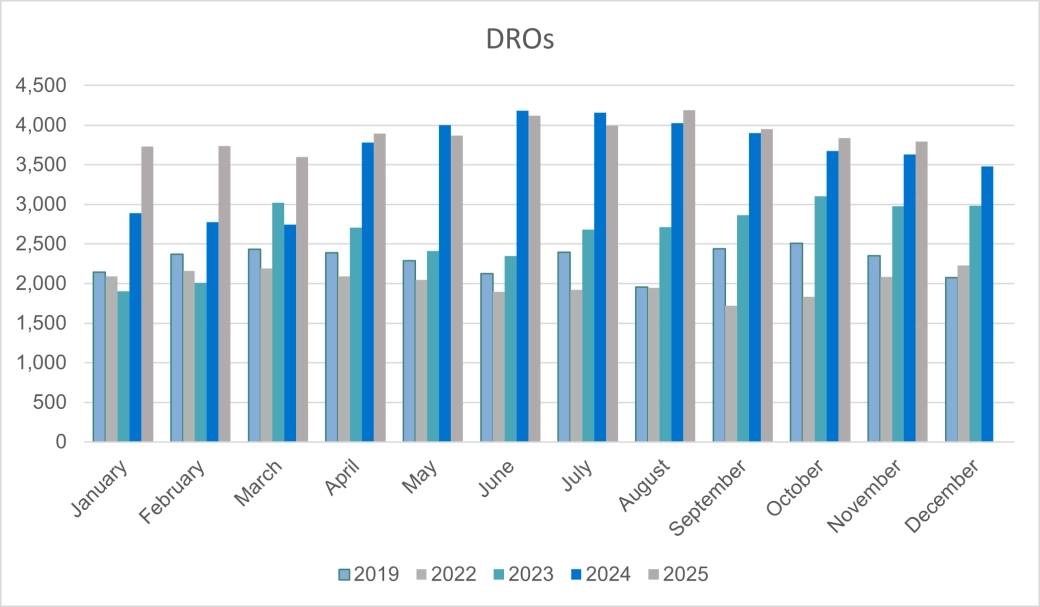

In November 2025, there were 3,792 DROs. 68% above the long-term monthly average but below the August peak of 4,190. Since the £90 fee was abolished in April 2024, DRO volumes have stayed near record highs, with 46,192 in the last 12 months.

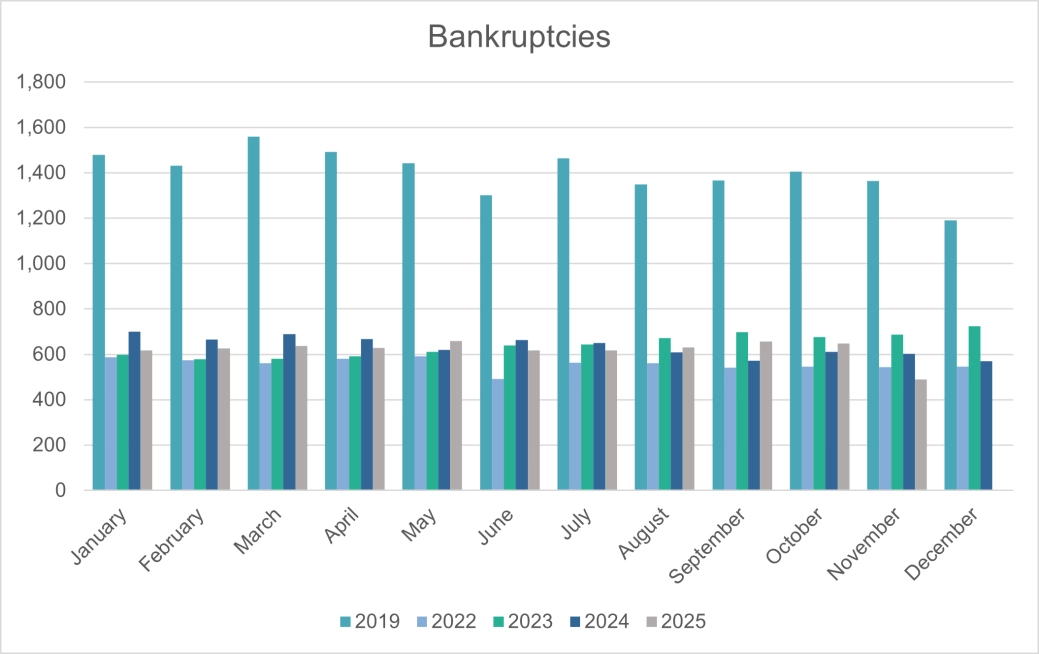

With DRO’s now increasingly being the debt solution of choice for many, bankruptcy numbers have decreased. Bankruptcy numbers are still low compared to the past, but the average monthly figures in 2025 are about the same as in 2024.

November 2025 saw 489 bankruptcies—25% fewer than October and 20% fewer than November 2024. Bankruptcy numbers have been falling since 2009, dropped further during the COVID-19 pandemic, and remain well below the long-term monthly average of 1,023 (2015–2024).

There were 346 debtors’ applications (31% fewer than October and 23% fewer than November 2024) and 143 creditors’ petitions (3% fewer than October and 12% fewer than November 2024).

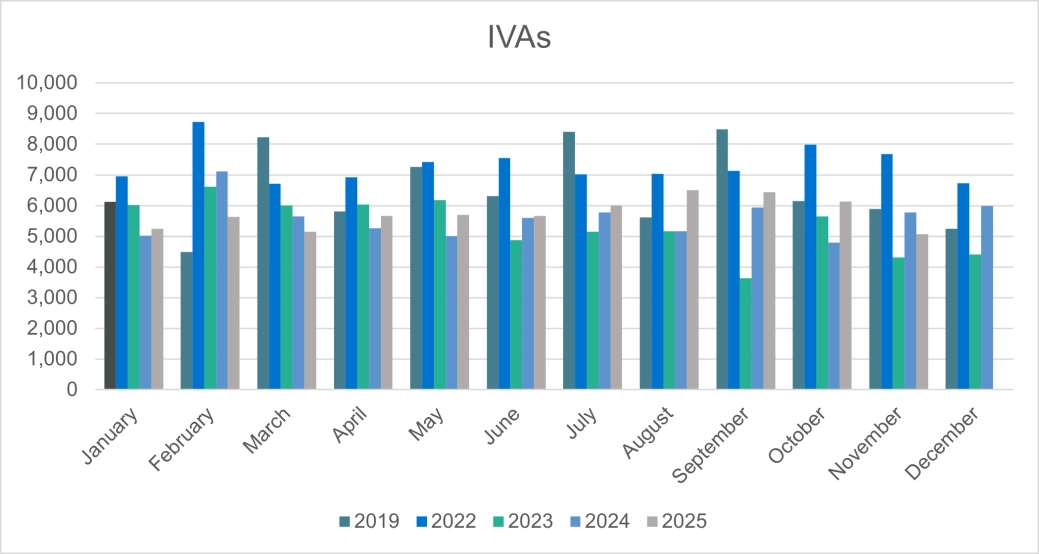

The Insolvency Service’s new case management system, introduced on 1 November 2025, caused a temporary backlog of IVAs. As a result, November’s reported figure of 5,062 IVAs—17% lower than October and 12% lower than November 2024— is unlikely to reflect all applications during the period.

During the first 11 months of 2025, IVA numbers exceeded the monthly averages for 2024 and 2023 but remained below 2022, which had a record annual total.

Overall, Personal insolvency trends in 2025 show historically high DRO volumes, steady IVA activity despite system changes, and continued low bankruptcy numbers. Planned reforms aim to simplify access to regulated debt advice and modernise the framework, reducing barriers for those seeking financial relief.

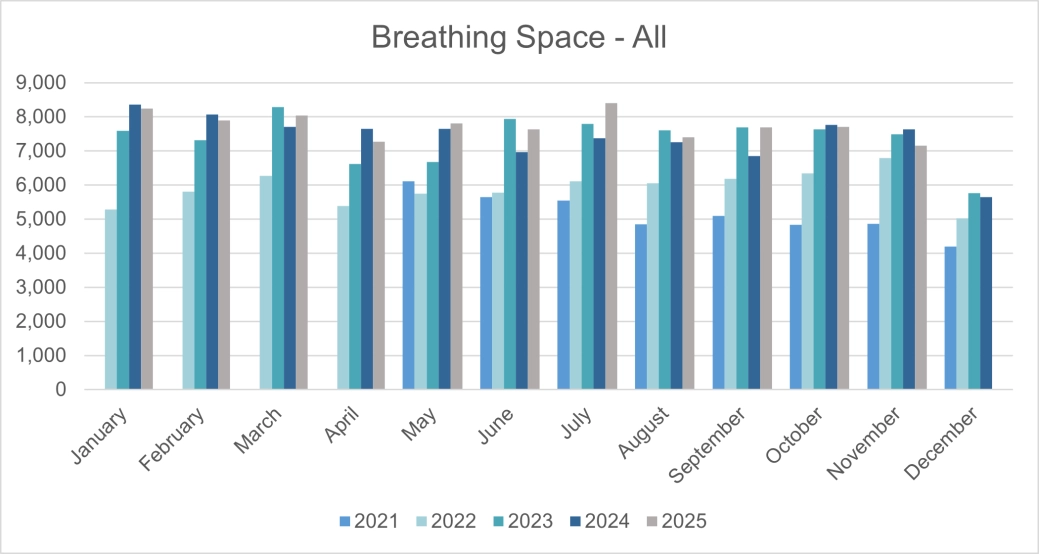

There were 7,151 Breathing Space (BS) registrations in November. 7,009 were Standard and 142 Mental Health. Since May 2021, StepChange has registered 59% of all breathing spaces.

Scotland

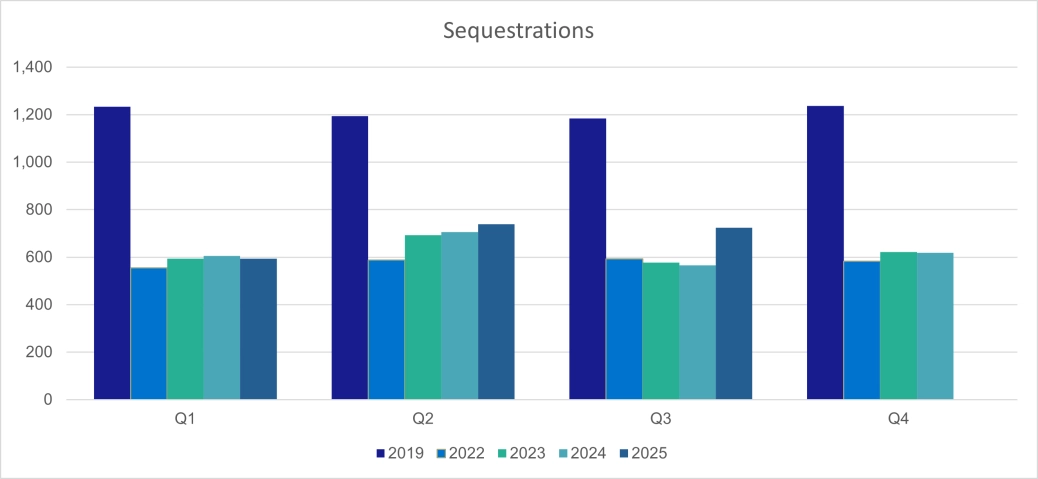

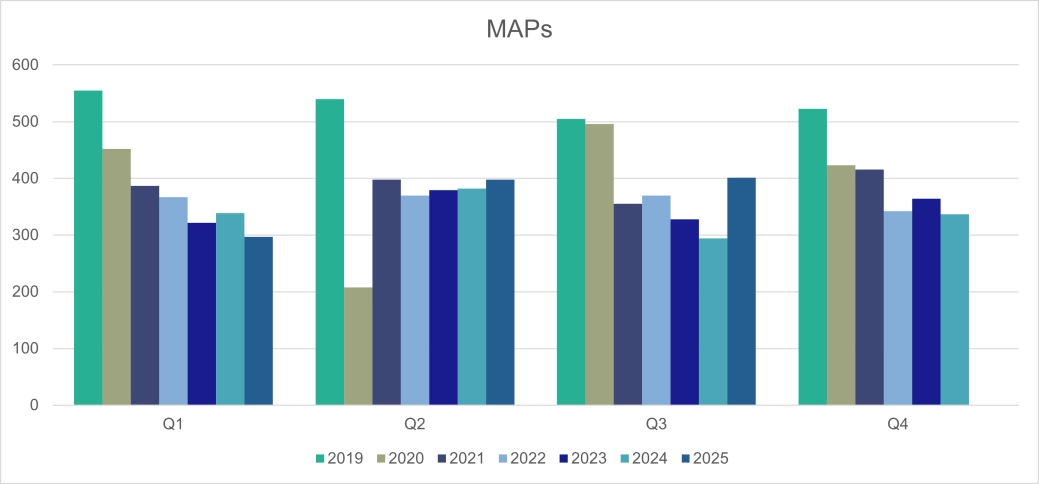

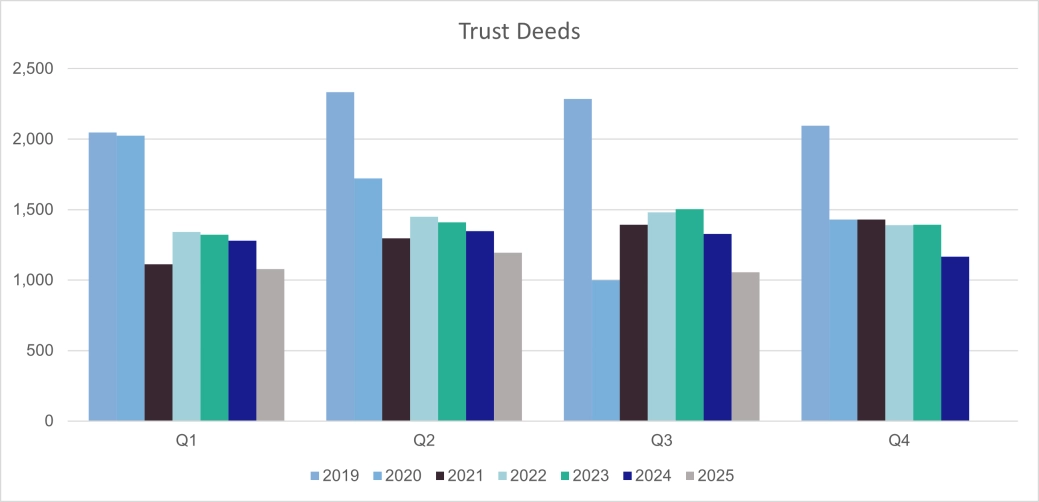

The Accountant in Bankruptcy produces individual insolvency statistics on a quarterly basis. Therefore, the numbers in this section are only updated once every 3 months.

The quarters referred to are calendar year quarters, such that Q1 2025 covers the period 1 January to 31 March 2025. In Q3 2025, there were 1,780 individual insolvencies in Scotland, which was 6% lower than in the same quarter of 2024.

The individual insolvencies were comprised of 1,056 protected trust deeds and 724 bankruptcies (also known as sequestrations), of which 401 went into bankruptcy via the minimal asset process route. The rules regarding bankruptcy differ to those in England and Wales, so numbers of bankruptcies are not directly comparable.

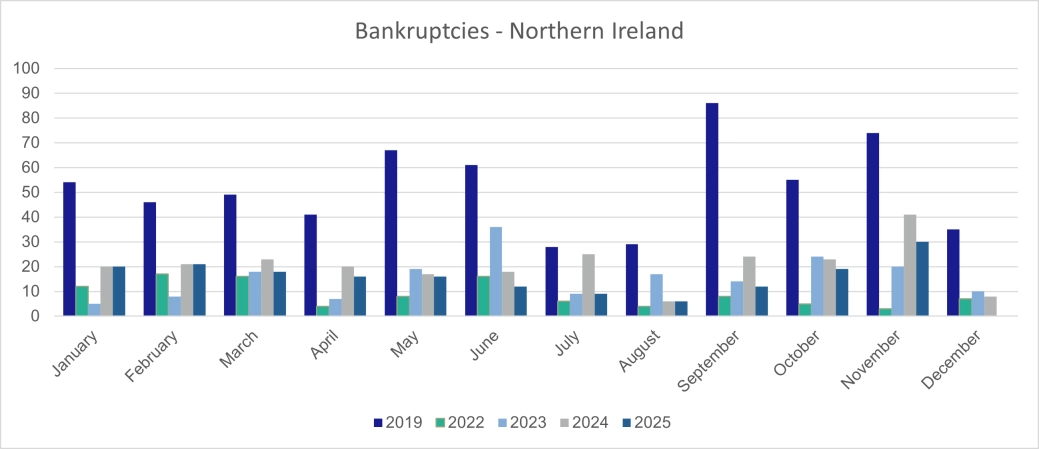

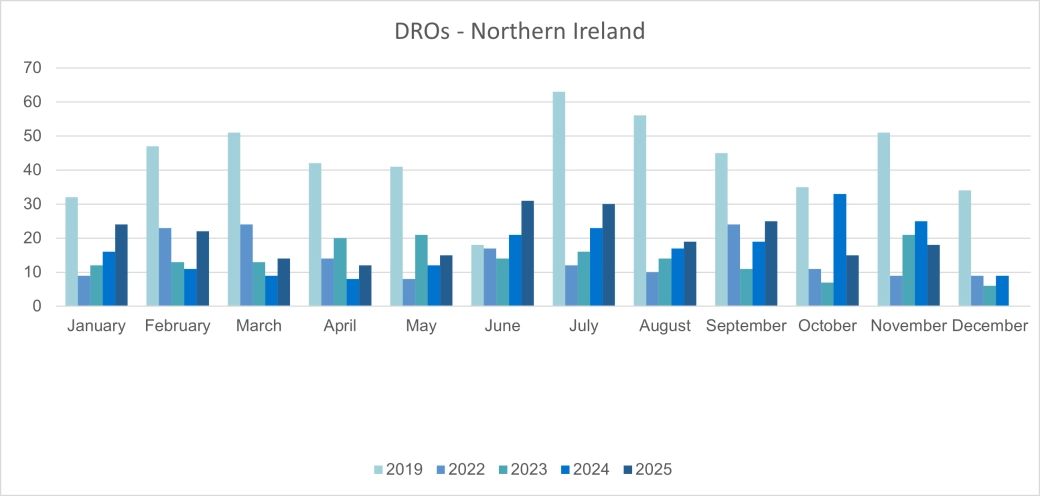

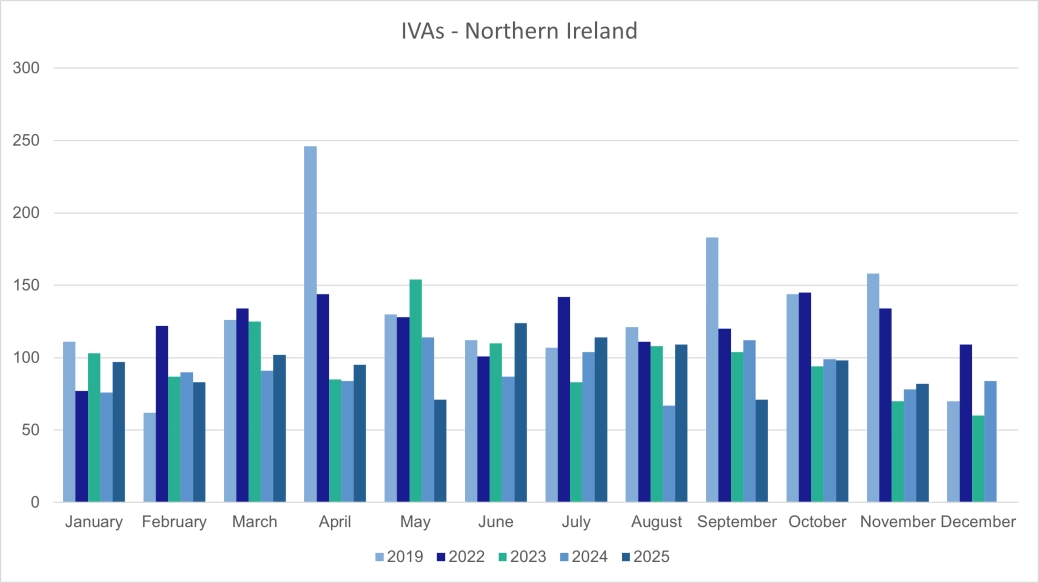

Northern Ireland

In November 2025, there were 130 individual insolvencies in Northern Ireland. This was 10% lower than in November 2024. There were 82 IVAs, 30 bankruptcies and 18 DROs.